People aren’t saving enough into workplace pensions: we need new ways to engage them

Members also do not appear to be engaging with financial incentives that encourage greater contributions in the way that policy-makers expected.

The question of how best to engage employees with workplace pension saving now that the introduction of auto-enrolment is complete is a priority for both policy-makers and the pensions industry.

Pensions decisions are complex and varied

I have recently carried out research with the Pensions Policy Institute that has shed new light on employee engagement. We wanted to understand how individuals make decisions following auto-enrolment, including opting out, sticking to defaults and increasing contributions. This research has revealed that pension decisions are complex and varied, and follow four main approaches:

- The threshold adults are at the start of their workplace pension journey and have more important life goals so make little or no pension contributions.

- The protectionist savers make increased contributions but do not want to engage with the details of their pension.

- The sceptical speculators limit their engagement with workplace pension saving and need to feel more confident about participating.

- The market investors are active in terms of managing their pension as an element of their investment portfolio.

These four groups need different forms of support and intervention to achieve adequacy in later life.

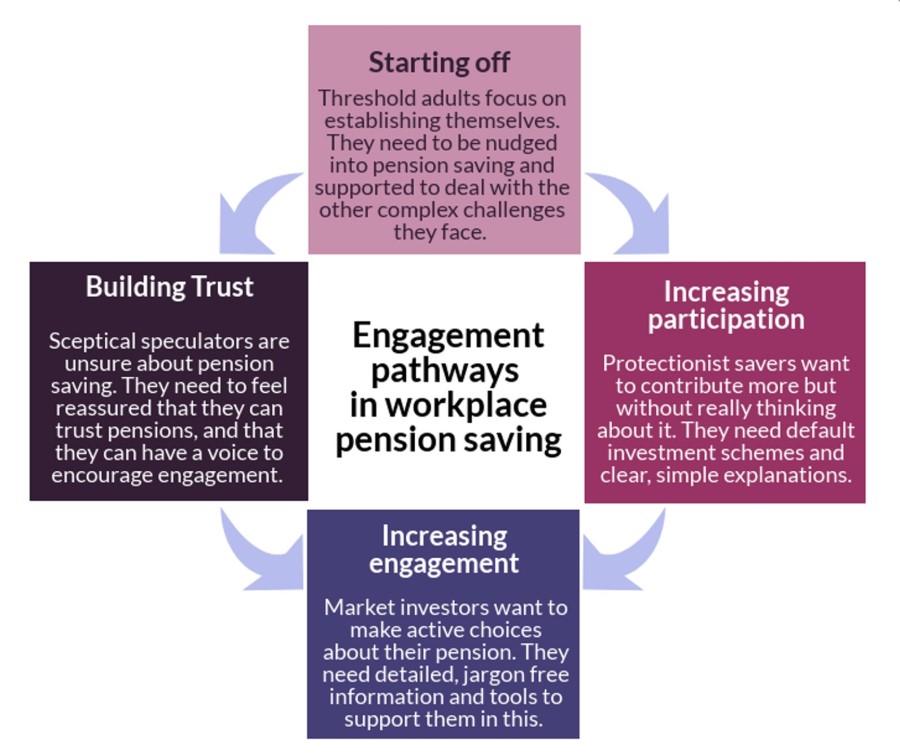

As these approaches are connected to other factors such as life status and wider attitudes to money, individuals adjust their approach to pension decisions and can change group over time. Those changes mean that individuals can follow pathways of engagement in workplace pension saving, which are illustrated in the diagram below. Each step on the pathway requires specific forms of intervention, such as building trust or increasing participation, in order to support and encourage engagement.

The market investors, who were the most engaged group, had specific knowledge, access to financial products and resources that had aided them in developing this approach. This suggests that it is unlikely that the market investor approach could be successfully followed by everyone, which would affect the adequacy of pensions in the long-term.

This is particularly important since the market investor group were mostly male. There is a risk that decision-making after automatic enrolment could reinforce the disadvantages women face in pension systems that do not take account of their real-life experiences, such as career breaks and lower pay.

This is a challenge for policy and industry, both of which have tended to take a one-size-fits-all approach to workplace pensions engagement.

The role of engagement after auto-enrolment and its implications for pension outcomes now requires urgent attention to ensure employees save adequately for their retirement, rather than simply following the minimum contribution levels set by legislation.

Read the full report on Engagement Pathways published by the Pensions Policy Institute.

Dr. Hayley James is a researcher at The University of Manchester Institute for Collaborative Research on Ageing (MICRA), with sponsorship from the Pensions Policy Institute.