Financial wellness, wellbeing and benefits strategies: the importance of consistency and alignment

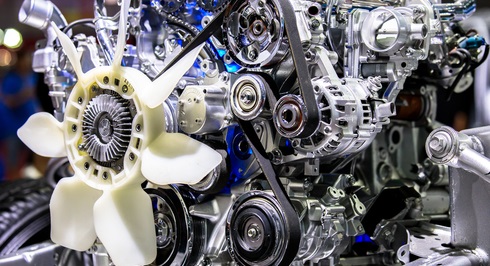

You call the salesman, who says: "Congratulations! Since you're our one millionth customer, we replaced your engine with the best engine from the fastest car in the world. The sound is a bit unusual, but it'll run like a dream!" You should ask yourself: Do you keep the car as it is, or do you insist on the one you originally purchased?

Let that sink in for a while. We'll get back to it.

The modern workplace evolves and so too, our approach to wellbeing in the workplace. There was a time when the concept of wellbeing was linked solely to physical health. Over the years, mental health was added - as we recognised the impact of poor mental health on the wellbeing and productivity of employees.

Over recent years, financial wellness has come to the fore as essential for the same reasons. In order to keep up, the benefits and interventions on offer have had to evolve as well, providing endless opportunities for providers to help solve workplace concerns.

Whether you're looking after your employees as a true duty of care (doing the right thing), or whether you're simply concerned with productivity and maintaining attractive positions in your organisation (getting the job done) - chances are you have already considered or implemented a number of these solutions.

It can all be very confusing. A recent development in workplace evolution is that employers have come to realise that a wellbeing strategy is absolutely necessary. Of course, this is true; in the absence of a coherent strategy, an organisation might incur costs on benefits that prove not to be fit for purpose - ultimately experiencing a drop in productivity as they lose their best people to an employer who knows and can deliver what its employees want.

Our survey - the 2017 Barnett Waddingham UK Workplace Wellbeing Index - shows that 71% of employers surveyed currently have, or are developing, a wellbeing strategy. Compared to 51% in the previous year, we see this as a growing trend.

What companies generally do is to implement a strategy - or at least have guidelines in place - for financial wellness and wellbeing separately. The reason for this might be that the benefits and interventions associated with each are very different and offered traditionally by different types of providers.

Sometimes, one might even find different people in an organisation responsible for each strategy. On top of this, the benefits you offer as an organisation should also have a structure and be implemented according to a set plan.

What could happen if these strategies are not consistent?

Studies show there is a strong link between financial wellness and mental ill health. We also know that sustained depression or other mental conditions can eventually manifest in physical illness. In fact, most of the different aspects that make up overall wellbeing are closely linked. However, if we are not able to actually measure the effect of one on the other, it is difficult to find the right way to address a specific problem.

For example - it is not good enough to simply roll out financial wellness initiatives like pension education or employer loans and expect your employees' state of health (body and mind) to improve. We need to be able to assess the effect of a financial wellness benefit not only on employees' financial security but also on their health and other aspects of wellbeing.

Failing to do so may impact a company's bottom line as it experiments with various benefits in a process of trial and error to see what works or to keep up with the latest trends.

Back to the new car. Just because it has the fastest engine in the world doesn't mean it will work best in your vehicle. The number of adjustments to the engine block and transmission that the workshop has had to make to make the engine fit might cost you a lot of money in the long run to maintain. In addition, the car you now drive is not the one you wanted, even with the greatest engine. Will the bigger engine cost you more in fuel? Very likely. Will the car perform as you expect it to perform? Probably not.

The best way of achieving consistency in performance is through aligning the different parts to the whole; have an engine that is suitable for your vehicle.

If we take this one step further and consider the most effective alignment, then it has to be using only the parts that fit your car - parts that are tailor made; your car should be built from one plan.

So, how do we align financial wellness, wellbeing and benefits strategies in the best way?

- Start over with one overall wellbeing strategy

- Incorporate all the aspects of wellbeing into this one strategy - financial, physical and mental, support structures, protection benefits, sickness policies, the delivery of employee benefits, employee engagement platforms and programs etc.

- Clearly set out the objectives, aligning them with the organisation's culture and business strategies to include performance, staff attraction and retention

- Determine the needs of your workforce across all aspects of wellbeing

- Determine the solutions to address these needs

- Determine and implement the delivery of these solutions

- Define a method for measuring the return on investment for any interventions and benefits

- Ensure your strategy is flexible enough to remain suitable as the workforce grows and changes over time.

One holistic strategy that incorporates all the aspects of wellbeing will be more effective than trying to align a number of different strategies.

Drive the car you intended to drive in the knowledge that everything under the hood is designed to work together and culminate in the best overall performance.

Riaan van Wyk is workplace wellbeing consultant at Barnett Waddingham.

This article was provided by Barnett Waddingham

Supplied by REBA Associate Member, Barnett Waddingham

Barnett Waddingham is proud to be a leading independent UK professional services consultancy at the forefront of risk, pensions, investment, and insurance. We work to deliver on our promise to ensure the highest levels of trust, integrity and quality through our purpose and behaviours.