How total cost of ownership (TCO) can improve your company car offer

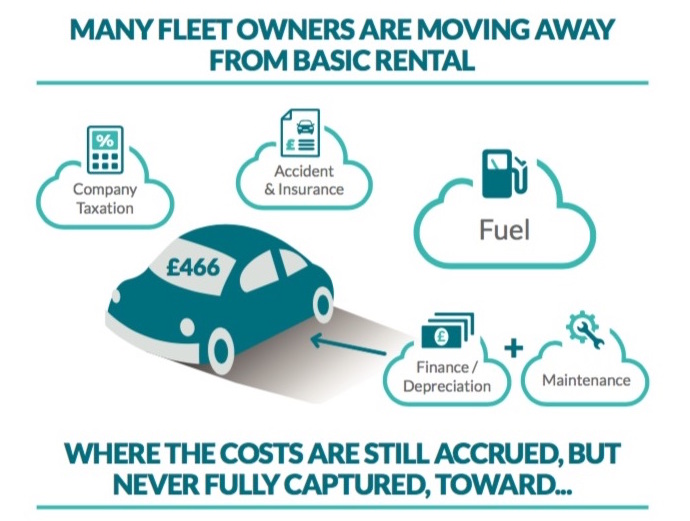

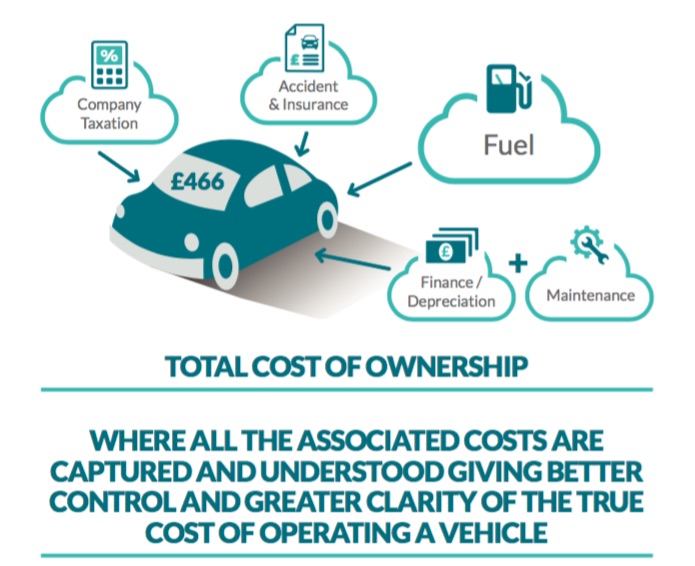

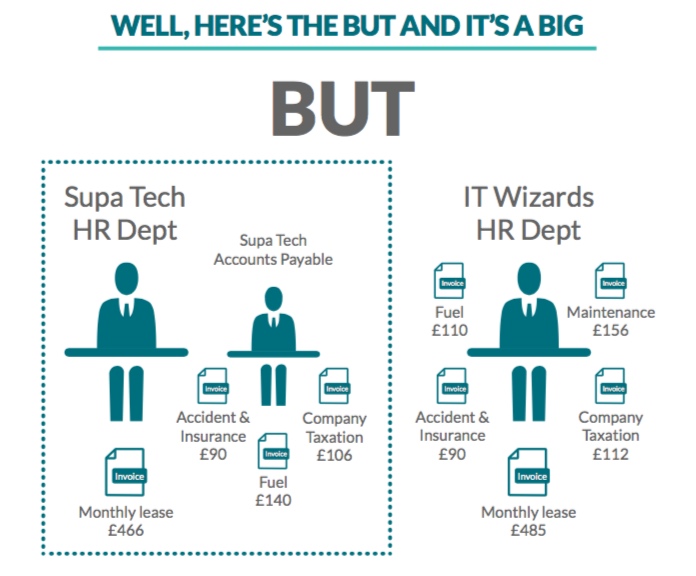

These factors vary but generally include:

