How to choose benefits technology

Spot the difference:

Your shortlist will have met most, if not all, of your key requirements and passed your due diligence. So how do you differentiate between them? There is no simple answer here.

Also terminology between providers is notoriously inconsistent. Check that service levels proposed use the same terminology. For each key step, ask the provider what they do and what you have to do. Quite often it is what the provider has not said needs to be done that is left to you. The more transparent a provider, the more likely you are to have a valuable relationship.

A site visit is also a useful step. You can meet the team that will be handling your implementation and BAU (business as usual) stages. You can assess the office environment and the wider team. Do they seem easy to work with? Are they experienced? Could you see yourself working with that team? What happens if there is a personality clash (would they make a change of personnel)?

Measure them on the following sections and see who comes out on top. This could be the winner.

1) Communications

Before you make a final decision, you should consider communications as these are critical to effective employee engagement. A good provider should be able to offer you a range of options depending on your situation and budget.

Generally the more changes there are, the greater the need for clear messaging and media. This can range from a few emails, posters and desk drops to a comprehensive programme including videos, roadshows etc. You can expect communication costs to stabilise after the initial launch or transition.

Questions to ask could include:

- How has the provider proposed you get the messages out to your workforce?

- Have they taken the time to learn about your organisation’s employee segmentation, including geo-locations, age ranges, education, career levels, use of technology in house, etc?

- Have they utilised internal communications already in place - newsletters, payslip inserts, staff meetings etc?

- Have they asked you how you currently communicate with your employees across departments and geo-locations?

- Can they show you examples of other successful communication campaigns?

- Have they taken your budget into consideration? If you are not being charged for this element, ask for more details as it may be a basic service which can jeopardise the entire scheme’s success. If their charges are high, find out what is included and consider removing some less important items for a reduction in cost.

2) Flow

You’ve probably reviewed the technology already but is there a differentiator? Is the employee journey intuitive and logical? Can the employee move around the platform with ease?

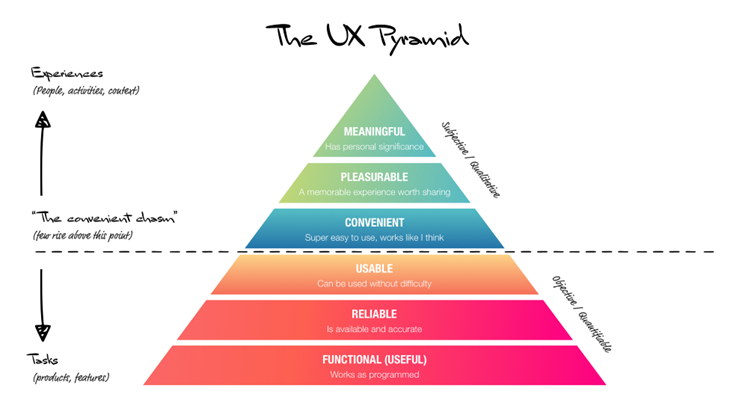

Based on Maslow's hierarchy of needs, does the user experience (UX) follow the principle below or does it get stuck in “the convenient chasm”? The red sections of the chart below represent your hygiene factors (what people expect as standard). Not every scheme needs to hit Pleasurable or Meaningful but you need to decide where you want to be and figure out if the provider will get you there.

3) Current market trends

The market is changing very rapidly and providers need to offer real value, not just expensive software that makes your benefits look good. Current benefit trends involve content around financial education along with health and wellbeing. Can they include these benefits to provide added value?

Consider an extra step by offering financial or retirement guidance through technology like moneygym. According to a recent survey of 10,000 participants by Neyber, 70% say financial worries affect their work and productivity. You can help by offering low cost debt consolidation. Neyber statistics quote a 20% reduction in monthly payments using this kind of service.

What do they do to help engage your employees with problems they care about? Who do they work with to stay ahead? Are they challenging the way you think about your employees for the better?

Contracting with a provider:

Once you have selected the provider that best matches your requirements and have given them the good news, what’s next? You will need to decide a starting point for contracting (yours or theirs).

Beware

Before you embark on this journey, check your current contract for the termination clauses. Most contracts will revert to a rolling 12 months with a window near the end of the contract year to terminate.

If your contract does not have clear and defined support for termination it might be worth asking for some now. I recommend starting with their contract for detailed aspects of the work, as this is what they do, but consider using your standard for any main aspects of liability, definitions and responsibilities of each party, with the provider’s detailed work being addendums to this. In this way, you could potentially shave six weeks off the legal process.

Implementation

Once you have dry ink, the fun begins with a kick-off meeting. This is where you will need to make sure you partner with someone that can listen and challenge with new thinking. Once the requirements are scoped out, the scheme design is signed off and the project plan is put in place, you will need roughly 4-7 months to migrate from a systems and communications standpoint.

A good implementation plan and thoroughly scoped out scheme design is worth the time and effort. You will need the help of an experienced consultant who knows the pitfalls as well as the great additions to make to your scheme. I would advise choosing a provider that can provide a complete end-to-end solution from scheme design through to implementation, not just the technology.

The consultant will capture anything missed in the passionate sales pitches that happen before the contracts are signed. You may not actually have the scheme design or implementation plan scoped out properly at this point. However you want to know the provider has the processes in place to get it right. This will save you a lot of time later.

Also learn from the provider’s experience on how to engage employees on their views and how the plan would fit with their needs and the business.

Yard stick

I highly recommend measuring employee engagement pre and post launch. It is the only real indicator year on year if your strategy is working, needs scrapped or just needs a tweak. You can do this in many ways.

The easiest is a short staff survey, one before you launch and one after the effective date. I don’t mean over 20 questions with free text answers as this would take forever to complete and result in low completion rates.

You need to keep it simple by:

- Using a maximum of 10 questions, preferably closer to 5

- Making sure the questions are clear and concise

- Having multiple choice answers

- Using an online tool i.e. www.surveymonkey.co.uk which will capture the data.

- Keeping free text to one question max (don’t expect a lot of free text answers).You can also use the MI from the provider to help measure the effectiveness and engagement levels.

In conclusion

Changing providers is not an easy process but can bring long term benefits for your business and make your benefits programme more engaging for your employees. Make provision to measure engagement before and after any change to the scheme. Most providers will also be able to help you produce a convincing business case which demonstrates the ROI to the key stakeholders.

I hope you find these tips helpful on your benefits journey.

Best of luck!

Alan Meyers is business development director at Staffcare

Alan Meyers is business development director at Staffcare

This article was provided by Staffcare.

Supplied by REBA Associate Member, Zest

Zest is the next generation platform that’s reinventing the world of employee benefits.