Inside track: Actions reward and benefits professionals are taking in the face of coronavirus (1)

1. REBA Professional Members can share and ask for advice via our vendor-free online networking tool rebaLINK.

2. Email the REBA team. Please state if you’d prefer to remain off-the-record in any information we publish.

Update 09:35 26 May 2020 - Webinar financial wellbeing during the coronavirus crisis

Watch REBA’s latest webinar on the importance of looking after employees’ financial wellbeing during the coronavirus pandemic.

The 7th webinar in REBA’s crisis series focused on supporting senior reward and benefits professionals in managing their staff financial wellbeing. The webinar featured insight from REBA’s panel of reward leaders and industry experts, including:

- Mark Chadwick, Head of Pensions and Benefits at RBS

- Caroline Howes, Principal & Business Development Director at Mercer

- Tim Robertson, UK Compensation & Benefits Leader at Microsoft

- Andrew West, Head of Reward UK & Ireland at BOC UK & Ireland.

Watch the full webinar here.

You can also watch all of the webinars in REBA’s crisis series by visiting our webinar hub.

Update 08:25 22 May 2020 – Latest Coronavirus Job Retention Scheme update

HMRC has updated its Coronavirus Job Retention Scheme (CJRS) guidance to explain that employers will be asked to give the amounts separately for the NICs, pension and wages they are claiming for.

It has also added information about employee authorised salary deductions, and has confirmed that these can be made from grant payments. For example, you can deduct from furlough net pay certain amounts (such as those made under flex schemes which are net deductions). However, this does not apply to salary sacrifice as this is a salary reduction not a deduction.

Update 09:45 21 May 2020 – REBA/Unmind Covid-19 and employee mental health research

REBA’s latest research into COVID-19 and employee mental health, supported by Unmind, found that conversations around mental health have skyrocketed in organisations since the outbreak of coronavirus.

Around 88% of respondents report an increase in mental health discussions at senior management level, while the picture among Board members is similar, with 80% reporting an increase in these conversations.

Other key findings from the survey include:

- over three-quarters of businesses have seen an increase in requests for mental health support in the wake of COVID-19

- more than 90% of businesses have increased their emphasis on the importance of employee mental health as a result of the pandemic

- over 85% believe the virus has or will negatively impact their employees’ mental health

- less than 2% of businesses have seen a decrease in requests for mental health support

- less than 2% of businesses think the pandemic will not have an impact on employee mental health.

Download for free the full survey results.

REBA conducted this survey between 4 May and 11 May 2020, to gain fast-track insight into the impact of the COVID-19 crisis on employee mental health and employers’ strategic planning and investment responses.

Update 09:20 19 May 2020 – Webinar financial wellbeing during the coronavirus crisis

Financial wellbeing is now, more than ever, a concern that is pressing on all of our minds. The wave of uncertainty brought by the pandemic has left us searching for answers on how to help our workforce on a day-to-day basis. In light of this, the next webinar in the REBA crisis series is dedicated to supporting the financial wellness of employees and will address the following crucial questions:

- How has the concept of financial wellbeing changed since the start of the coronavirus crisis?

- What services, benefits and tactics are employers offering to working and furloughed employees?

- Are workplace loans a good or bad idea? Is there another way?

- How do we identify our most financially vulnerable employees?

- Can we support staff on furlough?

- Can we help our Zero Hours employees, contractors and gig workers with their financial wellbeing?

- How do we communicate financial wellbeing to staff out on the front line or working from home?

- Is there an opportunity to encourage savings among staff spending less than usual during lockdown?

Join us on Friday at 11am for this live session where the following reward leaders and industry experts will share their perspectives and explore the current challenges:

- Mark Chadwick, head of pensions and benefits at RBS

- Caroline Howes, principal & business development director at Mercer

- Tim Robertson, UK compensation & benefits Leader at Microsoft

- Andrew West, head of reward UK & Ireland at BOC UK & Ireland.

Update 14:22 18 May 2020 – Mental Health Awareness Week and coronavirus

Looking after employees’ mental wellbeing during this coronavirus pandemic will be critical to the long-term health of the UK’s workforce.

To highlight this issue during Mental Health Awareness Week REBA has compiled a selection of resources to help employers support their staff during this difficult time.

Update 12:32 18 May 2020 – Webinar: executive incentives, pay and employee share plans

Watch REBA’s latest webinar on executive incentives, pay and employee share plans, and the challenges employers now face with changing share prices and economic conditions as a result of coronavirus.

REBA’s expert panel discussed the current pressures to reduce pay and incentives for executives and what they are doing in their own organisations; what their plans are for all employee share plans; actions around communications; and what lies ahead for both executive incentives and employee share ownership?

The speaker panel included:

- Helen Baker, head of secretariat, Coca-Cola European Partners

- Anna Fletcher, group head of reward, Rentokil Initial

- Roger Fairhead, group reward director, Legal and General

- Janet Cooper OBE, partner, Tapestry Compliance

- Chair - Debi O’Donovan, co-founder and director, REBA.

Watch the full webinar.

Update 14:35 07 May 2020 – employers move to protect employees with new benefits, finds REBA’s snap survey

REBA’s latest snap survey revealed the dramatic effect coronavirus has had on reward and benefit strategies, with many employers introducing new benefits to protect the health and safety of their workforce.

- 6% of employers have introduced or will introduce COVID-19 testing, while nearly half are reviewing it.

- 6% offer or plan to offer antibody testing, with a further 54% reviewing it.

- 22% offer or plan to offer face masks, with a further 52% reviewing

- 11% offer or plan to offer alternatives to public transport, with a further 41% reviewing

- 15% offer or plan to offer tech/app to notify colleagues if positive, with 60% reviewing

Although many employers have already taken the decision to implement these new benefits, the majority are still reviewing whether they will introduce these measures.

