Are your reward and benefits ready for the Health & Social Care Levy?

The Health & Social Care Levy (HSCL) is a new charge aligned to National Insurance, introduced to provide additional funds to support the provision of social care in the UK.

When will it come into effect?

The HSCL is being introduced in two phases. From 6 April 2022, it will take the form of a 1.25% increase in National Insurance contributions (NIC) for the employed, employers and the self-employed. However, from 6 April 2023, this increase will be reversed and replaced with a separate levy. This is when things become more complicated.

Who will pay the HSCL?

In 2022/23, the increase in NIC will apply to employees and employers Class 1 NIC (and will include both Class 1A and Class 1B NIC paid by employers on employee expenses and benefits) and to Class 4 for the self-employed.

This represents a total increase of 2.5% in respect of employed workers (split equally between the employer and employee) and 1.25% for the self-employed.

In 2023/24, the HSCL will apply to any earnings subject to NIC. However, one important change is that this new tax will also cover the earnings of those over state retirement age who would not pay employees’ NIC.

What are the practical implications?

The most obvious implication is the cost increase for individuals and employers. On top of HSCL, workers are facing a cost of living increase, while businesses see higher input costs due to energy price hikes, and supply issues. The suggestion that pay rises will be given to ease the impact of cost of living increases, thereby further pushing up inflation is widely reported. We are yet to see this in practice, but those needing to recruit and retain staff are urged to monitor market rates to avoid exposure to staff losses.

There are also administrative matters which employers should consider when the HSCL replaces the NIC increase in 2023. Where employers have a contractual right to deduct income tax and NIC under Pay As You Earn (PAYE), they should review relevant documentation to ensure that it extends to cover the levy. This includes incentive plans for both cash and share-based schemes. For example, many share option plans include a provision enabling the employer to transfer NIC to the employee, this will not automatically extend to the HSCL. If the employer also wishes to transfer the HSCL, professional advice should be taken to ensure documents effectively reflect the position.

Equally, when undertaking mergers or acquisitions, businesses should ensure that warranties and indemnities as well as the due diligence process also extend to cover the operation of the HSCL.

The Federation of Small Business estimates that the rise in NIC will add more than £3,000 to the employment costs for an average small business. While the £4,000 annual Employment Allowance for NIC can be used against the new levy as well as NIC liabilities, it may not cover the whole cost for many employers.

Individuals operating through personal service companies will have to pay the levy on any salary they pay themselves and, if they take their income in the form of dividends, the tax rate on those will also rise by 1.25% from April 2022.

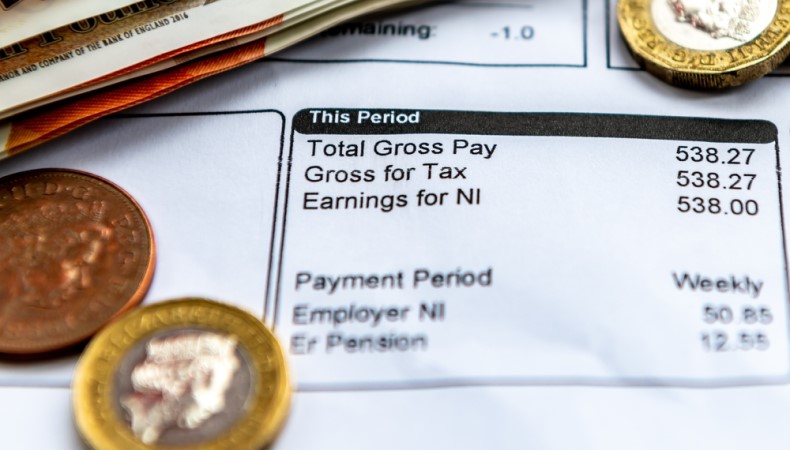

Finally, the HSCL must be shown separately on payslips and self-assessment payments from 6 April 2023. For 2022/23, HM Revenue & Customs are encouraging employers to include the following on payslips: ‘1.25% uplift in NICs, funds NHS, health & social care’.

Interaction with salary sacrifice

Where employers operate a salary sacrifice arrangement the impact of the HSCL will depend on the pay and non-cash benefits that make up the salary sacrifice arrangement.

Where the taxable value of the benefit is calculated through the normal benefit in kind rules (such as electric cars) or are subject to certain exemptions (such as pensions and childcare vouchers) then the salary sacrifice generates NIC savings. These will be increased in 2022/23 by the HSCL and it is understood that in 2023/24 the HSCL treatment will follow that for NIC purposes and so the saving should be retained. However, when the HSCL takes the place of the NIC increase, it will be important to ensure that payroll systems can process the adjustments correctly.

Can we expect to see a change in the proposed rules or a delay in their introduction?

High inflation has led to cross party calls for the Chancellor to abandon or delay the HSCL to reduce the extra financial pressure on households and British businesses.

However, the Health and Social Care Levy Act 2021 covers not only the operation of the levy but, unusually, also explains that the funds raised should be applied: ie paid to “the Secretary of State towards the cost of health care and social care” in England, Wales, Scotland, and Northern Ireland. Therefore, there will also be pressure to retain the charge to support our healthcare system post pandemic. If changes are announced before 6 April, I would expect them only to apply to low-paid employees.

Employers should ensure that they are prepared for the NIC increase from 6 April, and make best use of the intervening 12-month period to ensure that all policies, procedures and documents include provisions to take account of the levy.