REBA Inside Track: Employers plan for pensions change

Almost three-quarters (74%) of employers are likely to review their pension plans over the next 18 months, with a focus on investment strategy, the type of pension plan they offer, providers and governance strategy.

REBA surveyed 72 reward and benefits directors with responsibility for company pensions for its Future of Pensions Summit in September 2023. Overall, respondents are responsible for £1.9 billion in annual pensions contributions.

Nearly half (47%) use a Group Personal Pension (GPP) for their primary open (auto-enrolment) scheme, with a further 31% using a master trust and 16% a single-employer DC trust.

Most respondents said their organisation pays above statutory employer minimums for auto-enrolment, with 70% contributing between 4% and 8%. However, only 10% say that they intend to increase contributions further, with 86% expecting to continue to pay the same in future.

Governance and employee understanding are key priorities

When reviewing their plans, employers expect to prioritise:

Employee understanding

- Communications – 55%

- Employee guidance and advice – 50%

Governance

- Investment strategy – 52%

- Governance strategy – 31%

- Value for money – 26%

Scheme and provider

- Type of pension offered – 40%

- Pensions provider – 38%

- Broker/adviser/consultant – 14 %

Multiple and legacy pension plans are still a key factor

Defined benefit (DB) schemes are still a major component of employers’ pensions portfolios, even though most are closed either to new members or to further contributions.

Nearly three quarters (74%) of respondents said that their organisation has a legacy DB scheme, which could have both cost and governance implications for current pension provision.

At least a third of employers may also be managing more than one DC scheme, with 35% saying that they offer at least one GPP other than their main (auto-enrolment) scheme, and 19% reporting that they manage additional master trusts.

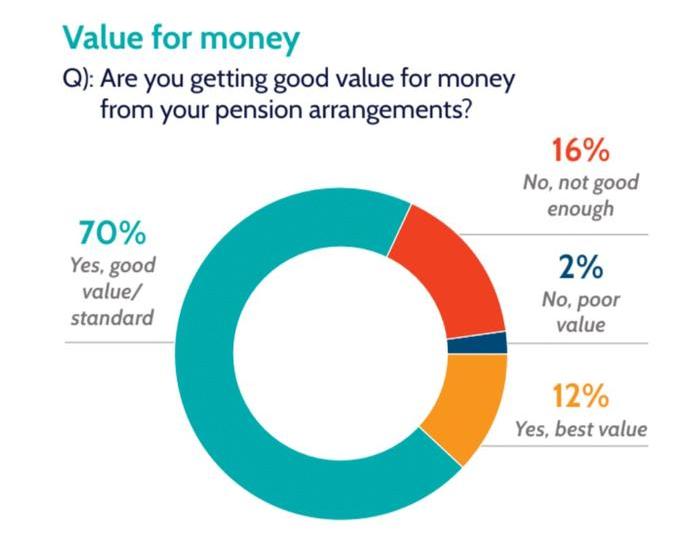

Value for money is good, but not outstanding

Only 12% of respondents said that they are getting the best value for money from their pension arrangement. At the opposite end of the scale, nearly 20% of delegates say their pension offers poor value.

Pensions continue to be an employee benefits priority. Over a third of respondents (39%) said that pensions are becoming more valuable to them as an organisation, with just 6% saying that their value is falling.

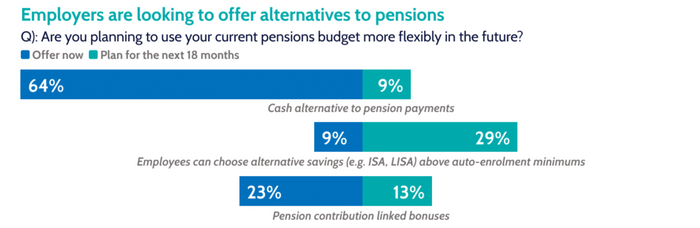

However, employers are also considering alternatives to pensions, with 73% saying they expect to offer a cash alternative by 2024, and 38% offering or expecting to offer alternative savings such as Lifetime ISAs.

Employers and employees face pension challenges

Employers’ priorities about their schemes are focused on good quality, low-complexity scheme management. They are also looking towards integrating pensions into wider financial wellbeing approaches.

- Ensure robust workplace pensions governance – 85%

- Integrate pensions within a financial wellbeing strategy – 69%

- Reduce pensions administration and/or complexity – 60%

Respondents said that their biggest challenges related to employees and pensions are focused on understanding and engagement:

- Increase employee understanding of pensions – 92%

- Increase employee engagement with pensions – 79%

- Improve support for employees approaching retirement – 74%

Since auto-enrolment was introduced over a decade ago, the pensions landscape has changed significantly. From a corporate perspective, pensions are now more likely to be outsourced, but businesses also want to make sure that they are getting return on investment.

The cost-of-living crisis could have a long-term impact on financial wellbeing and the role of pension saving. Employees also have more autonomy over how they spend their pension savings and need good quality support to make appropriate decisions.

Our results show that the majority of employers want to make sure that they are offering a pension that is right for their business and for their workforce. With government plans for auto-enrolment to broaden in scope, and other regulatory changes on the horizon, employers will need to consider the long-term impact on their reward and benefits strategy. Now is an opportunity to rethink the role of pensions in wider financial wellbeing, as well as the relationship between pension providers, employers and employees.