Download the full research findings for free to find out more about: the use of the Coronavirus Job Retention Scheme; executive remuneration: pay, LTIPs, bonuses and shareholder AGMS; how COVID-19 is changing employee wellbeing offerings and insurances; the impact on employee financial wellbeing services; and how employers are supporting physical, mental, financial and social wellbeing.

Update 08:30 06 May 2020 – Equality and Human Rights Commission issues coronavirus guidance for employers

The Equality and Human Rights Commission has launched guidance to help employers understand their legal obligations to ensure the decisions they make in response to coronavirus do not directly or indirectly discriminate.

“We appreciate that difficult decisions need to be made, including changing the ways employees work, choosing how to pay those self-isolating and making decisions around furloughing and redundancy,” states the guidance.

“As an employer, you are still under legal obligations to ensure the decisions you make in response to coronavirus (COVID-19) do not directly or indirectly discriminate against employees with protected characteristics.

“In a time when you are facing demands to do things differently, we want to help you understand these obligations, so you can make inclusive decisions to support staff through these challenges,” the guidance states.

Update 11:25 04 May 2020 - pensions focus webinar: supporting pre-retirement employees in the time of coronavirus

Watch the recording of REBA's latest webinar on supporting pre-retirement employees in the time of coronavirus. Our excellent panel advocated being patient and the importance of financial wellbeing at this time. As well as answering a host of questions from our live audience.

A massive thank you to our panel who shared their insight and industry knowledge:

- Nigel Baldwin, people development executive at Marshall Group & pensions trustee at Thales UK;

- Jenny Holt, proposition director at Standard Life;

- Nathan Long, senior pensions analyst at Hargreaves Lansdown;

- Matthew Webb, global head of benefits at Refinitiv;

- Natasha Wilson, global reward director at Oxford University Press.

Watch the full webinar.

Update 10:40 30 April 2020 – Coronavirus snapshot survey

The pay, reward and employee benefits landscape is continuing to change and adapt in the face of the coronavirus pandemic. To help employers keep a finger on the pulse of the changes, we have launched our third snapshot survey.

The poll will only be open for responses until Tuesday 5 May at 10am, and should take just 5 minutes to complete. Take the survey.

The initial results will be discussed during this week’s webinar on Friday, while the findings from our previous survey can be downloaded for free.

Update 10:12 29 April 2020 – nearly one-third of group risk providers have no been proactive in talking to their clients

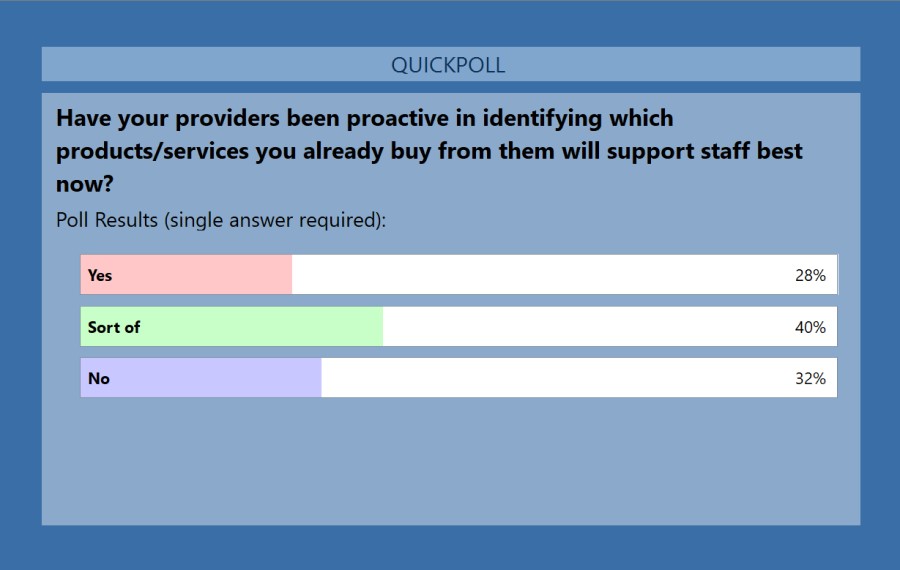

Last week REBA ran a snap-poll during its webinar on group insurances and employee benefits. We asked: have your providers been proactive in identifying which products/services you already buy from them will support staff best now?

Surprisingly just 28% of respondents said yes, while the majority (40%) said sort of, and 32% said no.

The lack of response from some providers has been called out by Equiniti, who say it is time for providers “to reveal how their products and services will continue to provide value during – and immediately after – the COVID-19 pandemic to provide much needed clarity”.

What has your experience been? Why not find out more from your peers on rebaLINK our confidential peer-to-peer forum?

Update 09:30 28 April 2020 – HMRC guidance update

HMRC is continuing to update its Coronavirus Job Retention Scheme guidance. The latest update provides employers with more details about how to claim for 100 or more furloughed employees and the type of bank account details you must use.

Update 09:40 27 April 2020 - REBA webinar on group insurances and employee benefits during the coronavirus crisis

REBA’s latest webinar into group insurances and employee benefits it now available to view.

The webinar generated some fantastic questions about the impact of coronavirus on group insurances, private medical insurance, health trusts, associated services such as EAPs and virtual GPs, as well as issues around cost management and future changes to reward and benefits strategy.

Thank you to our expert panel who provided their insight into how the insurance market is developing and responding during the coronavirus crisis, and the actions they are taking to support their employees.

Update 09:15 24 April 2020 – HMRC publishes guidance on reporting furlough payments

The reporting payments in PAYE Real Time Information from the Coronavirus Job Retention Scheme is the latest guidance to be published by HMRC.

This information provides the latest technical information to support employers with how and when to report payments to HMRC made to employees under the Coronavirus Job Retention Scheme using the PAYE Real Time Information system.

