Delivering financial wellbeing for success

Enhancing workplace financial wellbeing will require the engagement of all employees so they feel empowered to drive positive change. This is achieved through education to maximise the value of each £1 and bolster resilience during times of financial stress.

It’s an opportunity for you to shake things up and refresh the way you engage with your employees - delivering benefits inclusive to all, regardless of age, wealth or life stage.

Take your employees on the journey with you

No-one likes directives – even when they are supposedly good for you – we all remember that reflex reaction to someone telling you to eat your vegetables! Although you may have solutions to make your employees lives better, achieving their ‘buy-in’ is never straightforward. So taking your employees on the journey with you, allowing them to have those light bulb moments themselves will make the solutions more personal, more meaningful and ultimately gain the desired level of commitment.

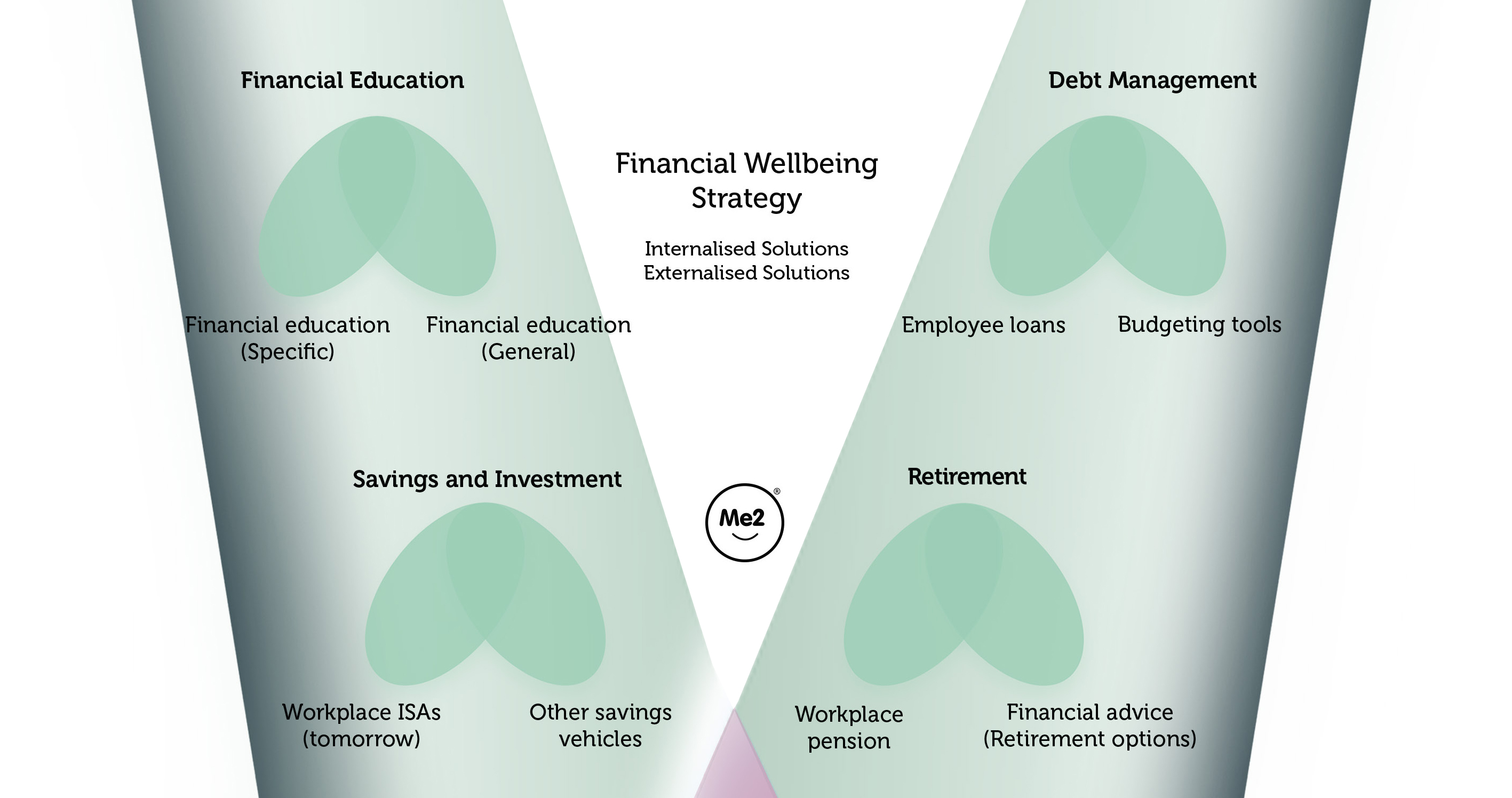

Employee surveys are a useful way to identify issues and trends when it comes to delivery, but be careful not to always try and fix last year’s problems. The focus is better placed on a forward facing transformative approach – what we want to achieve not just now but in the future (both near and far) – we call this ‘today, tomorrow and one day’.

Gathering together an employee forum or engagement champions, representing the views from the floor, means that you are involving employees in driving this change and it is an easy way for you as the employer to listen and importantly, show you are listening.

Employees are likely to know better than you what they want anyway – you might assume that they’d all be thrilled with a discounted David Lloyd membership, but maybe you’ve got a core team of runners looking to enter into an IronMan competition and actually it’s not discounted gym membership they need but help with for training, travel and entry costs.

Choosing your communication channel

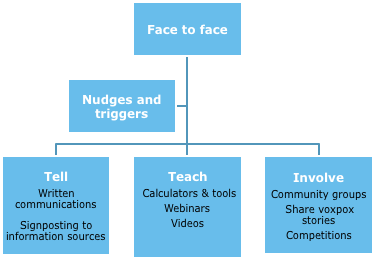

For the best chance of success, it makes sense to communicate with employees in the way they are most comfortable with – this may mean offering multiple channels from face to face to digital. In a Why Bwell survey, an overwhelming 47 per cent choose face to face communications for wellbeing and benefits with 28 per cent preferring email, seven per cent digital and 7 per cent preferring paper based communications.

