A 3-step approach to improving employee financial wellbeing

The term ‘financial wellbeing’ encompasses so much, from salary to pensions and mortgages to debt, and yet it seems to be so little understood.

So how do you provide employees with tools to improve their understanding without singling anyone out?

The Money and Pensions Service (MAP) defines financial wellbeing as feeling secure and in control of your finances. It’s knowing that you can pay the bills today, can deal with the unexpected and are on track for a healthy financial future.

Health is linked to financial wellbeing

According to MAP:

- 22 million people don’t know enough about retirement planning

- 11.5 million people in the UK have less than £100 in savings

- 9 million people often borrow money to pay for food and bills

- 5.3 million children don’t get a meaningful financial education

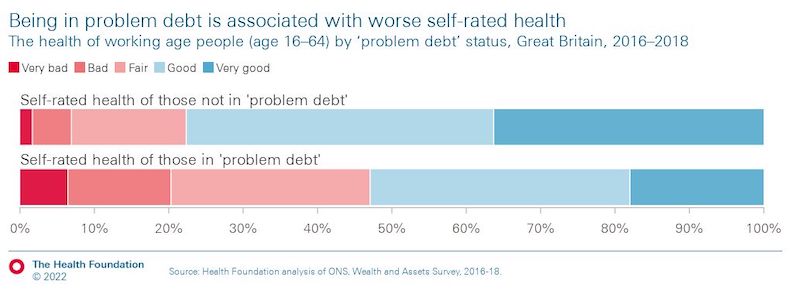

On top of that, there are strong links between problem debt and poor health. The Health Foundation found a correlation between self-rated health and money problems:

Debt is not a dirty word

Money is typically a private topic and one to be handled carefully in the workplace. In general, we recommend regular company newsletters with a dedicated module about employee benefits. Better yet, a separate email covering all that’s needed to know about your benefits portal and handy tips to make the most of what’s available.

Incorporating a segment on money management and debt advice is essential, as it’s impossible to determine an individual's financial situation based on appearances or job title alone. We also recommend making this information easily accessible around the office.

Talking is the first step to support

Sadly, a lot of the time, it’s not until people are in problem debt that they realise they need to take action. As with a lot of difficult situations, the first step is talking about it. Making sure your employees know about your EAP is crucial.

EAPs are safe and confidential resources that offer guidance in various areas. They cover topics such as financial management, debt advice, legal rights, relationships, mental health, harassment, and more. Ensuring that all employees are aware of this support system, how to access it, and its potential applications, is crucial for promoting overall wellbeing in the workplace.

Pensions and future proofing savings

Pensions can often leave people bamboozled. Some of the top questions include:

- When should I start saving?

- How much should I be paying into my pension each month?

- And where can I get free advice about my pension?

The answers are vague: save as much as you can, as soon as you can. And this often puts pensions to the back of mind for many people.

What do your employees know about their own pensions? Do they know how much they are paying in and your company’s contributions? What about if they are entitled to a Smart Pension or if enhanced rates are available?

There are other income protection schemes your employees should know about, from income protection insurance to life assurance.

Financial wellbeing in the twilight years

Although it may feel like a long way off, financial planning needs to extend to the day you finally retire. People aged 85 years and over represent the fastest growing segment of the population, according to Age UK. Having a pension pot that covers your needs can feel confusing. No one can predict how long they’ll live and what kind of care may be needed when they are elderly.

Some financial wellbeing resources may cover aspects of elder care, such as what, when and how to appoint a power of attorney. They can also provide advice and recommendations on releasing home equity, ensuring that no one falls foul of scammers.

3 steps to financial wellness

All employers should include financial wellness programmes. Not only do employers have a duty of care to employees, but as they are in essence in control of their income they have a responsibility to help protect it.

1. Lifestyle benefits and perks

These savings on the regular essential outgoings such as food, clothes, travel and transport, can help stretch your employees money.

2. Educational tools

Offering access to financial advisors, financial planners, debt and money management services, is a great way to promote good habits and keep people safe from scammers who will try to take advantage of those looking for help.

3. Digital tools

The biggest barrier to accessing employee benefits is communication. Regular emails reminding employees of what’s available and how to access them is a simple, sure-fire way to make a big difference.

The more we talk and share knowledge, the more empowered we become. Money can be a delicate and sometimes awkward subject, but there’s no need to pry into personal details such as retirement plans or credit card payments.

Instead, fostering small yet effective habits, like informing everyone about the financial resources offered through their workplace benefits, can make a substantial difference in fostering a culture of financial wellbeing.

Supplied by REBA Associate Member, Avantus

Flexible Benefits & Technology specialist providing online, highly configurable platforms to Customers and Intermediaries worldwide.