Six ways that an international workforce can benefit from financial wellbeing

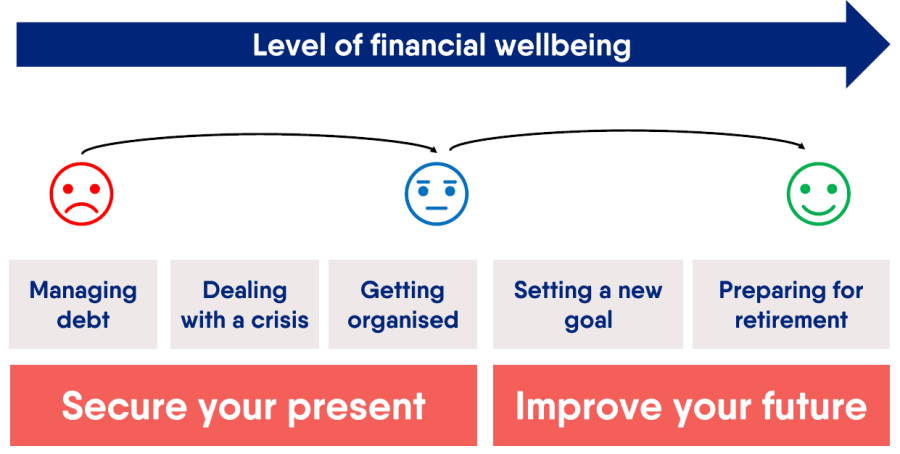

These basics include:

- control over finances on a day-to-day basis

- being able to cope with a financial shock

- the ability to have choices to enjoy life now

- being on track to be financially secure once paid work stops.

Wherever in the world your employees are based, there are several ways they can benefit from you helping them to improve and maintain their financial wellbeing.

1. Demonstrate corporate values

Financial wellbeing support and related financial products are a tangible reinforcement of an employer’s values and demonstrates care, respect and concern for employees. The more that people feel valued by their employer, the better they’ll perform and the less chance they’ll move on.

2. Unified benefits approach

Your benefits package will obviously vary according to the country location in which your people work, but a coordinated method to financial wellbeing can provide a common thread to your reward and incentives approach. This can improve the perceived value your people attach to their remuneration and improve their level of job satisfaction and overall sense of wellbeing.

3. Focus on money habits, not tactics

Retirement planning, disability support, taxation and employment rules will vary from one country to another, which makes financial wellbeing support more challenging for an international workforce. But by focusing financial wellbeing support on developing and maintaining effective core money habits and behaviours, rather than on country-specific elements, all employees stand an equal chance of having high financial wellbeing.

4. Support workforce mobility

Having appropriate help and support available to internationally mobile employees helps when recruiting from abroad or moving existing staff to different regions of the world. Financial support can include information on: insights into the cost of living, state entitlements and other local financial factors.

5. Resilience creates opportunity

People who feel that their personal finances are a mess or who are struggling to control their day-to-day finances are less likely to be able to cope with and manage a successful move to a posting in another country. The more that employees feel financially organised, capable and confident, together with being in control of debt and having adequate savings, the more willing and able they are to consider moving roles internationally. Having international employment perspective and capability increases opportunities and choices.

6. Less worry, more happiness

If your financial wellbeing is effective, your staff should worry less about money and be more focused on delivering in their role. Higher productivity and lower sickness levels from greater financial wellbeing means a better chance your people will meet their role objectives, thereby improving their future reward and promotion prospects.

Financial wellbeing in the global workplace means focusing on the fundamentals of personal money management consistently and effectively, so that country or region-specific benefits can be both valued and exploited by an increasingly internationally mobile workforce.

Interested in finding out more about financial wellbeing in the workplace? Download the Employer’s Guide to Financial Wellbeing 2019-20 here.

This article is provided by Salary Finance.

Supplied by REBA Associate Member, Salary Finance Inc

We understand the impact finances have on our health, our happiness, our home life & our work life.