Why saving for Christmas and saving for retirement are similar

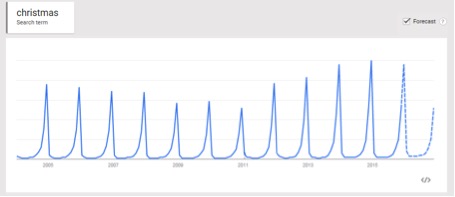

It's an assumption that is backed by Google Trends whose research shows that although December is the peak month for interest (obviously!) people definitely start searching online for “Christmas” around October time whilst between January to September, Christmas drifts from our minds once again.

Now in our third year of producing our Employee Insight Report one of the questions we have always asked people is to highlight what they feel are their main financial priorities over the coming year. The questionnaire is issued in February each year and interestingly “Saving for Christmas” has never once been popular. The reason for this is that it never occurred to us to include it when we issued the questionnaire. But then again, it didn’t occur to anyone involved in putting the questionnaire together, because in February we are simply not thinking about Christmas. So, considering that we can’t think even 12 months ahead, it would be a bit rich to expect others to do so…

So, appreciating our shortcomings, we surveyed people in October this year as well, including “Saving for Christmas” as an option. Unsurprisingly given the timing of the survey it came out as the fourth biggest financial priority, selected by more than one in five employees.

The results show that unless something is imminent people tend not to have it as a priority on their financial to-do list. Many of us within the pensions industry wonder why not everybody wants to focus on trying to put as much in their pension as possible but this Christmas analogy explains why. Sometimes it is easier and more relevant to focus on our short-term goals and try to get to the next milestone rather than think long-term and about retirement. (Short-term goals are unlikely to have much to do with pensions unless this really is the next upcoming milestone.)

So if we struggle to think long-term (where retirement could be 50 years away for some people), perhaps it’s time to bring pensions back to the present. Perhaps we need to set easier targets, make information a bit more bite-size and relevant and give people easy milestones to hit.

As good as our intentions may be with long-term savings, many of us will still act in the short-term. For many of us this is essential. But communicating pensions is a challenge and can’t be kicked into the long grass forever – so perhaps it should rear its head at the right times and in the right way.

We have long talked about the importance of relevance here at Capita and I think this message fits pretty snugly here. We are more likely to think of “Saving for Christmas” as a financial priority in October than February as it is more relevant at that point in time.

Even if some of us moan that shops are promoting Christmas a little early (not me!) we’ll still go in and start some of our Christmas shopping early anyway. Because the shops know us a little too well and come October many of us are genuinely ready to start planning for Christmas (even if the bah-humbugs deny it). Why therefore should the same not be true of pensions?

Gareth Davies is research manager at Capita Employee Benefits.

This article was provided by Capita Employee Benefits.

In partnership with Capita Employee Solutions

UK leader in technology-enabled business process management and outsourcing solutions.