Employers welcome the new Lifetime Isa for the under 40s

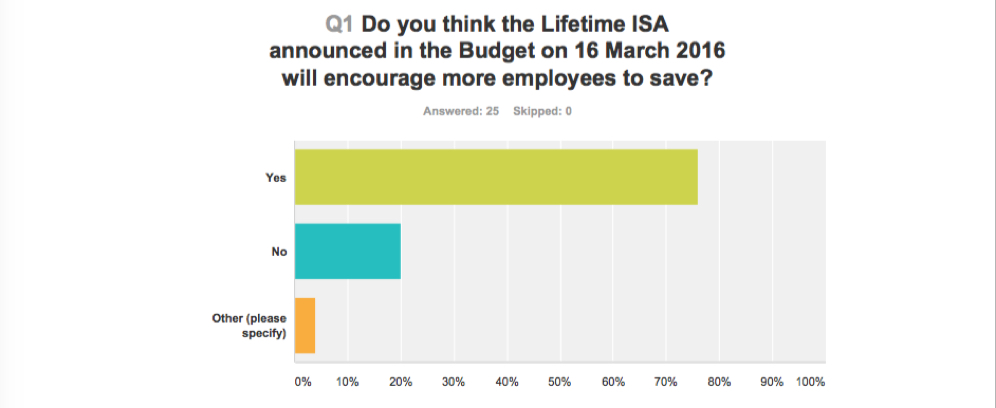

Among our 25 respondents three quarters believe the Lisa will encourage employee savings.

One respondent said: “Possibly but some may choose the Lisa over a pension, which would be a serious concern.”

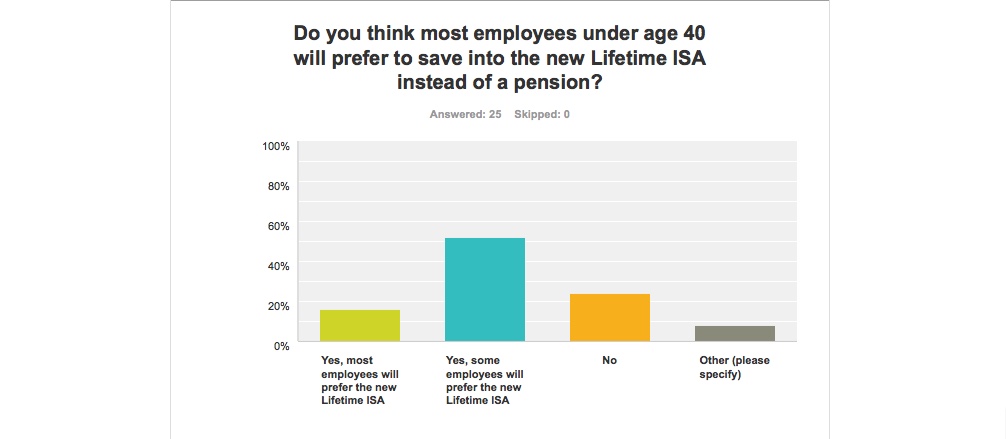

Over two thirds (68%) say most or some employees will prefer the Lisa over a pension.

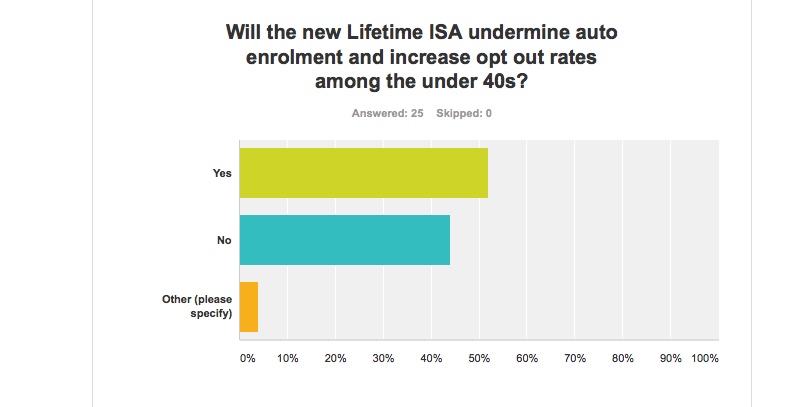

Initial pension industry reactions showed fears that the new Lisa would undermine auto enrolment and increase opt out rates. Our employer respondents were more divided, but slightly more than half also believed it will have a negative impact.

