Inflation is hitting workers’ finances – but you can help your employees cope

We all need financial resilience, so we can cope with whatever life throws at us. Otherwise, when we’re hit by the unexpected, it can cause real pain.

Rising inflation

During the pandemic we faced more than our fair share of ups and downs and the financial turbulence isn’t over yet. Inflation hit 5.4% in December, its highest level for 30 years, and economists expect it to continue climbing, predicting 6% – or even 7% – by the spring. And this isn’t just a figure bandied about by economists, it will hit you too. It reflects big rises in the price of everything from filling up the petrol tank to filling the supermarket trolley. Take margarine, just one everyday essential: the cost has skyrocketed 27.3% in a year.

Price rises are already bad enough, but there’s every chance it will climb higher in April, with the energy price cap set to be raised by £600 or more. At the same time the freezing of tax bands, plus the national insurance hike of 1.25% across all tax brackets (basic rate taxpayers 13.25%, higher rate 3.25%) means we’ll be working for less take-home pay too.

Pain for lower earners

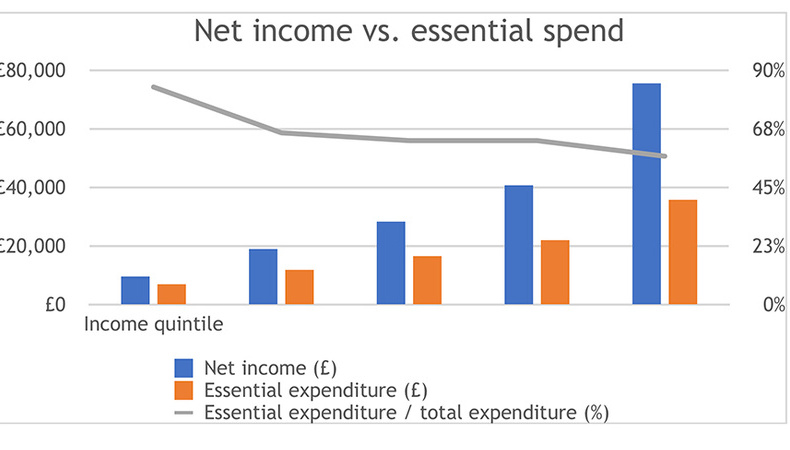

For lower earners, the rising costs of essentials will be particularly painful. Already they spend almost 84% of their income on essentials, so a rise in prices will have a massive impact on their spending. By contrast, those on the highest incomes spend nearly 57% of their income on essentials, so they have a much bigger margin to absorb rising costs.

But the rising cost of living will be worrying all your employees.

We want to make it easier for people to see where they stand. Earlier this month, we launched The HL Savings and Resilience Barometer in partnership with Oxford Economics. The Barometer lets people get to grips with how their own situation compares to other people’s, to help them understand their vulnerabilities and build their financial resilience.

People tend to associate financial weaknesses with lower incomes, but it can hit everyone. The Barometer reveals that 1 in 10 of the UK’s top 20% of household earners don’t have 3-6 months of ‘rainy day’ money.

This is consistent with previous HL research which found that 12% of households making at least £150,000 could not last a single month on their savings. As income rises, typically so do our outgoings. When you earn more, this can mean taking on more debt – because they expect to be able to pay it off quicker.

Higher earners are more resilient

On the whole, higher earners may be more resilient than lower earners, but there are evidently still big holes in their financial safety net that need addressing.

Planning ahead will give your workforce the best chance of absorbing the challenges coming this year. Employers are in a unique position to provide the tools needed to increase financial resilience, whether through a financial wellbeing programme or by signposting educational resources and support services.

If employees are unaware of the concept and purpose of a ‘rainy day fund’ or don’t understand, how inflation will squeeze their income, they cannot prepare for the obstacles coming their way. To use the old adage, knowledge is power. And, in this case, it is key to building long-term financial security for them and their loved ones.

That’s why last July we launched Five to Thrive, a holistic blueprint for achieving financial resilience. It’s not personal advice, but a collection of educational resources designed to complement The Savings and Resilience Barometer. We recognise five key pillars:

- Control your debt

- Protect your family

- Save a penny for a rainy day

- Plan for later life

- Invest to make more of your money

Should the Barometer indicate that a household has low financial resilience, Five to Thrive aims to help them navigate the five pillars. It provides the order in which we should consider fulfilling the building blocks to financial resilience ie households should prioritise rainy day money before considering investing.

The author is Clare Stinton, workplace financial wellbeing analyst, Hargreaves Lansdown.

This article is provided by Hargreaves Lansdown.

Supplied by REBA Associate Member, Hargreaves Lansdown

Welcome to HL Workplace - savings & investments your employees can understand, engage with, and value.