Financial wellbeing – A workplace savings sidecar is a must

It’s currently being ‘road tested’ by Timpson the multinational retailer, with Yusen Logistics and the University of Glasgow joining in Autumn 2019. The experience of these early adopters will no doubt influence the final product design.

Admittedly at first glance the ‘sidecar’ is not the most exciting financial services product ever launched but it does represent a shift in agenda. The point that’s been overlooked by most people, is that by its very existence the sidecar is a government level admission that a pension in isolation is not enough to meet the financial needs of today’s workforce – inaccessible pension savings cannot help the 16 million people in the UK who have less than £100 in savings (Money Advice Service)!

From an employer perspective that’s 16 million people in the UK who aren’t, by anyone’s definition, financially resilient. All it takes is one unexpected expense to push one of these people into major financial stress. Financially stressed employees won’t be focused at work which impacts productivity levels.

It’s the latter point that makes this a workplace issue, requiring a workplace solution and NEST is surprisingly leading the way.

But why NEST?

NEST is the pension scheme set up by the government and established by law to specifically deal with auto-enrolment. It’s run by the NEST corporation, a nonprofit public organisation falling under the Department of Work and Pensions. When auto-enrolment was launched, the government needed to ensure that all employers had access to a suitable pension scheme; a scheme that would accept any employer regardless of size and accept contributions regardless of how small.

The latest figures show that NEST was essential to ensuring that auto enrolment was – and continues to be – a success. Since its introduction in 2012 auto-enrolment has added more than 10 million employees to pension schemes, of which nearly seven million are active members of NEST.

It’s the demographics of the NEST membership that shows why they’re leading the industry in this way. The average pensionable salary of NEST members is only £18k per annum and nearly a third of the total membership is under the age of 30, according to NEST’s 2017 figures. This is a target market that will absolutely benefit from the sidecar product.

Sidecar explained

In a nutshell, the sidecar product is a cash account which sits alongside an employee’s pension account. Some of the pension contributions get directed into this cash savings pot until a pre-determined limit is reached, at which point all pensions contributions are redirected back into the pension scheme. The employee can access the cash pot for any reason and at any time; it’s ostensibly an emergency cash fund.

If the cash pot is used, the money is replaced by contributions being redirected from the pension scheme until the set limit on the cash savings pot is reached.

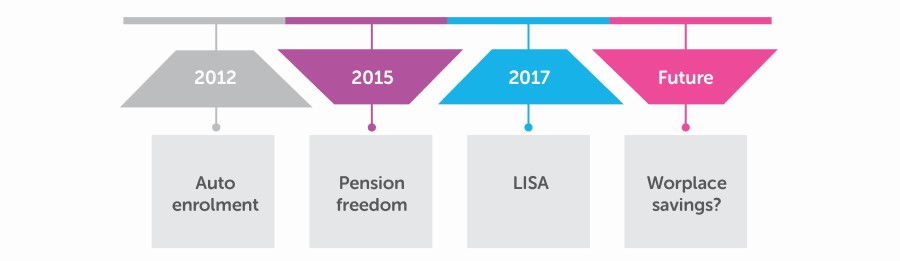

This type of long-term savings product with an accessible element seems to be on the government’s savings agenda; we’ve probably just failed to join up all the dots. For instance, in 2012 the introduction of auto-enrolment brought the next best thing to compulsory pensions, followed by pension freedom in 2015. 2017 saw the introduction of the Lifetime Individual Savings Account (LISA) which comes with a government bonus and is used to save for a first house purchase and/or retirement, but with the ability for account holders to withdraw money (albeit with a penalty) at any time for any reason. There’s a growing call for the LISA to become an approved automatic enrolment vehicle.

Accessibility is key

There‘s no doubt that we’re inching towards a workplace savings environment that looks to balance longer-term savings needs with shorter-term saving necessities; we just need it to pick up speed. Imagine facing real financial stress or even ruin and receiving a pension fund statement showing a fund value that would solve all your problems – but not for another 20 years! There has to be a middle ground.

The good news is that as an employer you don’t have to wait for any further government initiatives or legislative changes; you can achieve this middle ground by rethinking your current approach to pensions; just like NEST.

In many ways the NEST sidecar falls short of providing for the financial needs of all employees and any employer looking to introduce this concept should implement a structure that goes beyond just an emergency savings pot. But whatever the agreed structure, the following points are critical to its success:

Payroll deductions

Just like the pension scheme, any contributions should be processed through payroll. In our experience employees find it easier to commit to saving when contributions can be taken from pay and paid across to the provider by the employer.

Support and communications

Just like any other employee benefit, the more communication the better the take-up rates. It’s also important that the sidecar (the additional savings vehicle) is communicated as part of a bigger initiative, for example, as part of the pension scheme or an overall financial wellbeing programme.