Update 13:20 22 April 2020 – REBA webinar on group insurances and employee benefits during the coronavirus crisis

Join us for our fourth webinar on how employers are tackling the coronavirus pandemic.

This latest session in REBA's crisis series on 24 April at 11:00 is centred around the topic of “Managing the costs and effectiveness of group insurances and employee benefits during the coronavirus crisis”. Debi O'Donovan, co-founder and director at REBA will be chairing an expert panel of employers and industry experts:

- Andrew Baillie, Reward Director - Europe and Africa, Diageo

- Lorna MacMillan, Global Head of Benefits, P. Moller - Maersk

- Karen Gaynor, Global Head of Benefits & Regional C&B Lead for NW Europe at Siemens

- Jaco Oosthuizen, Co-Founder and Chief Insurance Officer, yulife

- Deborah Frost, Chief Executive, Personal Group

Click here to register to attend – live webinar Friday 24th April, 11am.

Update 10:50 21 April 2020 – Coronavirus Job Retention Scheme portal opens

The portal for claiming employees’ wages under the Coronavirus Job Retention Scheme is now live.

The government portal provides information about how to calculate the amount to be claimed and what employers need to provide before submitting a claim.

The portal opened yesterday morning, and according to figures announced by the Chancellor Rishi Sunak, as of 4pm yesterday more than 140,000 firms had applied for government help for one million furloughed staff.

Update 09:33 20 April 2020 – REBA’s latest coronavirus webinar on mental health

Looking after employees’ mental health has never been more important than during this pandemic. With so many aspects to consider, from isolation and loneliness through to trauma and bereavement, it seemed only right that REBA tackle this issue in its latest webinar.

The expert panel featuring Adele Ayling, head of reward at ITN, Debbie Fennell, senior benefits manager at DHL Supply Chain, Jane Gibbon, group HR director at JUST EAT and Nick Taylor, CEO and co-founder of Unmind all gave their insight into communication, line managers, wellbeing champions and, perhaps above all, the need for kindness.

Watch the full webinar recording.

Update 08:50 16 April 2020 – HMRC updates Coronavirus Job Retention Scheme eligibility criteria

HMRC has updated its guidance on how to claim employees’ wages through the CJRS.

A significant change is the adjustment to the period for claiming for furloughed employees.

The guidance states: “You can only claim for furloughed employees that were on your PAYE payroll on or before 19 March 2020 and which were notified to HMRC on an RTI submission on or before 19 March 2020.

“This means an RTI submission notifying payment in respect of that employee to HMRC must have been made on or before 19 March 2020. Employees that were employed as of 28 February 2020 and on payroll (i.e. notified to HMRC on an RTI submission on or before 28 February) and were made redundant or stopped working for the employer after that and prior to 19 March 2020, can also qualify for the scheme if the employer re-employs them and puts them on furlough.”

Read the full guidance.

Update 09:45 15 April 2020 – calls to extend the Coronavirus Job Retention Scheme

There have been reports in the media over the past couple of days that business groups are seeking reassurance from the government that the Coronavirus Job Retention Scheme, which pays 80% of furloughed employees’ wages up to £2,500 a month, will be extended beyond the initial three-month period.

Business groups, including the CBI, have reportedly been in discussions with the Department for Business, Energy and Industrial Strategy about the need to make a decision by 18 April, as this is the deadline for deciding whether employers can afford to keep employees on beyond May. The deadline relates to employment law, whereby companies needing to make more than 100 people redundant need to hold a 45-day consultation period.

Is your organisation facing this dilemma? Why not discuss different approaches to saving jobs on rebaLINK, our confidential peer-to-peer forum?

Update 14:20 14 April 2020 – Inside track podcast

REBA’s editorial team, along with reward expert Dr Duncan Brown, teamed up to deliver their latest podcast on coronavirus and the impact it is having on reward strategies.

The team analysis the latest findings from REBA’s snapshot survey, while Duncan Brown looks ahead at how reward might develop in a post-coronavirus world. In particular, how COVID-19 has shifted our perceptions of low-skilled workers and how they should be remunerated.

Listen to the full podcast.

Update 09:40 09 April 2020 – coronavirus actions

Over the past few weeks we have been sourcing articles from our fantastic Associate Members about how to approach the coronavirus pandemic. They have turned their expertise to help employers navigate an array of issues from mental wellbeing, to maintaining employee engagement during these difficult times, to more practical issues relating to pay and furloughing staff.

All of these articles can be found in our newly created Coronavirus Actions section, in the content part of our website.

Update 13:50 08 April 2020 – REBA launches second snapshot survey results

This morning we published the full results from our latest snapshot survey on the impact coronavirus is having on pay, bonuses and employee benefits.

Strikingly the government’s Coronavirus Job Retention Scheme looks to be working, with the proportion of employers planning to cancel or defer pay rises dropping since our last survey. It also highlighted how some employers are increasing their spend on employee benefits to best support their employees' wellbeing. Read the full round-up of the results.

Thank you to all those who responded to the survey including HR and reward professionals from BBC, BP, Costa Coffee, easyJet, IKEA, Marks & Spencer, Santander and Wells Fargo, who together with the other respondents represent 1.3 million employees.

Update 15:45 07 April 2020 – emergency volunteering leave

Last week we published a comment from rebaLINK asking other employers how they are approaching pay for those who choose to volunteer under the government’s emergency volunteer programme. They were particularly interested in whether other employers were enhancing pay or offering a matching scheme (one week leave/one week enhanced pay).

One of our Members has replied with the following comment:

We are considering 14 days additional paid leave as we have medically qualified staff who can volunteer in ICUs. We are currently checking if our Life Insurance coverage could be impacted.

We have already heard of companies who have adapted their production lines to make hand sanitiser or ventilators, but it’s also great to hear about organisations that are keen to support their staff if they want to take on volunteering roles within the NHS or other services.