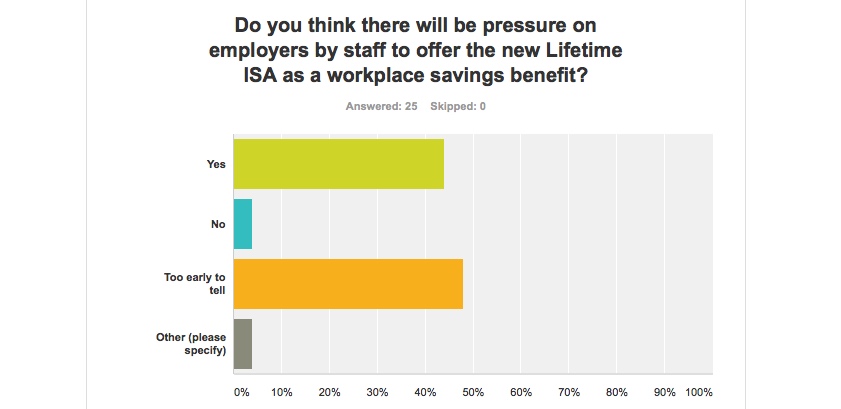

Although it is far too early to tell how employers will react (this poll was conducted just days after the announcement), our quick poll shows that at least 44% think there could be pressure on employers to offer the Lisa as a workplace savings benefit.

The question going forward will be: what could it look like in the workplace? Would employers contribute? Could offering one be seen to encourage auto enrolment opts outs?

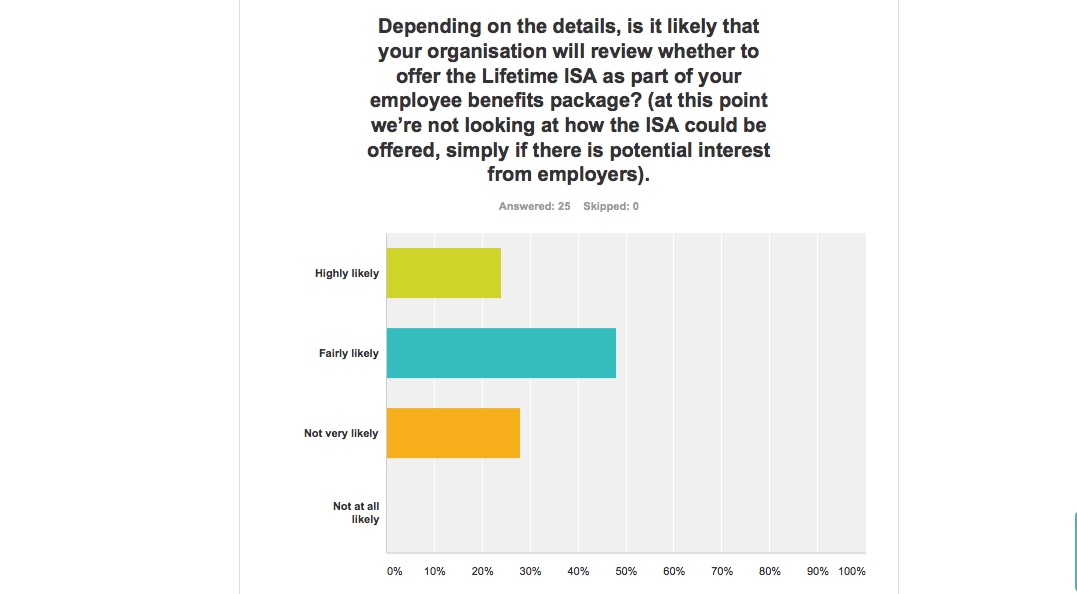

So simply in theory: nearly two thirds (62%) said it is highly or fairly likely that they would review the idea of including a Lisa in their reward package.

Other comments from our respondents included:

“It will not affect auto enrolment as employees will not walk away from the employer premium.”

“It will be useful for people specifically saving for their first house deposit, but auto enrolment into pensions will remain the best way to save for retirement.”

“Shame its for under 40's only.”

“Limit for property still too low to help buy property in London!”

“Think it's good to have both options/choice – auto/enrolment and lifetime ISA - as employees always want simple systems plus better/sooner access, which is pension’s downfall. However, pity they are not yet linked up - that would make much more sense - i.e. transfer any excess lifetime savings across to pension with all tax advantages that would currently give.”

“This is TEE pension tax regime by the back door and could result in future generations having insufficient funds for retirement.”

“I can see potential for age discrimination issues due to the age restrictions.”

“Most people won't appreciate that the combination of employer contributions and tax relief makes pension schemes a better long term savings vehicle than the Lisa. But the Lisa has more flexibility and the possible use for first time home purchase is positive. One concern is that this will be at the expense of sufficient pension saving, leading to a demographic time-bomb. Another key concern is that this is a means of replacing the current pension regime with an Isa-style one (for younger people) which will come about in stages over the coming decades.”

“People typically don't understand pensions so anticipate the ISA will be more appealing as a more straightforward option for employees.”

These results are based on a poll conducted 18-23 March 2016