Retirement income decisions: how the pensions industry is shifting to better support savers

As auto-enrolment reaches its twelfth year following its launch, more UK workers are building up savings through workplace pension schemes than any time in history, often with multiple employers.

It has been more than nine years since the launch of the Pension Freedoms in 2015 which allowed UK workers to take their savings in several different ways and as one or a number of cash lumps.

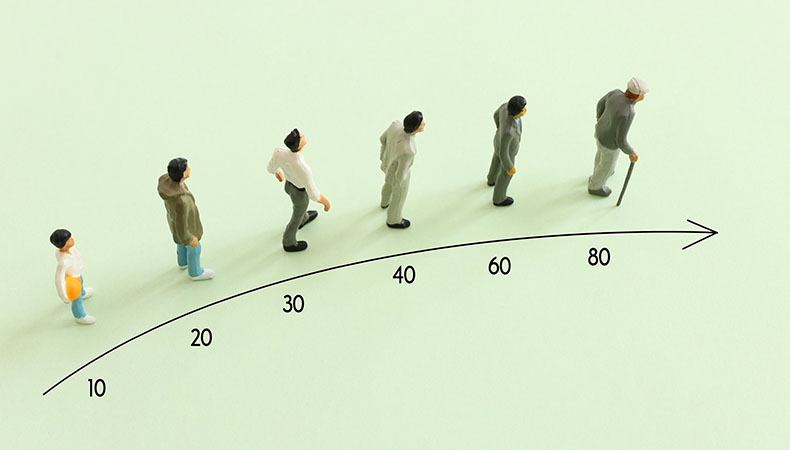

As a result, many of us have never had more choice in terms of how and when we can retire, but with all this (no longer new) flexibility, the decision is arguably more complicated than it’s ever been.

So, how can those who have worked all their lives to enjoy a well-earned retirement balance the day-to-day challenges of life, while ensuring they are sufficiently planning for retirement?

Enhancing member outcomes: retirement solutions

The industry is now focusing on improving the quality of member outcomes in retirement and the solutions available to savers to help navigate such a key life decision.

The term ‘retirement solutions’ is given to summarize the overall process members experience throughout their retirement process, including how they take their benefits and the information, guidance and advisory services available to support in the making of this decision.

While many providers of contract-based and master trust pension arrangements have retirement solutions in place to help savers make and process their retirement, the Department for Work & Pensions (DWP) consulted with the pensions industry on a proposed range of measures to address the issue of value leakage for retirees in own-trust pension arrangements.

While the Government’s response to this consultation (published in November 2023) did not lay down regulations, it clearly set the direction of travel that all pension schemes will need to offer the right solutions to support savers with their retirement income decisions.

Ensuring value for your workforce

As a facilitator for most UK pension savers, employers may be thinking how this clear statement of intent and the subsequent changes may affect them. If it does, what do they need to do to ensure both they and employees are getting the best value from their pension scheme?

At a high-level, employers will need to consider the following:

- Asking the right questions to understand what retirement solutions are available through your workplace pension scheme – get advice if you are unsure of what the right questions are.

- Whether the retirement solutions in place are suitable for your workforce demographic – if not, consider changing.

- Raising awareness among members through engagement strategy. You can have the best pension scheme in the world, but if members are unaware then value is drastically reduced.

Strategies to enhance retirement outcomes

Member engagement is critical to ensure members can take advantage of the retirement solutions available through their workplace pension scheme.

Formulating a comprehensive strategy to understand what, how and when to engage with your employees is arguably the most important step of facilitating a robust solution.

In my experience, employer HR & reward teams are busy dealing with a wide range of non-pension issues. Sometimes it is easy to overlook that most pension scheme providers offer a comprehensive suite of engagement material that employers can factor into their strategy, often at no cost.

That doesn’t mean provider content is wholly sufficient. Employers will need to take a view based on the collateral available and their workforce demographic to assess whether any ‘gaps’ need to be filled to direct employees to help best take advantage of the retirement solutions available.

For example, you may want to consider the following questions:

- Is your company intranet up-to-date with the latest material and links to your providers’ content?

- Does your onboarding process sufficiently make employees aware of their pension scheme?

- Are your communications accessible, diverse, and inclusive enough for the needs of your workforce?

- How do your HR team and/or line managers proactively engage with employees in the lead up to retirement?

Supplied by REBA Associate Member, Barnett Waddingham

Barnett Waddingham is proud to be a leading independent UK professional services consultancy at the forefront of risk, pensions, investment, and insurance. We work to deliver on our promise to ensure the highest levels of trust, integrity and quality through our purpose and behaviours.