Which employees need extra support as cost-of-living crisis continues to bite?

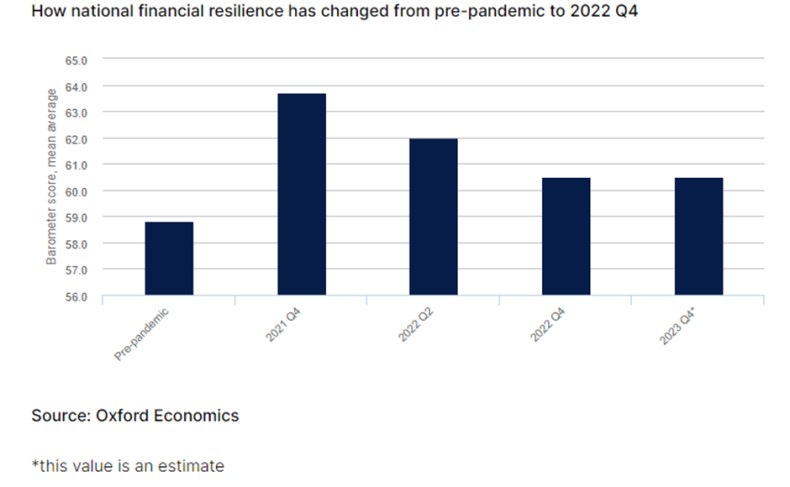

By the end of 2022, Hargreaves Lansdown estimated that nearly 40% of households had unsustainable levels of spending. And although the cost-of-living crisis is likely to have peaked in Q4 2022, the pain of rising prices is set to continue this year.

Inflation is expected to stay higher for longer than we previously forecast and wages are unlikely to make up the ground they lost over the last 12 months. This means households will need to cut spending, use savings or borrow more to make ends meet.

For the lower earners, young people and single person households in your organisation, it’s going to be a tough year.

How the cost-of-living crisis is affecting households differently

Income

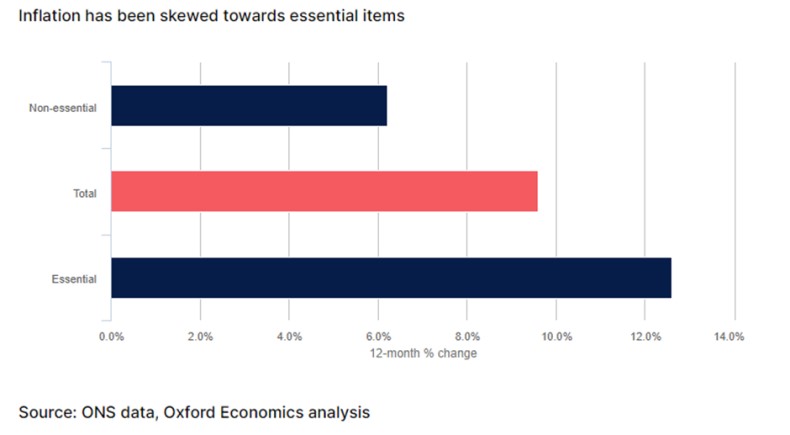

In the 12 months to October 2022, the price of essentials such as food and heating has risen at twice the pace of non-essential items.

Households on lower incomes are bearing the brunt of these soaring prices as they spend a larger chunk of their income on the essentials. This impacts the purchasing power of the poorest more than any other segment.

Office facilities staff or those in a service role, for example, who need to go into work every day will spend more of their income on increased travel costs than employees who can work remotely.

For those with no savings left, there’s an increased risk that this year will see more people on lower incomes being forced into debt.

These immediate challenges have a negative effect on long-term resilience. Lower income households are now less financially secure than before the pandemic and almost nine in 10 of the lowest income households have poor or very poor financial resilience.

However, almost a third of middle-income households now fall into this category, showing the squeeze isn’t simply impacting the lowest income households.

Age

The age of employees will also affect their financial resilience, with the least resilient aged 20 to 29.

Rising prices have hit younger people harder, with one in 10 of those aged 16 to 29 behind on energy bills. This is no surprise, as younger people tend to be on lower incomes and spend a higher proportion of their salary on the basics.

Family makeup

Children, understandably, reduce financial resilience with the additional costs they place on households, but the findings draw out the stark differences that come from sharing household costs.

Only 13% of single-person households without children have very good financial resilience compared with 41% of couples with no children.

Employment

The barometer also shows that self-employed and those employed part-time have far lower resilience than those employed and working full-time.

What to expect in 2023

Tumbling house prices

The barometer forecasts a fall of 10.4% in house prices from Q3 2022 to the end of 2023. First-time buyers or anyone remortgaging this year face higher interest rates and borrowing costs, which will affect both savings and debt.

Generation Z and Millennial homeowners tend to borrow a larger proportion of the house value and will face a fall in financial resilience of almost three times that of their Boomer counterparts. Younger homeowners are expected to suffer the biggest hit to long-term financial security.

Mounting debt

We expect an increase in debt management concerns in 2023. Runaway inflation hasn’t just damaged our ability to make ends meet today, it has also affected the levels of debt we’re carrying and the resilience we’re building for the future.

What can employers do to help?

The impact of high inflation and current economic factors are having an impact on employees’ financial resilience - with a disproportionate squeeze on low income households.

The barometer shows that by the end of 2023, nearly a quarter of households will be forced to adapt financially.

The breakdown of data can assist policymakers and employers in supporting different groups during the coming year. The employer plays an important role in driving financial education within an organisation through shaping employee education and benefits. Our Five to Thrive framework can help employers identify how they can guide employees towards a more financially resilient future.

Read the full HL Savings and Resilience barometer report and findings.

What is the barometer?

We’re delighted to publish our third six-monthly report into the financial resilience of the nation, in partnership with Oxford Economics.

The barometer is building a picture of people’s financial resilience that tells us where people are vulnerable and about the gaps in their finances. We can look at the long-term impacts of today’s events, as well as the more immediate strains on finances.

The breakdown of data in this third wave is especially useful for policymakers considering how to support different groups in the cost-of-living crisis. Read the full barometer report and findings.

Supplied by REBA Associate Member, Hargreaves Lansdown

Welcome to HL Workplace - savings & investments your employees can understand, engage with, and value.