Employers dive into data to elevate financial wellbeing

The need for better and more sophisticated employee data is not new.

However, employers are becoming more proactive in attaining the information they need to make evidence-based decisions about their financial wellbeing offerings.

There is increasing emphasis on understanding how they connect and affect wider HR and business objectives.

REBA’s Employee Wellbeing Research 2024 found a move towards greater analysis and measurement of wellbeing initiatives across the breadth of wellbeing offerings.

For instance, 14% of respondents said they currently analyse the impact of wellbeing on employee performance, yet 61% plan to do this in the next two years.

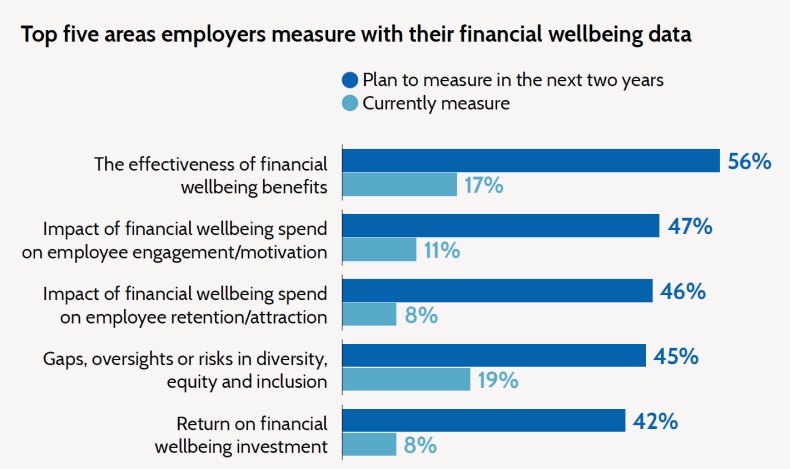

The use of financial wellbeing data is set to change dramatically over the next two years, with employers moving to better understand the impact of their strategies on broader HR and business objectives and how financial wellbeing is delivering value to justify future investment.

Of the top five factors on the graph, four are linked to proving its effectiveness and impact.

Furthermore, the proportion of employers planning to measure employee performance and financial wellbeing (up from 2% to 41%) highlights how employers also want to understand the consequences of poor financial wellbeing on an individual.

The shift towards greater use of data to analyse the effectiveness of benefits is a core focus of REBA’s Benefits Design survey 2025.

Learn what data your peers are collecting and how it’s influencing their benefits design and spend by taking part.