Log into rebaLINK to view the Emergency Volunteering and other posts.

Update 10:10 07 April 2020 – Coronavirus Job Retention Scheme update

The government has published further details about who the CJRS applies to, what employers can claim for and whether employees can be put on and off furlough multiple times.

Read the full updated guidance.

Update 10:20 06 April 2020 – webinar poll results

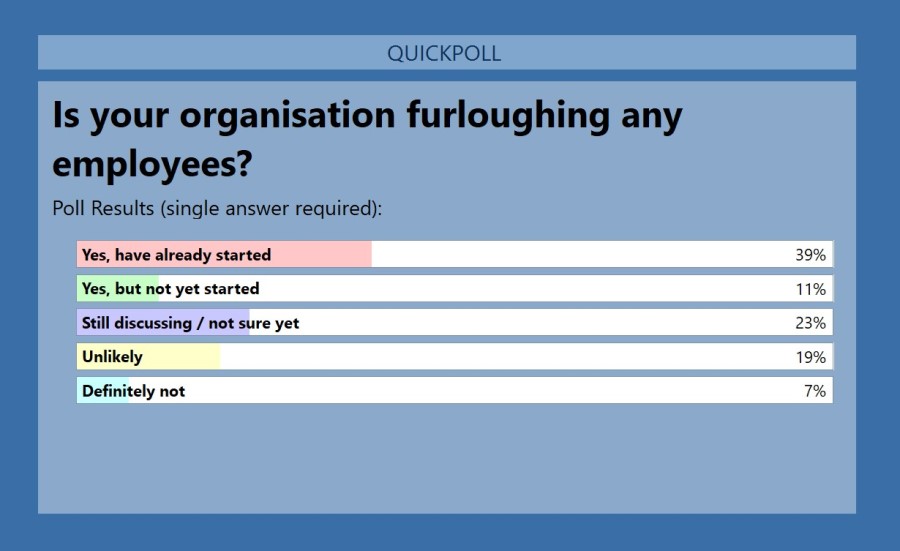

During last week’s webinar on how the government’s Coronavirus Job Retention Scheme is changing pay, reward and furlough decisions, we asked the audience whether they were furloughing any employees. The answers demonstrate just how widely coronavirus is effecting businesses across the country.

Half (50%) of the respondents said they planned to furlough some staff, with 39% having already begun the process. A further 23% were still unsure whether they would use the government’s Coronavirus Job Retention Scheme. And just 7% were sure they would definitely not use it.

Update 14:20 03 April 2020 – watch REBA’s latest webinar on coronavirus

A massive thank you to our expert panel who took part in our webinar session this morning on how the government’s Coronavirus Job Retention Scheme is changing pay, reward and furlough decisions.

We had a fantastic live audience who sent in questions ranging from annual leave issues, to what to do about company cars, how to furlough those on maternity leave, as well as how to keep your furloughed workforce engaged.

If you missed it, you can now watch the recording.

Update 10:20 03 April 2020 – Emergency volunteering

To help with the current emergency the government has asked for volunteers to help in various roles to support the wider community. One of our Members asked what approach employers have been taking to volunteering.

We are considering enhancing pay or offering a matching scheme (one week leave/one week enhanced pay) for those who choose to volunteer in the latest Emergency Volunteering policy. Interested to hear how others are approaching this.

One Member offered their approach.

We have 3 days volunteering (paid) leave as a standard policy. Hoping this will help support employees, given a lot of the activity doesn't require full days to complete and can be juggled with some flexibility in standard hours.

How have other businesses been helping with volunteers? We’d love to hear your stories. Please email the team or add to this rebaLINK thread.

Update 16:15 02 April 2020 – Leave for reserve forces

Earlier this week the government announced it would be calling up 3,000 reservists for a six-month mobilisation to help fight coronavirus. Part-time soldiers, sailors, airmen and Royal Marines with specialist skills will be activated.

One of our Professional Members submitted a question on rebaLINK highlighting that they had been receiving more enquiries from employees who are also reservists about their stance on this issue, given that the government may broaden its mobilisation.

In light of the increasing state of “national readiness”, we have seen an increase in the number of queries from our employees who are members of the Reserve Forces or who are Special Constables.

If they are officially mobilised then different provisions for absence apply, but for other occasions that may be voluntary or for training, we currently permit up to eight days paid Special Leave per annum, with any extra from unpaid leave or their own annual leave. It would be helpful to get a feel for whether our normal provision is in line with wider practice or is perhaps not generous enough?

Another Member gave their insight into what they offer:

We have reviewed our policies to ensure that they remain relevant. We are not planning to extend any additional further paid leave. Our current practice is very similar to your offering. We will, however, reserve the right to refuse leave for Volunteering for Critical programmes to ensure that we are protecting the Onsite workforce.

Read the Government guidance about managing employees who are reservists and who get called up.

Update 13:00 02 April 2020 – Additional support for carers

What additional support, if any, are you putting in place to help those employees who are also carers? One of our Professional Members asked on rebaLINK whether employers are doing anything extra to support this cohort? If you have any suggestions please answer on rebaLINK or send us an email.

Despite the interruption of COVID-19, and perhaps because of the challenge it poses to all but particularly carers, we are continuing to investigate how we can better support the carers in our company.

If you've publicly declared what your organisation is doing in this space, are you able to share more here and advise what support you make available to carers. In particular, do you offer additional leave, paid or unpaid?

Update 10:10 01 April 2020 – The Coronavirus Job Retention Scheme: support for employers during the COVID-19 pandemic

Details about how the government’s coronavirus job retention scheme (CJRS) will work have been explained in a detailed article.

Caroline Harwood, partner, head of employment tax and share plans, and Nick Irvin, employment tax assistant manager, Crowe UK, produced the article outlining who the scheme applies to and how employers can claim for the grant.

