How pensions are more popular than Kanye West

We know that people use online resources to conduct research on financial products, in fact, 63% admit they prefer to source information online according to the Employee Insight Report 2015 released by Capita Employee Benefits.

Google Trends, which analyses a percentage of Google web searches to figure out how many searches were done over a certain period of time, supports this notion but adds an extra dimension to the research – it allows us to compare the popularity of search terms online relative to one another. So, we took a look at pensions.

The popularity of pensions on Google search

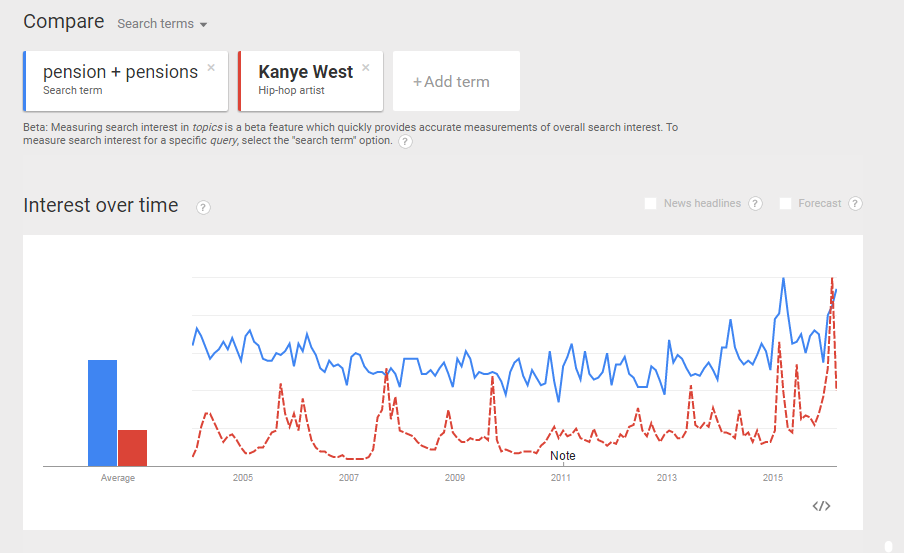

Pensions tend to get a bad rap, an area of personal finance that we have to strong arm people into engaging with but having played around with Google Trends, we noticed that pensions are probably more popular than we think, at least from a search perspective. Despite being the Michael Jordan and Stephen Curry of music, according to Google Trends, pensions are more popular than Kanye West.

Like many of you probably are, I was quite surprised to see this, and I’m sure Kanye’s ego will take a bit of a blow regardless of how resilient it appears to be.

Interest is on the increase

Nonetheless, this trend can be viewed as encouraging; Kanye West is an internationally recognised pop culture figure, thus we can assume he generates a reasonable amount of search traffic. Using him as a benchmark, it not only shows that there is a demand for information about pensions (more than we probably expected), but also that there is a gradual upward trend in search volume.

On face value, this could be considered good news – more people are trying to swot up about pensions, but looking at this objectively, this trend is a double edged sword.

Are users getting the information they need?

Yes, it is great (possibly even exciting) to see that people are taking an active interest in pensions, but are they getting the information they need and more importantly, is this information being interpreted correctly?

It is no secret that employees struggle with pensions terminology, 50% find it confusing and complicated according to our report, so it is unsurprising to see people flocking to the internet to understand them better. However, a user’s ability to conduct an effective search is largely dictated by their prior knowledge i.e. if we don’t know what to search for, we can’t search for it – the “unknown unknowns” as Donald Rumsfeld once put it.

When searching for information on an unfamiliar subject, you will naturally start with what you do know, and then read, refine and repeat until you get the answers you want. The likes of Google, Bing and Yahoo! all do their best to interpret search queries to provide the most relevant results from trusted sources. However, users do need to be able to navigate search engines properly and ask intelligent questions that will garner appropriate responses.