- Lease cost

- Insurance

- Fuel

- Maintenance

- Company taxation cost

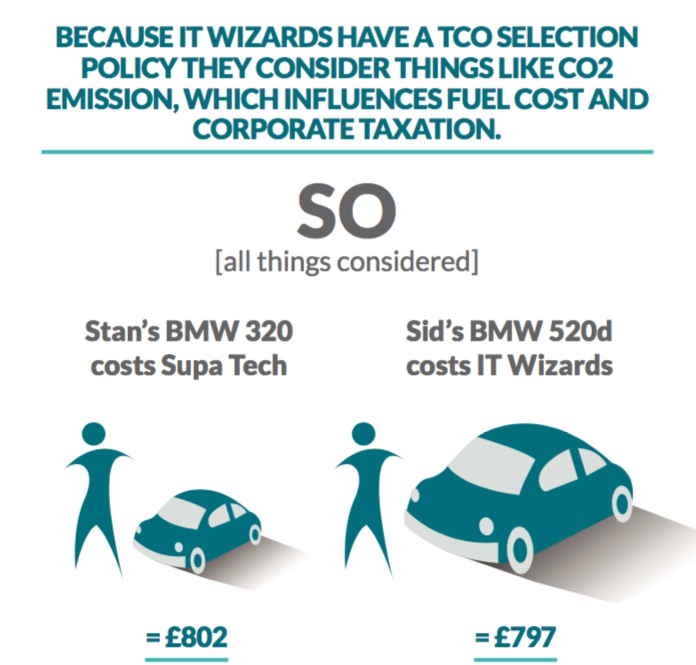

TCO brings into focus all the costs associated with each company car, allowing a better understanding of the total cost of running that vehicle. Looking at one figure, rather than looking at costs in silos without ever consolidating them to one cost line, means a tighter focus on spend and value.

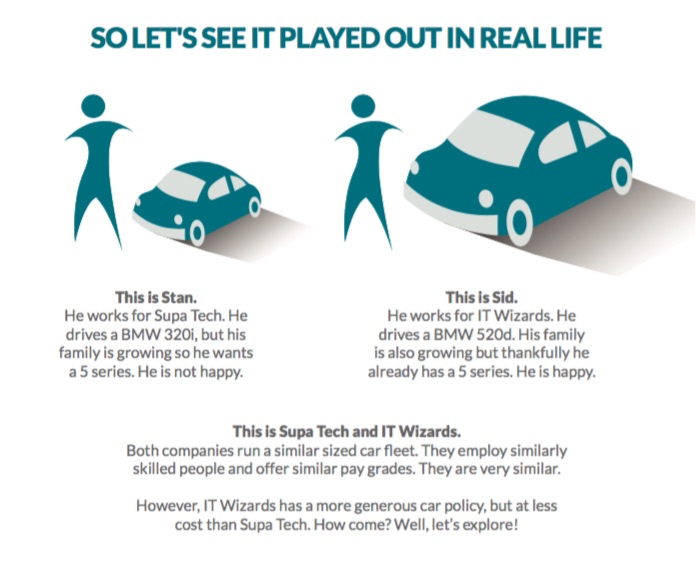

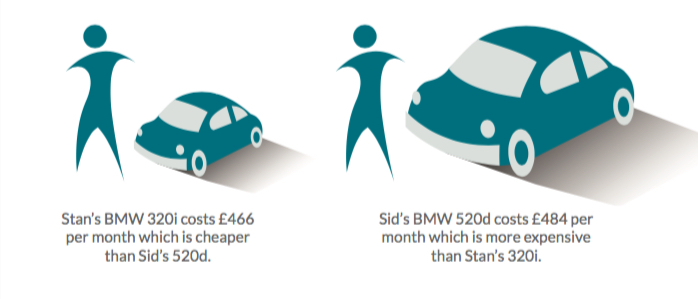

To demonstrate all this in a real scenario the following infographic tells the story of two very similar companies each using a different company car selection. See how using basic rental or TCO impacts massively on the type and value of the car that can be offered.

This article, provided by Fleetworx, is part of a series of articles that is based on the ebook: “Reward Like a Heavyweight on a Middleweight Budget”.

In partnership with Fleetworx

Fleetworx help the car fleet supply chain work better for everyone.