The financial wellbeing risks you can't ignore - act now

This year’s Financial Wellbeing Research aims to delve further into the people risks affected by poor financial wellbeing.

It considers the financial resilience risk factors employers are planning to address, and how these connect with the strategic objectives of financial wellbeing strategies to mitigate future people risks.

It follows last year's Financial Wellbeing Research 2024, which found that parenting, caring, housing costs and poor mental health are creating people risks for employers.

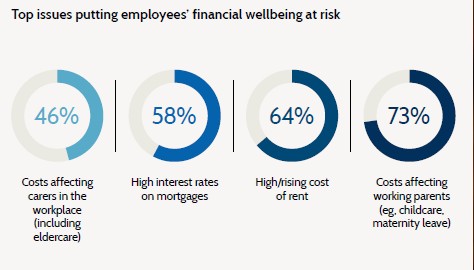

The high cost of housing, from rent and energy bills, through to getting onto the property ladder, is creating stress in the workforce. Working parents and carers in particular face higher financial burdens.

Employers have long known that external factors play a role in employees’ overall health and wellbeing. Yet, the impact of the pandemic, followed by sustained rises in the cost of living, has made employees’ financial stability significantly more variable.

This lack of financial resilience has knock-on consequences in the workplace, with the high cost of living not the only area that is driving the need for financial wellbeing support.

Increasingly, employers are becoming aware of how those dealing with more complex clinical mental health conditions can be particularly vulnerable to poor financial wellbeing and exclusion.

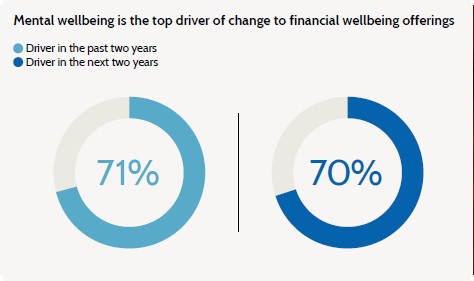

REBA’s Financial Wellbeing Research 2024 found that supporting mental health was the top internal driver of change within employers’ financial wellbeing offerings.

Financial distress in the workplace was also a driver of change for one-third of organisations in the next two years.

Issues such as higher stress levels for those worrying about living expenses, through to absences due to poor mental health driven by financial instability, all contribute to lower productivity and performance.