Face to face communications also offer inclusivity

In the UK 1.4 million people have learning difficulties, as reported by Mencap and there are probably many more undiagnosed. Additionally The National Literacy Trust report that 5.1 million UK adults have literacy levels at or below expectations for an 11-year-old.

If live face to face isn’t feasible – video clips work equally well and have the advantage that they can be dubbed over in other languages.

Layer up

Employees may look to receive information across a number of different modes – a recent employee focus group fed back they would look for initial face to face communication, followed by either digital or print information to follow up in their own time. This could be an opportunity to look at new delivery channels.

Know your limits

Don’t limit the employee experience to your own expertise – make use of specialists or simple signposting, such as information from government bodies or charities.

Be Mindful

We can all react to the same situation differently. Encourage step by step wins and promote mindfulness to help employees cope and have hope.

Take it to the people

Don’t just rely on employees reading your quarterly newsletter. Proactively take messaging out to them. A great example of this is Netflix and their ‘tops picks for you’ approach - we use a similar process of nudges and triggers to promote relevant content. Generating active discussion through community / chat groups is also a brilliant way to sustain focus and keeping savings ideas flowing.

Time may well be another big factor in the engagement of employees. Can you carve out time for staff to focus on their finances? Perhaps lunchtime or afternoon coffee sessions will encourage people to take time out – even just for 20 mins – to focus on their financial wellbeing.

Advocacy - who will champion financial wellbeing internally?

Whilst is it important employees see financial wellbeing support from the top, engaged employees will drive a bottom up approach.

This article is provided by Barnett Waddingham.

References

- Financial wellbeing – fad or fundamental? Barnett Waddingham, 25 September 2018

- ACDC: how to avoid the highway to financial hell, Barnett Waddingham, 6 November 2018

In partnership with Barnett Waddingham

Everything we stand for at Barnett Waddingham is embedded in our promise – to do the right thing. We’ve applied this meaningful principle across all aspects of our business with continued success.