Individual Savings Accounts (ISAs)

The next best thing to pensions are ISAs; there’s no tax deductibility upfront but the funds held in it are tax efficient. It’s also critical that the full range of ISAs are available including a LISA for employees under the age of 40.

Platform and incentives

Just as payroll deductions make it easier for employees to save, the chosen provider platform needs to be easy to use and offer clear value. For instance, discounted fees.

What are the structure options?

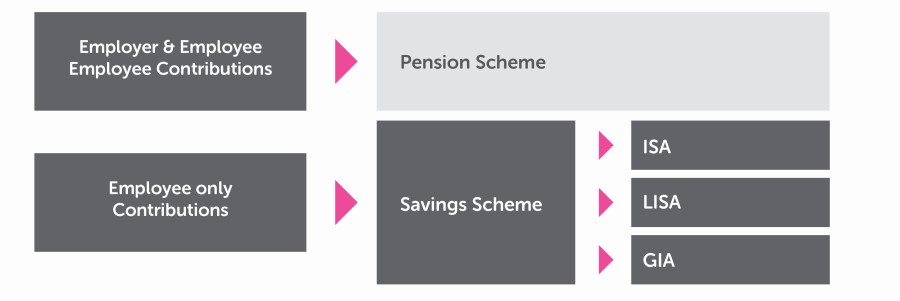

A soft sidecar

This is the NEST model where the pension scheme remains unchanged but there’s an additional savings vehicle on the side into which employees can voluntarily save (deducted through payroll).

This model works well for employees who are already looking to save or for employees with specific needs, for instance higher earners. Due to the introduction of the tapered annual allowance, the contributions that higher earners can pay into their pension scheme might be restricted to as little as £10,000 per annum (including any employer contributions). The soft sidecar model provides an alternative vehicle for contributions over the allowance, ideally an ISA which allows for further tax efficiency.

A hard sidecar

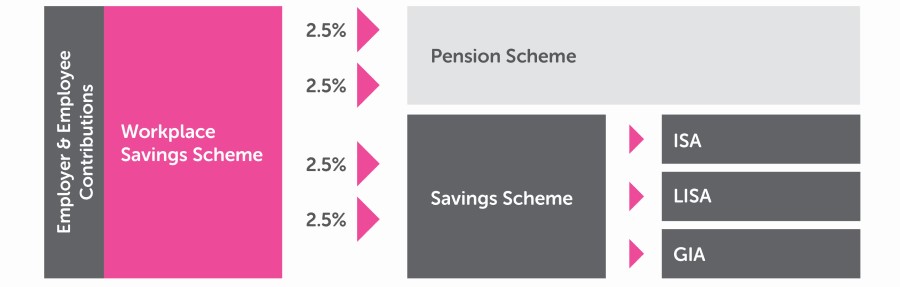

This is becoming more and more popular and really speaks to the needs of all employees. In effect this approach recognises that although pensions are important, they can’t cater for the needs of all employees.

The pension scheme effectively becomes part of a wider ‘workplace savings’ programme. Some contributions are paid into the pension scheme whilst the balance is paid into an ISA. For instance, if the current pension contribution structure is 5% from the employer and 5% from the employee, this might change to 2.5% from each party with the balance paid into an ISA.

The hard sidecar approach requires a real departure from the past for employers; it recognises that pensions are only part of the solution – they’re not the solution. If you’re looking to cater for all employee needs this is the ultimate structure.

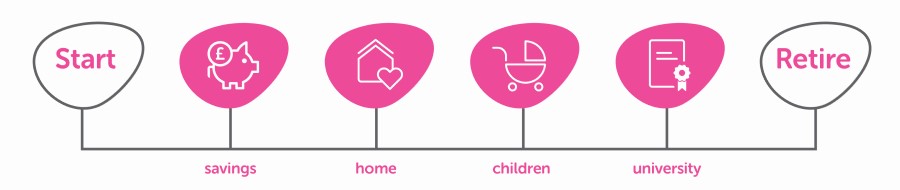

Let’s consider millennials. They have 30 or maybe 40 years to go until retirement but between now and then there are more pressing financial concerns like first home purchase. It’s not denying the importance of pensions but recognising that retirement is the end of a financial journey – not the journey itself!

What’s stopping change?

For years pensions have dominated the landscape and for most of this time employers have been looking for ways to increase engagement with pensions. After all pensions are a huge cost to the business and the only return to the employer is engagement levels. But we’ll still be looking to increase engagement levels in 10, 20 or even 30 years because the fact is pensions are focused on one life event but employees aren’t. No matter how much more effort, time and money we throw into communications, pension engagement won’t suddenly increase - but workplace savings will.

The author is Steve Watson, head of proposition at Smarterly.

This is a sponsored article provided by Smarterly.

Supplied by REBA Associate Member, NatWest Cushon

NatWest Cushon is a workplace pensions and savings provider with an award-winning proposition.