How to cushion the blow of increased national insurance costs

It’s happened. We knew it was coming and now it has. Instead of fresh budgets, this tax year has ushered in a series of increased costs that businesses now have to deal with.

I won’t try to sugarcoat it – this could be tough to manage. But what goes up could come down.

By making one simple tweak to your workplace pension contributions, you could significantly mitigate the cost of national insurance – with no need for any drastic cutbacks.

What’s changed for the 2025/26 tax year?

Where NI costs are concerned, it’s a double whammy:- Employer’s national insurance rate increased from 13.8% to 15%

- Secondary threshold reduced from £9,100 to £5,000

So you pay a higher rate on a larger portion of every employee’s income.

The national minimum wage has also increased by about 80p an hour, which will hopefully give the UK’s lowest earners a noticeable boost amid ever-rising costs of living.

But from a business perspective, this is of course another dent in the profits margin.

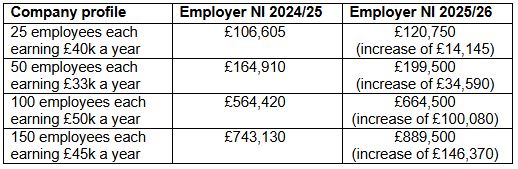

How much difference do increased NI costs make?

Let’s put it in perspective:

Figures are based on a 5% employee pension contribution of the same salary in each example, employment allowance discount of £10,500 where appropriate, and assumes salary exchange is not currently used.

As we’re seeing in the news, and as you yourself might be facing, businesses across the UK are up against it.

The fallout from these increased costs range from mass redundancies and stunted recruitment activities to desperate cost-cutting in other key areas.

There could also be knock-on effects for employees’ future prospects.

In some cases, businesses who once went above and beyond are now looking at reducing their pension contributions to the minimums set by auto-enrolment.

If they do find this necessary, it would be a substantial blow to an invaluable benefit.

Although understandable, it’s not what the government intended when raising these costs and, what’s more worrying, it’s storing up a problem for future generations.

Pensions adequacy is already a hot topic.

As the Pensions and Lifetime Savings Association reiterated this February, “more than 50% of savers will fail to meet the retirement income targets set by the 2005 Pension Commission”.

Employees need more support, not less.

How to mitigate the cost of increased national insurance

Before you make cuts to your workforce or their benefits, make sure you’re not leaving any money on the table.

Maybe you can recoup some costs by becoming more tax efficient.

If you adjust how you pay into employees’ pensions, using a method called salary exchange (also known as salary sacrifice), you could make a significant national insurance saving – and so could they.

How does salary exchange work?

- An employee agrees to reduce their gross earnings by the amount they pay into their pension.

- The business agrees to pay both the employee and employer pension contributions.

- And because gross earnings are lower, so is the national insurance bill.

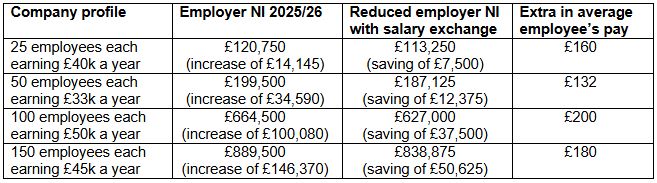

How much could your business save with salary exchange?

Let’s return to the previous examples as a rough guide to the potential savings – for both your business and your employees.

Figures are based on a 5% employee pension contribution of the same salary in each example, employment allowance discount of £10,500 where appropriate, and assumes salary exchange is not currently used.

Try the salary exchange calculator

How to get started with salary exchange

You’ll need to work with your pension provider to get this set up.

It shouldn’t take long and the benefits speak for themselves – think of it as a painkiller for those increased NI costs.

If your provider doesn’t offer salary exchange (or salary sacrifice) then it might be time to shop around.

And while you’re at it, make sure you find a workplace pension that really adds value.

If you’re paying this much for the benefit, you at least want employees to appreciate it.

For more on this topic, take a look at: Three steps to make sure your most expensive employee benefit adds value

Supplied by REBA Associate Member, NatWest Cushon

NatWest Cushon is a workplace pensions and savings provider with an award-winning proposition.