Can responsible pension investment engage younger employees with their finances?

We asked younger members of the PSGS team what they think. Yes, the sample size is small, but it does represent nearly 20% of our staff. Given what we do, you’d expect some to be more financially savvy than average, but plenty of our team are in non-financial roles like marketing. Here’s what they said:

The range of engagement is wide

Financial wellbeing is important to our younger employees, with an average rating of 4.7 out of 5 (where one was not at all important and five was really important). Overall, they feel reasonably engaged with their finances too (average 3.8 out of 5); however, the range is much wider. Whilst some felt they were ‘right on top’ of their finances, others are not at all engaged.

ESG is becoming more important?

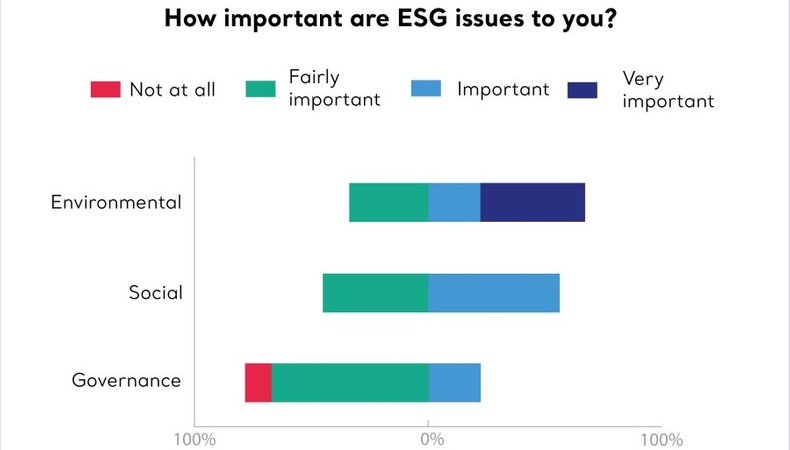

Over half (56%) of PSGS’ younger employees have already considered environmental, social and governance (ESG) aspects when making financial decisions, particularly about savings, pension, and utility bills. In order of importance, environmental issues come first, followed by social and then governance.

As illustrated in the bar chart below, two-thirds (60%) of our younger employees say environmental issues are either important or very important. Maybe that isn’t surprising given the extent of coverage of environmental issues in all forms of media in the UK, but it demonstrates younger people do care about this.

89% think ESG issues will be influential in their financial decision making in future

Some felt as compliance requirements change and awareness increases, the offering of ESG products will also increase and become the norm. Others think ESG will provide better outcomes, not just financially but for their children and grandchildren or that including ESG values means they can assess the sustainability of their financial practices in the future.

Another respondent said, “I expect I will do more with my pension savings relating to E, with a consideration for S. However, I will not be investing in individual stocks/assets. It’ll be through the use of passive funds. I can see utilities playing a part in the future, but the utilities market is currently changing fast and price could be the most significant factor in the short term until some stability returns.”

Some didn’t think ESG would be influential. Instead, they feel they’ll be more interested in the terms and conditions and making sure the financial decision they’re making is right for them. They wouldn’t ignore ESG issues completely but, when looking at personal finances, they need it to be right for them and wouldn't rule out a company purely on an ESG basis if they could offer the best product.

Personal ESG beliefs

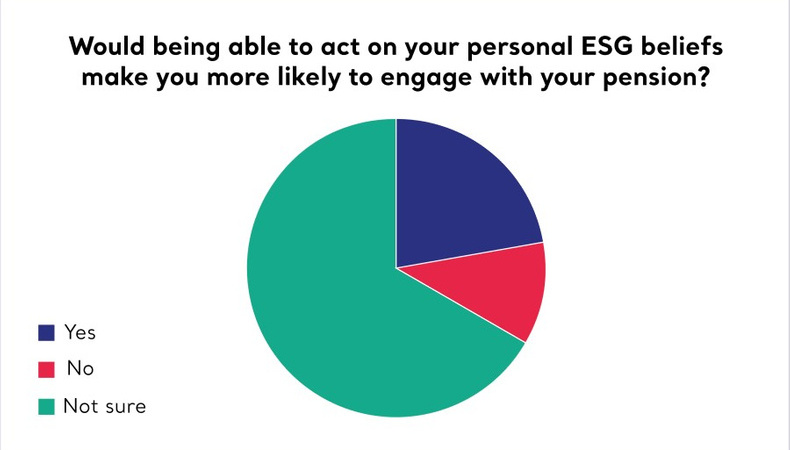

When asked if being able to act on your personal ESG beliefs would make you more likely to engage with your pension, only 22% of PSGS’ younger staff could confidently say yes, 66% are uncertain.

Help us understand

When we asked what a pension provider or scheme trustees could do to engage them with a pension scheme, answers were mixed but there were common themes. A competitive pension offering with a good employer contribution as the base is the start.

Then there’s the need for consistent communication, easily accessible resources outlining the funds/investments available. But above all, it should offer advice, guidance and courses to help people who are unsure about decisions and really interact with people younger in age.

One response to the survey rounded things up nicely:

“Making pensions information appropriate to the younger generation, marketing it at the right level and using technology. Help us understand - when you're young it doesn't seem so important. You need to help us realise it isn't just something you need to think about when you are older. There are so many financial decisions you need to make at a young age, trying to save for a house deposit and buying your first home, every pound you earn counts and pension can be forgotten.

"I've found the information around if I contribute a certain percentage at X date in my life, what kind of pension pot I can build up and what that equates to in lifestyle when I retire helpful. As always, it is about making it relevant and as easy to understand as possible, as it’s a very complex topic.”

Get education, communication, and technology right, then people will engage whether ESG is important to them or not.

This article is provided by Punter Southall Governance Services.

Supplied by REBA Associate Member, Vidett

Leading the way in professional trusteeship & governance