For more on the CJRS watch Caroline Harwood in this week’s webinar at 11:00 on Friday 3 April. Register your interest.

Update 08:50 01 April 2020 – Webinar: how the government’s coronavirus job retention scheme is changing pay, reward and furlough decisions

We're excited to announce the second in REBA's series of webinars to support and inform the reward and benefits community during the coronavirus crisis.

Taking place at 11:00 on Friday 3 April, this webinar will focus on the measures and decisions being made by employers since the Government announced its Coronavirus Job Retention Scheme (CJRS). How is the Government's relief package changing pay, reward and furlough decisions?

Debi O'Donovan, director and founder of REBA will chair a panel of reward directors including Yasemin Sezgin, Director Compensation & Benefits EMEA at GoDaddy; Caroline Harwood, partner at Crowe UK – an employment tax expert and author of recent CJRS article; Tina Samson, head of rewards, UK & Ireland at Molson Coors; plus an expert reward consultant from strategic partner Personal Group/Innecto Reward Consulting.

Register to attend the webinar.

Update 15:30 31 March 2020 – REBA launches second snapshot coronavirus survey

REBA has launched its second ‘snapshot’ survey about how employers are using reward, benefits and the Government’s Coronavirus Job Retention Scheme to support workers.

We would like to support the reward and benefits community by updating you on how employers are responding in the face of the coronavirus pandemic. Through this survey we can quickly track common challenges and trends.

The poll will only be open for responses until Monday 6 April at 10am, but we will discuss early results in our weekly Friday webinar this week and we will publish the final results next week.

Update 16:15 30 March 2020 – Webinar: saving costs and supporting workers during the coronavirus pandemic

Watch REBA’s latest webinar into employers’ approach to supporting workers during the coronavirus pandemic.

We feel it is important to bring the reward and employee benefits community together as much as possible at this time, so we can share ideas and knowledge, and understand that each of us is not alone when we do not yet have the answers.

To that end, we brought together a panel of experts to discuss the latest thinking on how to manage employees during this time.

Update 11:15 30 March 2020 - Webinar: poll results

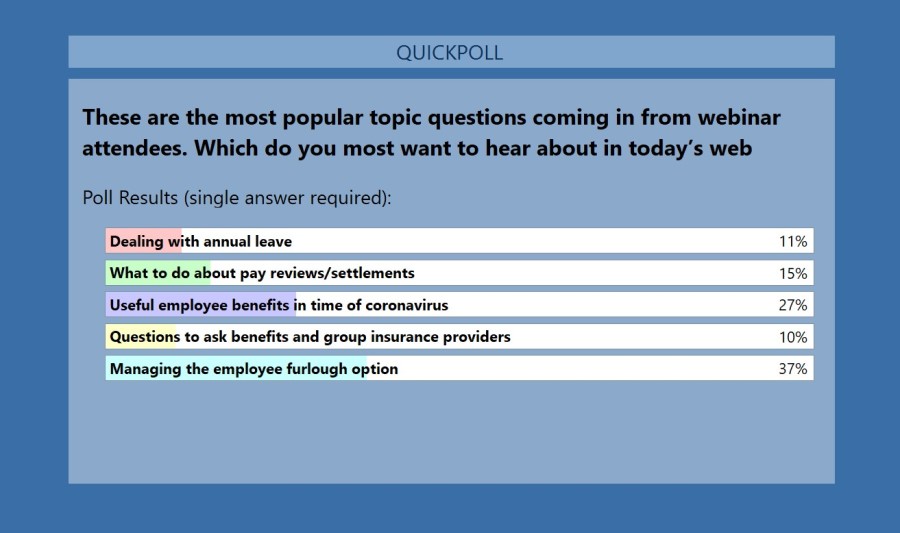

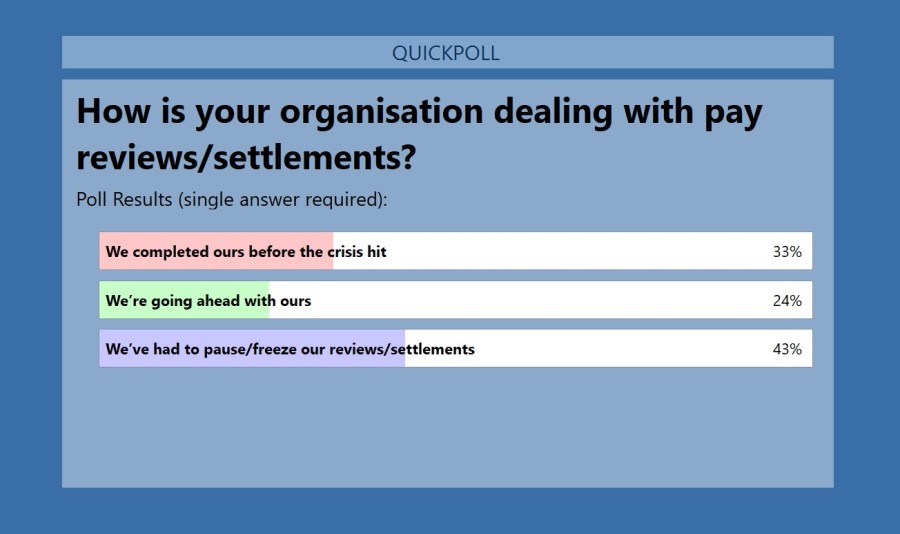

Please find below the results from the two polls that ran during our first webinar which looked at saving costs and supporting workers during the coronavirus pandemic.

Update 08:38 30 March 2020 – relaxation of annual leave carry over regulations

At the end of last week the government announced a relaxation of the law to enable workers to carry over (some) annual leave for two years. Workers will be allowed to carry over up to four weeks (not 5.6 weeks) annual leave into the next two leave years. Regulations implementing this change will be introduced before Parliament shortly.

