New Model Reward Research: Student debt starts to pressurise employers to raise pay for millennials

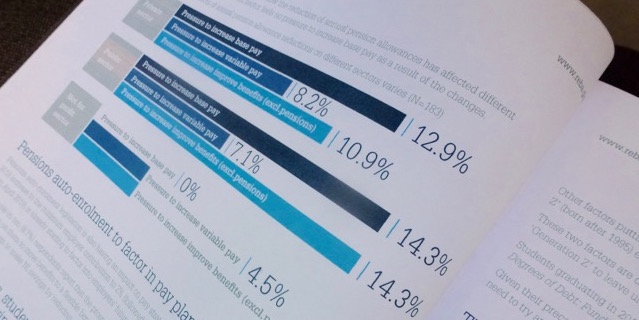

The report, produced by REBA in association with JLT Employee Benefits, shows that younger workers are feeling the pressure with today’s graduates entering the workforce with higher levels of debt than ever before. It shows that 15.8% of respondents feel pressure to increase base pay because of student debt.

And it’s of little surprise when you check the numbers. According to Degrees of Debt: Funding and Finance for Students in Anglophone countries (published by The Sutton Trust in April 2016) students graduating in 2015 owed an average of more than £44,000 each in student loans.

“This is a massive debt burden for new employees coming into the workforce and employers may feel the need to try and maximise their base pay rates in order to attract these new graduates,” said Debi O’Donovan, director at REBA.

Download the full 46-page PDF report here: New Model Reward research 2017. REBA members access the research for free.

For further in-depth discussion of this topic with senior HR and reward professionals, sign up for REBA's Reward Leaders' Forum on 27 April 2017. REBA Members can attend for free.