Caring for the carers: 3 tips for workplace financial education

Being a carer has a large impact on people’s lives, personally and financially.

Employees with care responsibilities could include parents, or people caring for elderly relatives, or relatives and dependants with additional caring needs.

A recent report revealed that 73% of employees in the US are caregivers. Juggling work responsibilities with caregiving duties can be overwhelming, and employers have an opportunity to provide valuable support.

One effective way to help employees with caring responsibilities make the most of their salary, and support the overall financial health of the household, is with financial education. By helping caregivers manage their finances more effectively, employers can contribute to reducing stress and improving overall wellbeing.

So, here are three top tips for how employers can support carer employees with financial education:

1. Talking can lighten the load

Consider hosting a Talk Money Week at your organisation and get employees to talk about money – particularly their money stories relating to the challenges they face. Destigmatising talking about money help people be more open and encourages them to ask for help.

Talk Money Week gives businesses the opportunity to engage different employee communities – like the carer community – with personalised financial education and training.

2. Educate through workshops and seminars

Arrange workshops or seminars that focus on topics most relevant to the carer community, like planning, budgeting, and saving. Tailor the session to address the specific challenges faced by caregivers.

This can include masterclasses on topics such as creating a budget, managing debt, and building an emergency fund. Highlight particularly relevant information like government assistance programmes and tax benefits that are available to caregivers. A workshop environment also allows employees to ask questions.

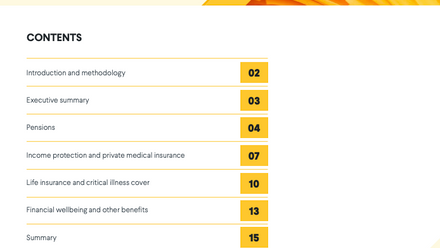

3. Benefits and insurance education go a long way

Ensure employees with caring responsibilities are aware of all the benefits and insurance options available to them.

Provide clear explanations of health insurance cover, life insurance policies and any other benefits that may ease the financial burden associated with caregiving.

By recognising the unique challenges faced by employees who are also caregivers, employers can take steps to support them.

Financial education programmes, tailored to the specific needs of caregiving employees, can empower individuals to make informed decisions about their finances.

By combining financial education with flexible work arrangements and a supportive workplace culture, employers can create a holistic support system that enhances the overall wellbeing of caregiving employees.

Ultimately, investing in the financial education of caregivers is an investment in the health, productivity and satisfaction of the whole workforce.

Supplied by REBA Associate Member, Nudge

A leading financial wellbeing benefit using behavioural science & technology to help employees.