Beyond the numbers: How emotional connections improve pension engagement

While auto-enrolment has successfully brought millions into the pensions system, the industry still faces one of its biggest challenges: genuine member engagement.

Too often, pensions remain abstract, invisible, and frankly uninspiring for the average saver – especially the younger generations. But what if we could change that? What if pensions became something people could connect to emotionally, regardless of age?

This was one of the central questions explored at the recent Pensions UK Annual Conference, where industry leaders discussed how private market investments, particularly UK-based assets, could play a transformative role in driving employee engagement and improving overall outcomes for them.

Private market investments ‘tell a story’

What have private market investments got to do with improving engagement for employees?

First let’s look at the strong investment case – they can offer improved projected returns, diversification, and access to sectors with high growth potential like infrastructure, renewable energy, social housing, and regeneration projects. All of these are solid financial benefits that any pension scheme would do well to consider.

But there’s something else that makes private markets particularly powerful. Unlike traditional listed equities or bonds, private market assets tend to tell a story. They’re tangible. They’re relatable. They’re investments that savers can actually see and understand in their daily lives.

Take some of NatWest Cushon’s investments, for example: affordable social housing in Milton Keynes – real homes providing security for families in their local community. Or wind farms off the Cumbrian coast, capturing wind and turning it into clean electricity for hundreds of thousands of homes.

These aren’t abstract financial instruments. They’re real assets carrying stories of impact and positive change – right here on our home turf.

The 'virtuous circle’ of emotional connections

The emotional connection becomes real when pension savers start to see the tangible impact of their investments.

When someone logs into their pension app and discovers that a portion of their savings helped build that affordable housing or funded that offshore wind farm, that’s when they start to feel more connected, and perhaps even proud.

This sense of emotional ownership is powerful. People are more likely to engage, to learn, and most importantly, they’re more likely to make better decisions, such as contributing more.

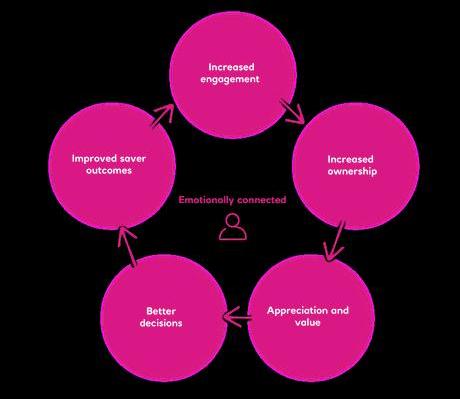

The result is a virtuous circle: emotional connection leads to ownership, engagement, appreciation, better decisions, and improved outcomes – circling back to strengthen that emotional connection once again.

Of course, this kind of investment impact can only drive engagement if people know about it. This is where technology becomes crucial – showing people not just their balance, but their impact.

Imagine opening your pension app and seeing a map of the UK dotted with projects your savings have helped fund. Videos showing the communities benefiting. Personalised notifications: “This month, your pension helped fund a school retrofit to improve energy efficiency.”

This isn’t just savvy communication – it’s engagement that leads to better outcomes in both financial and behavioural terms. It encourages long-term thinking and makes pensions matter to people today, particularly younger savers who need different motivations than those approaching retirement. That’s how we make pensions matter to people today.

What’s keeping providers from investing in private markets?

NatWest Cushon recently commissioned research from YouGov, which shows that 52% of employees agree that pension funds should invest more in the UK. But despite this employee demand, many pension schemes remain cautious about allocating to private markets. One of the biggest roadblocks being a narrow interpretation of fiduciary duty.

To address this, NatWest Cushon collaborated with law firm Eversheds Sutherland to clarify what trustees can legitimately consider. They came back with a simple but powerful legal opinion: trustees must consider members’ standard of living factors when investing – things like access to hospitals, improved infrastructure, and a stronger economy – provided these factors are objective, financial and quantifiable.

This new interpretation should empower trustees to align more of their portfolios with UK private assets, which would in turn support both stronger returns and tangible social outcomes. By reframing fiduciary duty in this way, trustees can better serve members’ long-term interests while unlocking capital for impactful UK investment.

Visible impact drives better engagement

Regardless of any barriers, private markets are set to become the norm.

The Mansion House Accord and Compact have created momentum, with 17 providers now signed up – representing about £252 billion in pension savers’ money. The government is backing this shift, recognising that DC schemes need to play a bigger role in funding UK growth while delivering better outcomes for savers. We’ve already seen that employees want more UK investment, too.

By investing in tangible UK assets that tell compelling stories and using technology to surface those stories, employers can transform how their people interact with retirement savings.

When pensions reflect values and create visible community impact, engagement follows naturally. That’s the future of pension engagement.

Supplied by REBA Associate Member, NatWest Cushon

NatWest Cushon is a workplace pensions and savings provider with an award-winning proposition.