Update 11:34 27 March 2020 – Webinar: Control costs, support people, recover fast

The first in a series of webinars on Coronavirus hosted by REBA will begin shortly. This week’s topic will reflect on the need for employers in the reward and benefits community to examine cost cutting initiatives balanced with ideas to support staff and protect culture during these unprecedented times. Register for the webinar.

Update 08:20 27 March 2020 – HMRC releases guidance about the Coronavirus Job Retention Scheme

HMRC has released details about how the Coronavirus Job Retention Scheme, which will enable employers to claim 80% of furloughed employees’ wages up to £2,500 a month, will operate.

The scheme will start from 1 March 2020. However, it will not be up and running until the end of April.

The guidance confirms that employers will be able to claim for 80% of wages, plus associated employer National Insurance contributions and minimum automatic enrolment employer pension contributions on that wage.

Update 13:30 26 March 2020 – employee benefits and furloughed employees

Many employers are now moving to furlough their employees in line with the Coronavirus Job Retention Scheme requirements, until business as usual resumes. However, this in itself is raising questions. One of our Professional Members raised the below question on rebaLINK.

Does anybody have any guidance on the continuation of employee benefits during periods of furlough? And would the guidance be the same for both employee funded benefits and company funded benefits?

At the moment official guidance around the Coronavirus Job Retention Scheme, which requires employers to furlough employees in order to be reimbursed 80% of their wages up to £2,500 a month, is limited. More details from HMRC are expected shortly.

However, our three of our Members had this insight to offer.

I don't actually know but would like to! Also how does this work with salary sacrifice and pensions? My guess is that the individual is an employee, furlough means the organisation gets a grant from govt to cover 80% of cost of wages up to £2,500 cap. I am therefore assuming that all benefits, pension and salary sacrifice arrangements stay in place? (Subject to T+Cs of those arrangements regardless of furlough?) I suspect no one has really figured this out yet?

I am interested to see too as we are working our scenario's as we speak.

Would also be interested to know what others are doing or more guidance, although currently we have said that nothing changes as long as we are committed to paying employees in full. We have provided guidance and sources of help should employees need it, but this is more around things like season ticket loans, private medical and gym memberships rather than salary sacrifice benefits, which remain in place as normal. I suspect as more cases of financial hardship arise where an employee's partners / families are losing jobs etc. we will have to review and perhaps deal with on a case by case basis. We are also working through the scenarios now.

Update 15:28 25 March 2020 – coronavirus articles

REBA’s Associate Members have been very busy writing lots of brilliant content for us on how to address the coronavirus in your workplace.

We’ve created a new topic category in our content section, so you can quickly find coronavirus related content. Articles cover a range of issues, such as mental health, financial wellbeing, communicating with staff and the wider impacts of coronavirus on pensions and benefits.

Update 13:50 25 March 2020 – increasing pay in the online retail sector

One of our members has asked the below question relating to pay in the retail sector. It echoes another question we had last week about whether employers are offering hazard pay to staff.

If anyone has any insight on this please get in touch either by responding to this query on rebaLINK or by emailing the REBA team.

Are you planning to increase your hourly rates for those workers who are required still to attend and pick orders and, if so, by what percentage figure? Are there any risk allowance that you are paying in these situations? What transport arrangements are you putting in place for those required to attend work or are you paying additional travel allowances? If you are willing to share any specific pay rates or percentages please feel free to private message me the info.

Private messaging is a feature of rebaLINK allowing individuals to keep their responses private, rather than publish them on the forum.

Update 11:20 25 March 2020 – Annual leave and COVID-19

A popular question to come up on rebaLINK this morning evolves around annual leave. One employer asked what approach employers are taking to managing annual leave during this period. The question posed states:

There have been discussions around annual leave during the COVID-19 pandemic and how employers are managing this. Some employers are asking employees to use some of their annual leave allowance over the coming weeks/months, or looking at options such as flexibility with holiday carry forward, etc. Interested to hear what others are doing?

So far we have had six responses from our Professional Members outlining their various approaches.

We're being flexible and offering the ability to be paid for holidays and still work (by mutual agreement) along with carry forward of up to five days. Our holiday year ends 31/3/20. For the 20/21 year we're encouraging colleagues to still take leave to get a break.

Our annual leave year runs from Jan to Dec and one concern for us is people 'stockpiling' annual leave and all going on leave at the same time when restrictions are lifted. We are unlikely to offer any exception to the maximum one week carry over of holidays, so quite a dilemma.

We are not allowing cancellation of holiday unless agreed during this period to ensure holidays are not built up for the end of the year.

Our 2019 carry over expires on 30 June and I'm communicating today that we will not extend this expiry as it's important for people to have downtime, even when they can't travel anywhere – we don't think it's unreasonable for them to have had to take a week off by the middle of the year. We usually allow a five day carry over but I am proposing we extend this to up to 10 days for anyone who has taken at least 20 days holiday by December 31.

No extension of standard carry over (period ends 31 March). Employees will need a break at certain times over the next period of time, so communicating the importance of holidays. Avoiding accrual build-ups.

We are not allowing the cancellation of booked holidays (unless for a business requirement). We need to ensure employees still take time out, rest and recharge, particularly during this difficult time; but also to avoid stockpiling of leave and all taking leave at the same time when travel restrictions are lifted. We will allow employees to carry a max of five days over into the new holiday year, which must then be used by end of Q1.

Update 15:15 24 March 2020 – Employers do not have to report gender pay gaps

Enforcement of the gender pay gap reporting deadlines has been suspended for this year. As such, employers will not be penalised if they fail to report their gender pay gap this year.

Employers can still submit their reports if they wish, but they do not have to. More information on this change can be found here.