The challenge of misinterpretation

Typing in ‘what pension’ into Google presents an obvious problem in how people may search for information via search engines. Google Autocomplete shows subjective questions, such as what pension will I get when I retire, questions that search engines will not be able to answer with any real accuracy due to the inability to incorporate individual circumstances such as socioeconomic factors and retirement objectives; at best they can provide a generic response, which may misguide employees in their decision making.

There is also the matter of interpretation and application of the information consumed. Just because someone reads an article doesn’t necessarily make them an expert.

It is much like a How To video for soufflés. You can have Michel Roux Jr show you how to make a soufflé, but your interpretation and application of the information will be what dictates the end product, which is invariably a sad looking pancake in a ramekin in my experience. The difference between a soufflé and pensions (aside from the obvious) is that you can practice, practice, practice the art of soufflé to refine your technique and get it right; you will get immediate feedback as to whether your soufflé is how it should be. Your pension is less forgiving and you have far fewer chances to get it right.

Is Google the last resort?

With people turning to online resources for information on pensions, it does beg a further question – are they turning to Google simply because they don’t know where else to go?

This presents employers with an opportunity to intervene. Search engines are a great first point of call for developing a base level understanding, but fail to provide the depth or personalisation that is often needed when it comes to making decisions about pensions. The pensions landscape is complex and often overwhelming, the amount of change that we’ve seen over the past few years has completely transformed the face of long-term savings and it may be a little optimistic to expect an individual to make the right decisions without as much good quality, relevant information as possible.

Pensions aren’t glamorous nor are they sexy, but there is a demand for information (more so than Kanye). Search engines are a good starting point to understanding pensions a little better, but that does not qualify employees as subject matter expects. A “one size fits all” approach to pensions will not suffice; our pensions are dependent on our own socioeconomic circumstances as well as our retirement objectives. Google is no substitute for personalised advice, but this could be a void that roboadvice fills in the future.

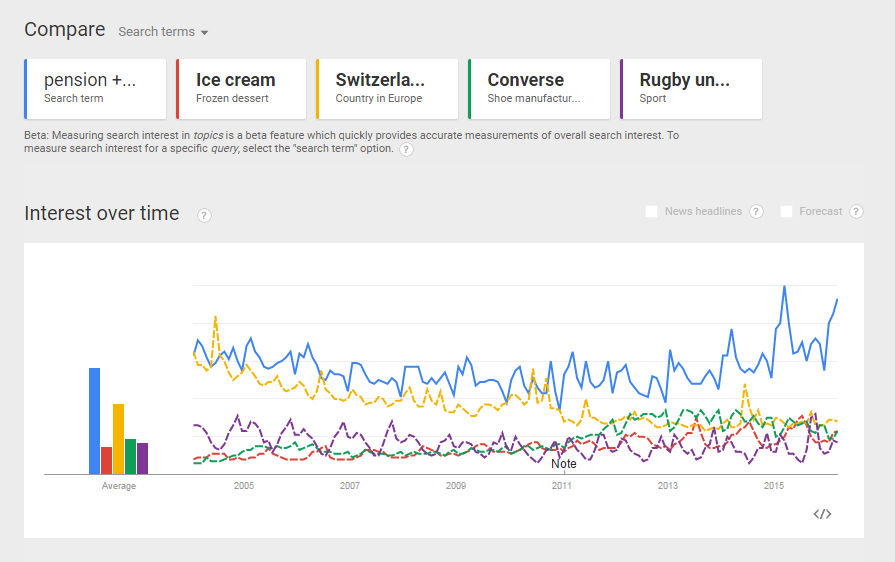

Here are a few other things pensions are more popular than:

(This is a reductive take on search engine marketing and Google Trends is by no means a definitive source. The article has been written to put forward the idea that people are searching for information on pensions.)

Robin Gray is digital marketer at Capita Employee Benefits.

Robin on LinkedIn

Robin on Twitter

This article was suplied by Capita Employee Benefits.

Supplied by REBA Associate Member, Capita Employee Solutions

UK leader in technology-enabled business process management and outsourcing solutions.