How to increase minimum pension contributions

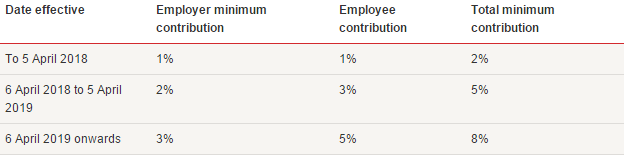

The minimum increases to pension contributions are mandatory for employers and happen on a phased basis between April 2018 and April 2019 as outlined below:

Here are some tips for implementing these changes:

Step 1: Identify the employees who are affected by the increases to understand the scale of the task. Some employees may already be above the new required minimum for April 2018.

Step 2: Understand how you have defined pensionable pay. AE compliance can be achieved by using different definitions of pensionable pay and the required increases may differ depending on which definition is used. Employers should be clear on how this works for them and it’s possible that they are using more than one definition across the workforce.

If you are using something other than the minimum qualifying earnings definition you will have certified the alternative contribution base. Double check your certificate factors in the increases in contributions.

Step 3: Discuss with your payroll provider to ensure that they can facilitate the increases to the relevant employees and that they do this for the first pay date after 6 April.

Step 4: Engage your people. There’s no obligation to tell employees about the increases, but if you don’t then you risk payroll and HR being inundated with questions as the changes take effect and you may see requests for employees to come out of your scheme. By 2019 employees will be paying in a new minimum of four per cent but this will be doubled to eight per cent through a combination of tax relief (one per cent) and employer contributions (three per cent). Good positive messaging on the benefit of staying in the scheme is important.

Minimum contributions unlikely to be enough

These increases to pension contributions bring contribution rates to something more meaningful for employees from the two per cent minimum that has been required to date. It is important to note, however, that the eight per cent total that is required by April 2019 will likely not be enough for many people to achieve the replacement income they need in retirement. We welcome employers who offer schemes that go beyond eight per cent, and who engage their employees on the benefit of saving into a workplace pension over and above these new minimum levels.

Now that every employer has staged for AE, it has become an integrated part of UK business particularly within payroll, HR and finance teams. AE has been a success to date but its continued achievement will rely a lot on the implementation of the new increased minimum contributions and employees staying enrolled.

The Pensions Regulator has more detailed information and guidance on the increase in contributions or read our FAQ document on the subject. Employees can access further support and information on our website.

The author is Alex McCallum, workplace pensions specialist at Scottish Widows.

This article was provided by Scottish Widows.

Scottish Widows is sponsoring REBA's Employee Wellbeing Congress 2018, which is being held on 5 July in London.

Supplied by REBA Associate Member, Scottish Widows

Scottish Widows is a life, pensions and investment company.