Update 12:00 24 March 2020 – Season ticket loan arrangements

rebaLINK is proving to be a fantastic resource for our Professional Members. There are so many things that are affected by the current state of affairs, here’s one that we hadn’t even thought of.

I just wondered if anyone can provide their approach to season ticket loans due to Covid-19? I understand that providers are offering refunds but not clear on where the refund money will go – to the company or employee? Also is anyone stopping deductions if the refund has been repaid to employee?

In response, our Members said:

Season tickets are usually purchased by the employee with the cash from the loan the employer makes. We know that train operators are offering a refund on season tickets and so we are offering a couple of options:

1) Employee obtains the refund and settles the balance of the loan with us in a one-off payment

2) Employee obtains the refund, keeps the payment and continues to have payments deducted from pay as normal.

Employees working for us can only have one season ticket loan in place and so, whilst giving them the choice, we are highlighting that with the second option they wouldn't be able to get a new loan until the old one is paid off. The vast majority of our employees continue to be paid as we are key workers. If a colleague was in financial hardship we might consider suspending season ticket loan repayments to support them.

Another Member added:

Remember this is a loan to employees for their travel card/ train fare. I don't see any issues upon cancelling and obtaining a refund that an employee can repay their loan in full. This can be done by either a final payroll deduction or one off payment (depending on the loan size).

Update 14:20 23 March 2020 – REBA’s COVID-19 snapshot survey results

We had a fantastic response to our snapshot survey on employers’ COVID-19 response. Headline figures include 33% of employers plan to make contractual changes as a result of COVID-19, with top measures including deferred/reduced pay rises, cancelled pay rises and reduced working hours.

Furthermore, 83% of employers had offered staff tips on how to protect themselves if they cannot work from home, 73% have issued mental health advice for home workers, and 71% have provided guidance on social wellbeing and the importance of keeping in touch with co-workers.

Download the full report on our findings.

Update 12:48 23 March 2020 – employee wellbeing ideas to support those working from home

Two of REBA’s Professional Members have told us on rebaLINK about what they’re doing to support employees who are now home-based. Here are their tips:

We are setting up Organisational Wellness Champions to be available for check ins, virtual tag ups and to share resources. We've put more focus on resources available on working from home, mental health and making sure we speak to colleagues more often.

RE metal health, Mind have a good site https://www.mind.org.uk/information-support/coronavirus-and-your-wellbeing We are also communicating various things such as ways to keep fit in the home (Les Mills and such are offering one month free trials), plus healthy snacking ideas and good working from home practices. We have used a lot of our provider resources for these, always best to speak to providers first as they often have a lot of info in this space.

Update 10:18 23 March 2020 - Inside Track podcast: REBA's COVID-19 reactions

In this Inside Track podcast REBA’s editorial team: Debi O’Donovan, Dawn Lewis and Maggie Williams, explore some of the key issues emerging from the reward and employee benefit industry and within the REBA community.

They share practical insights and tips on how reward and benefits professionals are responding and supporting their staff.

Update 09:50 23 March 2020 - Coronavirus Job Retention Scheme

The government has released further details about how its Coronavirus Job Retention Scheme, which will pay 80% of employees’ salaries up to £2,500 a month, will work.

Details can be found on its COVID-19: support for businesses page.

Update 16:33 20 March 2020 – hardship funds

Can anyone help with the below query from one of our Professional Members or have any experience running hardship funds?

Has anybody got experience of running a hardship fund? We have many low paid colleagues who may experience unexpected and unplanned difficulties in the coming weeks. We would like to set up a fund to provide immediate financial support and I'd welcome any experiences/insights.

It’s fantastic to see employers taking a proactive approach to their employees’ financial wellbeing. One of our members responded on rebaLINK with a link on how to set up a hardship fund.

Update 11.16 20 March 2020 – government updates guidance for employers

The government has this morning updated its guidance for employers on coronavirus. Please read it for the latest information on how to deal with someone who has symptoms of COVID-19, including certifying absence from work, sick pay and how to limit the spread of the virus.

Update 17:30 19 March 2020 – annual merit reviews

The topic of annual pay reviews and whether employers are going ahead with them has come to light in recent days and is one of the questions we asked in our snapshot survey. REBA’s initial findings suggest that a significant number of employers have either deferred or reduced upcoming pay rises, while others have cancelled them completely. Bonuses have also been affected, but to a lesser extent.

One of our Professional Members asked the following question on rebaLINK, our vendor-free online networking tool, about annual merit reviews:

With the current Covid-19 pandemic going on, what are organisations doing with regard to pay reviews for this year – are you still planning on implementing a merit review? I have heard of some companies not having any pay reviews this year in order to save jobs and money. We are still reviewing this position as our reviews are due for July, but wondered what the industry trend it.

In response, other Members gave their experience:

So far down the line there has been no direction budgets would change so are proceeding as normal for an effective date of increase 1st April. Annual bonuses were already paid.

Great question. We have three different merit population. The first two have already happened, but the third is happening right now. There are early rumblings in the business that there is simply too much to do with Covid-19 to cope with this too, so maybe postpone it for a while. So at the moment this is about bandwidth rather than cash savings. Candidly, I suspect businesses needing to save cash and protect jobs might need to go further and look at bigger (temporary) % reductions in base pay.

Our annual pay reviews are awarded in April. Working in the healthcare sector we definitely plan to proceed as cannot risk having a negative effect on morale at this moment in time and wish to ensure everyone is rewarded especially at such a critical time.

Internally the view is that delivering a review is more important than ever to retain engagement, particularly when we get to a recovery phase and will be asking a lot of staff. But clearly it will be different for every company depending upon cashflow and operating model. Tricky times - with a whole host of new challenges coming through it seems for the Reward profession.....

