How to create a financial wellbeing strategy that engages employees

These are unprecedented times. The cost-of-living crisis is putting a big strain on people’s finances, affecting their mental health and general wellbeing.

Research conducted last year by the Centre for Economics and Business Research (CEBR) showed that over 2.5m private sector workers took time off work in the prior 12 months due to money worries caused by poor financial wellbeing. Unsurprisingly, this unexpected time away from work has costly consequences for employers who, as a result, face estimated annual costs of £2.5bn.

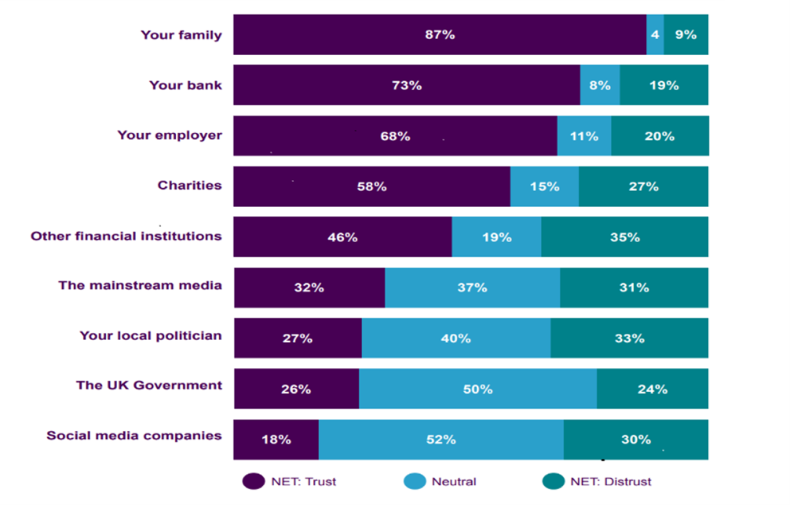

The good news is that a recent study showed that more than two-thirds of workers trust their employer when it comes to long-term financial planning, making them the third most-trusted institution among individuals in the UK.

As an employer, you’re in a prime position to help ease these pressures your employees face by offering an holistic financial wellbeing programme in the workplace. Implementing a strategy for your workforce makes it as easy as possible for them to engage when leading a busy life.

Give your employees a voice

There is no silver bullet when it comes to engaging employees with their financial wellbeing, so hand them power by asking what aspects of their personal finances interest them. This way, your starting point is what your employees want to hear about.

Different people have different needs, from budgeting and debt management, to understanding investment basics and maximising pension allowances.

Employee surveys are a great way of gathering this information. And anonymous surveys give employees the freedom to give honest responses.

Assessing feedback and implementing any suggestions will ensure employees feel heard and will help to drive engagement. Ultimately, it will result in a financial wellbeing programme that reflects what your workforce is looking for.

Promoting your wellbeing strategy

The first step is to have a well thought out financial wellbeing strategy. Step two is communicating it to your employees.

Visibility is crucial to employees engaging with your financial wellbeing programme and benefits.

If you have an online benefits portal, building in a centralised financial wellbeing section as part of this package is a good way of pointing your employees in the right direction.

Go one step further and emphasise the benefits your employees will get from engaging with your financial wellbeing strategy. These may include improved money management skills and reduced financial anxiety, or perhaps corporate discounts you’ve arranged with local shops to help them cut costs.

Tailoring your communications towards certain elements of your financial wellbeing strategy and demographics within your workforce can also be a useful tool to drive engagement. This could include, for example, running an email campaign for employees aged 50 plus, signposting tools and guidance in the run-up to retirement.

Consider the language in these communications. Use it to tell a story and link employee emotions to the numbers. And using positive rather than negative phrasing can lead to better results.

Bring in financial experts

Despite having a comprehensive financial wellbeing strategy in place, the content and terminology might still seem overwhelming to many employees. This is where a financial wellbeing expert can help. They can provide financial education sessions through online or in-person presentations, one-to-one guidance, or via online webinars.

Financial education can generally be split into three sections:

- Education - the employee learns about different financial topics

- Guidance - more personalised and tailored to the employee

- Advice - speaking to a qualified financial advisor who would advise the employee on how best to manage their finances. Charges will apply for this service.

Time is precious and employees value having an expert explain topics clearly and simply.

Whether this is done in-house or through an outside organisation, having a well-rounded financial education programme is a great way to empower employees to make well informed financial decisions and build their financial resilience.

Supplied by REBA Associate Member, Hargreaves Lansdown

Welcome to HL Workplace - savings & investments your employees can understand, engage with, and value.