How employers are reimagining their benefits offerings for a longer working life

Alongside the UK’s ageing population, our fragile economy means that an increasing number of workers are financially unable to retire at the state’s recommended age of 65. The latest UK labour market figures from the Office for National Statistics (July 2018) show that the number of people in work who are over the age of 65 has almost doubled (43 per cent increase) in the last ten years.

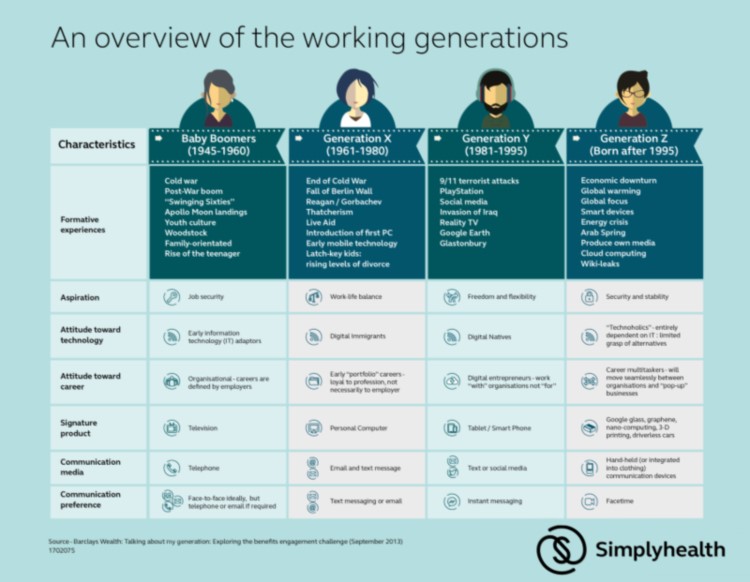

This has resulted in the new reality of a multigenerational workforce. A 4G (four generation) workforce has huge implications for employee benefits offerings. As you can expect, the priorities and expectations of a worker from the Baby Boomer generation (born 1945–1960) are very different to that of an employee from Generation Z (born after 1995).

Tailoring employee benefits for your multigenerational workforce

Flexible benefits offer a strong solution to these challenges. A wide range of employee benefit options can be presented to employees, appealing to distinct age groups. This gives employees more control – they are able to choose and modify the combination of benefits that they are receiving when, and if, their personal circumstances change.

More than half (51 per cent) of businesses surveyed for the Simplyhealth Industry Insight: Addressing the Challenges of a 4G Workforce (2017) offer all their benefits flexibly and 39 per cent offer some flexibly. Employees were surveyed too, and the vast majority of them (91 per cent) want to be offered benefits which meet the specific needs of both their life stage and lifestyle.

Taking a moment to consider the stereotypes of the generations in your workforce will show just how different their employee benefit wish list may look.

A young employee from Generation Z, thought of as a ‘technoholic’ – meaning they love their smart phones and tablets – might be most drawn to a shopping discount benefit as they will be able to save money on the latest gadgets. While an older Baby Boomer employee will stereotypically be more concerned with their impending retirement, meaning pensions or money saving schemes, could be most attractive to them.

Flexible benefits also offer various payment models to suit both employers seeking minimal financial contributions, and those able to invest a larger amount on their benefit offering. A selection of benefits could be offered as ‘core’ benefits, this means they are paid for entirely by the employer. While others can be either paid for out of a flex pot, allowing employers to contribute a certain amount of money towards an employee’s choice/s per year. Or flexible benefits can be entirely voluntary, where the benefit payment will come directly from an employee’s salary.

For example, at Simplyhealth, we offer our workforce a mix of flexible and core benefits. This allows us to ensure our employees receive the core benefits which matter most to our entire workforce, including access to our Optimise health plan and pension contributions. However, staff can then tailor their options to suit their life priorities, such as an animal healthcare plan, private medical insurance or shopping vouchers, which can be paid for out of their flex pot with the option to include voluntary contributions once that flex pot has been spent.

Adapting your communications for a 4G workforce

Engagement and communication are essential to make sure your employees both understand and use their flexible benefits offering. This can come in a number of different and innovative forms to ensure maximum uptake.

Our research for the Simplyhealth Health and Wellbeing Benefits Guide found that 56 per cent of businesses communicate with staff about their employee benefits package on less than a quarterly basis.

Your communication techniques may involve developing different ways of promoting benefits, including branded health and wellness programmes which endorse particular benefits. For example, workshops on dementia run by charities for employees caring for an elderly relative, downloadable information for managing stress, or competitions to win a juicer, which ties into a health plan.

Frequent, captivating communication really is king when it comes to engaging your employees. And you don’t have to go it alone. Typically, a good benefits provider will support you with a range of marketing materials, measurement tools, and best practice examples to help you to make some noise.

However, there is always the option for an employer to use their internal marketing expertise to help promote their flexible benefits package. To support Mental Health Awareness Week, Simplyhealth’s marketing team ran an extremely successful in-house campaign providing mental health advice and workshops, while also promoting our individual employee benefits which provide mental health support. At the end of the week, almost half (48 per cent) of our employees agreed that our activities made them feel better informed about mental health issues.

Workforce expectations

In our modern society, employees now expect their employer to offer an all-inclusive employee benefits package, our 4G workforce research found that 82 per cent of jobseekers would turn down a job if it lacked an attractive benefits package.

Flexible benefits allow each employee to pick and mix the benefits which best complement their life stage needs. Not only does this make for a satisfied workforce, but with 66 per cent of employees saying they would be more inclined to stay with an employer who provided good benefits, offering flexible benefits will also help you to retain your talent.

At Simplyhealth, we have created a comprehensive guide to help you craft a flexible benefits offering that will appeal to the multigenerational 4G workforce.

This article was provided by Simplyhealth.

In partnership with Simplyhealth

Our health plans make it easy for people to maintain their health&wellbeing.