Top ways to remove the stigma around mental health and finances

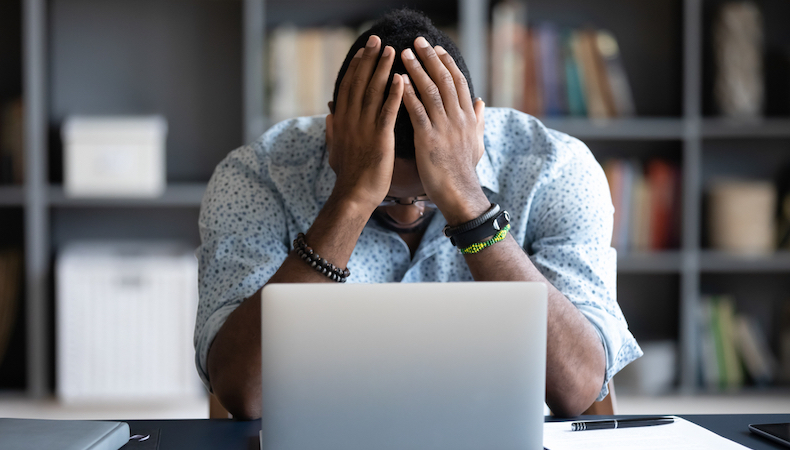

There’s no doubt that money worries affect mental health, which in turn can affect employees’ performance at work. More than two-thirds (70%) of employees told Cushon that financial worries have a negative impact on their mental health and nearly 60% said that it negatively affected their performance at work.

This is where a robust financial wellbeing programme is crucial to getting people back to being the best they can be and improving performance levels.

But unless we ‘normalise’ the issue, employees aren’t going to feel comfortable using available support. So, how do you remove the stigma and create a culture that makes it ok to get help and support in the workplace?

Create a safe space

There’s a bit of a ‘double whammy’ here in that you have the stigmas associated with mental health and money troubles, and as we all now know these two conditions are closely linked – money worries can cause mental health problems.

Making money worries ‘ok’ is about creating opportunity and encouraging people to talk about them. The more that they are talked about in the workplace, the more they become safe topics and normalised; no longer taboo.

It’s about convincing employees that, instead of being discriminated against or judged, they’re going to be supported. A poll by Populus found that less than half of people with a mental health problem had told their manager about it. But managers set the cultural tone and so it’s important that they are seen as approachable and are equipped to respond appropriately when employees need support.

Get involved in national events

A national initiative called Talk Money Week is held in November each year and is designed to increase people’s sense of financial wellbeing by encouraging them to open up about money. As it’s a national event, it’s a time when there’s increased awareness among employees and so it’s a great time for employers to set up workshops, events, educational programmes and show support.

Cushon runs campaigns during this week and provides its clients with materials to support their own financial wellbeing initiatives. The CIPD, MoneyHelper and the Money & Pensions Service also have some quality material available that employers can use to build their own campaigns.

Use everyday language

One of the biggest barriers to dealing with money problems is perceived complexity. It all feels difficult and much of this is to do with financial services jargon. For example, Cushon’s research found that nearly 60% of people feel that the information about their pension is too complex and full of jargon and over 52% of people would save more if they understood their pension better. The simple truth is, people don’t engage with complex things.

If we want to help people with money, we need to use everyday language. Whether it’s digital communications or our financial educational webinars, everything should be as plain and simple as possible. It makes a huge difference to engagement.

Make sure support is accessible

Another area that is really important to normalisation is accessibility. People want to be able to access support, education and solutions when they need them and in a medium that suits them the best. Basically, everything needs to be available digitally.

We are all now used to managing most things digitally and we expect everything to be available on demand. For instance, nearly 66% of employees told us that they would engage more with their pension if they could manage it through a mobile app.

Although the workplace is important to delivering financial wellbeing, people need to be able to have access to everything at home too and this can only be achieved by embracing technology.

This doesn’t mean that you can’t run webinars and workshops. These are really important components, but you need to make sure they are recorded and available on demand as and when people need them.

With the soaring cost of living, many more employees are going to find themselves in a financial pickle, and so it’s critical that we provide tools to support them and, perhaps more importantly, make it safe for them to access them.

Supplied by REBA Associate Member, NatWest Cushon

NatWest Cushon is a workplace pensions and savings provider with an award-winning proposition.