Update 11.55 19 March 2020 – helping employees to maximise their net pay

Thank you to one of our Professional Members who offered their insight into what they’re doing to help support the financial wellbeing of their employees.

I'm in an industry that has been hit hard by Coronavirus. In terms of employee benefits I'm focusing on helping employees to maximise their net pay, while not incurring extra costs on the company. We are looking at options to allow employees to temporarily opt out of taxable benefits. We will be promoting the discount schemes to help employees make their money go as far as possible. We are also promoting the EAP scheme and signposting to financial wellbeing and advice sites.

Update: 15:20 18 March 2020 – IR35 implementation delayed until April 2021

IR35 tax reform in the private sector will be delayed to 6 April 2021. The move is part of the Government action plan to support businesses and individuals through the economic impacts of Covid-19.

Nigel Morris, employment tax partner at MHA MacIntyre Hudson, commented: “This is very good news for potentially affected businesses, who have more than enough to focus on managing the impact of coronavirus.”

Update 13:40 18 March 2020 – paying employees

We’ve had another question from one of our Professional Members – if you have any insight into the below question please do get in touch with the REBA team.

Can anyone share what their plans are for paying employees who are unable to work from home?

Update 09:50 18 March 2020 – Snapshot survey on COVID-19

The poll will only be open for responses until Monday 23rd March at 12pm.

At REBA we want to know how the reward and benefits community is responding to COVID-19, so that we can better understand the challenges you are facing and to enable us to best support our community.

We’ll be running a series of short ‘snapshot’ surveys over the coming weeks about your challenges and responses to the current situation, and how you’ve been using reward and benefits to support your staff.

We’ve launched the first of these surveys and would love to include your response in our analysis. The findings will be used to inform REBA members about general industry response trends and to help us structure our content in the coming weeks.

The poll will only be open for responses until Monday 23rd March at 12pm. Look out for a summary of the findings on the REBA website during that week.

Update 11.33 17 March 2020 – mental health resources

One of our Professional Members has requested information to help staff adapt to their new isolated working environments.

We would like to provide employees with information and resources on mental health – working remotely – isolation. If anyone has such info or tips I would be thankful if you could share.

Please fine below links to recent articles we have run that relate to isolation and home working. We have also included links to a couple of mental health charities and other reliable sources who have produced information to help support mental health during the Coronavirus outbreak.

Video tutorial: Dr Ben Kelly of Nuffield Health on remote working, stress, wellbeing & productivity

How to combat wellbeing risks to remote workers

How to include remote and homeworkers in a social wellbeing strategy

Do remote and home workers have different requirements when it comes to mental health support?

World Health Organization - Mental Health Considerations during COVID-19 Outbreak

Mind – Coronavirus and your wellbeing

Mental health at Work – resources

Update 10.55 17 March 2020 – rebaLINK questions

Two new questions have cropped up on rebaLINK on two very different topics.

Is anyone providing hazard pay for employees who can't work remotely?

This isn’t something we’ve come across as yet. If you have any experience with this issue, or any guidance to offer please follow the thread on rebaLINK or email the REBA editorial team.

We're looking at providing employees with loans so they can purchase laptops so they can work from home. Am I right that there is no tax efficient way to achieve this in the UK anymore?

A few years ago the obvious answer would have been salary sacrifice. However, this option is no longer available for items such as laptops. As such, we believe that this would have to be treated like any other loan: https://www.gov.uk/expenses-and-benefits-loans-provided-to-employees

Update: 07:45 17 March 2020 – article on COVID-19: sick pay, absence management and employment law

Paul McFarlane, legal director at Capsticks, outlines the changes to Statutory Sick Pay and how employers can manage absence from an employment law perspective during this pandemic.

Update: 16:00 16 March 2020

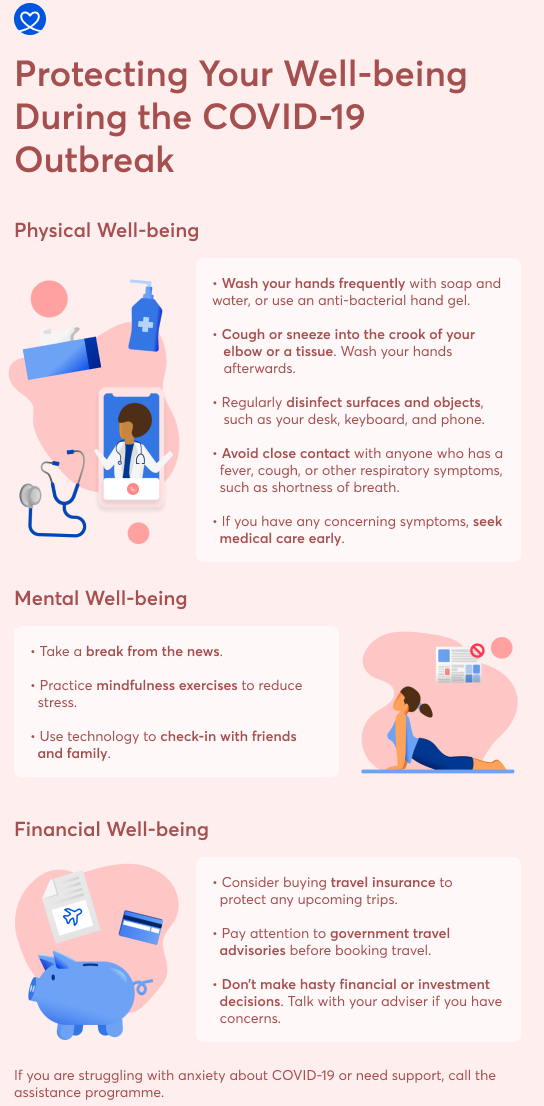

© LifeWorks 2020. This infographic is an example of the resources offered through

© LifeWorks 2020. This infographic is an example of the resources offered through

Related topics