Supporting employees worried about stock market downturns

It’s normal for pension fund values to go up and down, and if employees have been checking their online accounts over the course of this year, they’ll likely have had more than one sharp intake of breath.

Global stock markets are influenced by lots of factors, including the health of economies, unexpected events and consumer feeling. With the turmoil of the pandemic and now the current cost of living crisis, it’s not surprising that we’re experiencing a bumpy ride.

How does the stock market affect employees’ pension savings?

Modern pensions are invested in the stock market, with defined benefit pensions being phased out due to excessive costs. Default funds are used in auto-enrolment qualifying pensions with the aim to achieve growth over the long term.

As nearly 80% of employees now have a workplace pension, nearly 80% of employees are stock market investors. This means that the total value of an employee’s pension at retirement is largely based on how much is paid in and what investment return they achieve over the course of their lifetime.

Investments provide an opportunity to help beat inflation, offering the prospect of a better return than cash. This is particularly relevant in the current economic climate where inflation has climbed to a whopping 10.1%. And it’s expected to get worse before it gets better.

Reassure employees that stock market downturns are not one-off events

For some pension members, April 2020 was likely to be the first drop they experienced as the markets responded to the Covid-19 pandemic. However, the first bubble recorded dates back to the 1600s and centred around tulips.

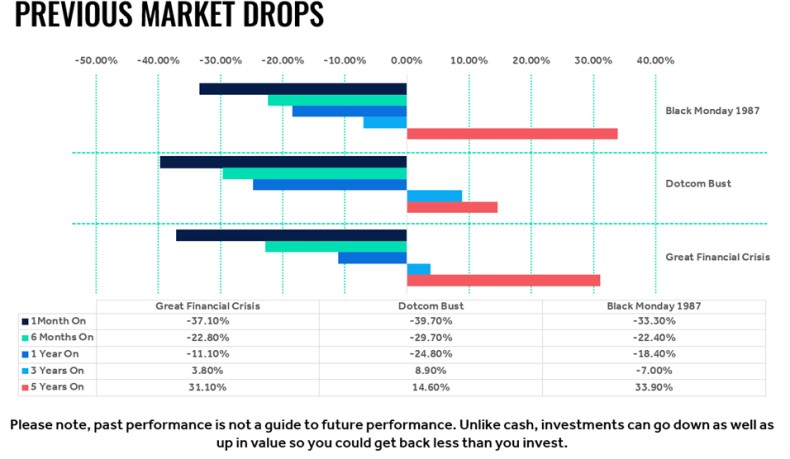

More recently we’ve witnessed Black Monday (19 October 1987), which still holds the record for the biggest one day market crash, with the Dow Jones market falling nearly 22% in a single day.

The chart above shows three events, all of which had a negative impact on the stock market. In all cases after five years the market recovered and people saw a positive return on their money. This does not mean that all downturns will mirror this pattern, but it does reinforce the need for employees to take a long-term view. And by investing for periods of five years or more there is the greatest potential for growth.

The nature of investments does mean that the value of employee pots will go up and down, sometimes significantly over the course of their career before they begin accessing their pension savings. And it is possible to get back less than invested.

Investing regularly over the long term can help

Employees typically contribute to their workplace pension monthly where the money is deducted by payroll and passed to the pension provider to invest. This process helps smooth out market fluctuations, averaging out the price paid for the investment.

Market volatility can present both challenges and opportunities for employees. Spreading the cost of an investment over a long period of time, means that as investments rise and fall, pension members will benefit by the fall in prices. This enables their same monthly contribution to go further, buying more units in their existing investment and at the same time, reducing the average cost paid per unit.

Compounding can also provide an extra boost to investment growth. This process allows employees to earn returns on any potential past returns, letting any increases build upon themselves in a snowball effect. Compounding works best when you do nothing and leave the money invested. The longer the time horizon ahead, the greater the potential effect. Employees should be regularly reviewing their investments to make sure they are right for them.

Time in the market, not timing the market

It’s only natural that when markets fall, people focus on what the impact is to their existing investments and what they have accumulated so far. Behavioural studies show that investors feel financial loss much greater than a financial gain of equal measure. It may be tempting to sell when a downturn strikes for fear of losing more money, but by doing so, employees run the risk of crystallising a loss – selling at a loss could mean reducing profit, or worse getting back less than originally invested. It’s also possible that they’ll have to buy back into the market at a higher price. It’s important that they don’t lose sight of their long-term view.

History shows that investors who hold their nerve and avoid making rash decisions are likely to end up better off. Known as the golden rule of investing, time in the market doesn’t rely on a crystal ball to predict when to move in and out of the market, attempting to buy low and sell high.

Some of the best performing days occur following a market downturn. Sitting invested in the UK stock market for the last 20 years would have returned just over 305%, Source: Lipper IM to 31 July 2022. Whereas, if you missed out on being invested for the 10 best performing days across that same time period, due jumping in and out trying to time the market, you would have achieved just 111% growth. Past performance is not a guide to the future though.

Generally speaking, the longer an individual invests, the greater risk they can take because they have a longer recovery period if needed – provided they are comfortable with that degree of risk as of course there are no guarantees with investing as you may not get back what you invest.

Employees should also review their investment risk profile to ensure it fits in with what they are prepared to accept.

You could direct employees to your pension provider to inform them of their options. It’s common for providers to have a selection of funds categorised by risk, and although unlikely to provide financial advice, they should be able to talk through the potential impact of downgrading or upgrading investment risk on an employee’s long-term plan.

Financial education and support from your pension provider will go some way to both, alleviating employee concerns and helping them understand their options, ensuring they keep their retirement plans on track.

What about pension members approaching retirement?

Those nearing retirement will feel the effects of volatility more keenly and may want greater certainty around the value of their pension. An individual’s preferred withdrawal method should inform their investment approach in the lead up to retirement.

For instance, those selecting drawdown, where you leave your money invested and take an income directly from the fund, may have another 15-20 years after retirement in the stock market. This gives them much longer to ride out the rises and falls, in comparison to those opting for an annuity.

It’s hugely important that people understand the bigger picture before making any potentially life changing decisions. Tax rules or state benefits referred to are those that currently apply, they can change over time and any benefit will depend on the individual’s circumstances. Once in a pension, the employee’s money is no longer accessible until age 55, rising to 57 from 2028.

Those unsure should seek advice, or contact Pensionwise.

Supplied by REBA Associate Member, Hargreaves Lansdown

Welcome to HL Workplace - savings & investments your employees can understand, engage with, and value.