Ways to support the financial wellbeing of the ‘sandwich generation’

Happiness makes people more productive at work. The flipside is also true, that lower happiness is associated with lower productivity.

Academic research supports this idea. A 2015 study by the University of Warwick that found happiness made people around 12% more productive. One of the researchers said: “The driving force seems to be that happier workers use the time they have more effectively, increasing the pace at which they work without sacrificing quality.”

Other research found companies scoring highly for employee friendliness ranked above average across a range of business performance benchmarks. It seems investing in employee wellness really does pay off.

Bang for your buck

Employers will still need to take care to maximise returns on that investment in wellness to ensure every penny counts.

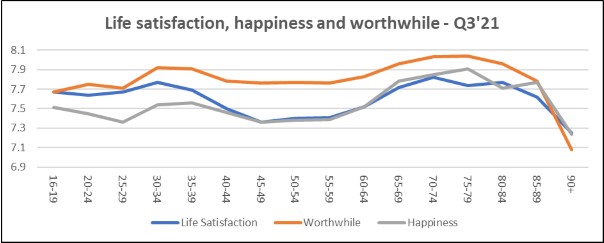

The Office for National Statistics provides a quarterly update on wellbeing measures, including feelings about people’s life satisfaction, the extent to which they think the things they do in life are worthwhile, and their happiness.

One of the patterns that has emerged is a dip in the key indicators starting from when people reach their 40s and lasting for around two decades.

This cohort has been dubbed the ‘sandwich generation’. It is the age group where they are more likely to have children still at school and university who financially depend on them, and also may have ageing parents with care needs.

They may still be paying off mortgages, while also trying to contribute more to pensions. Today’s rocketing cost of living is only likely to be adding to the pressure.

Their state of mind is likely to be heavily influenced by their financial situation, which itself is closely linked to their working lives. The value they put on their work is likely to go beyond the financial rewards to their own identity.

Stretched thin

Financial wellness programmes need to have something for every generation of worker. But perhaps they should reflect the fact that the special ingredient that makes a business thrive is often locked up in those who have built up the most experience and knowledge.

Wellness packages that target this 40–65-year-old age group have the potential to deliver the greatest benefits for both the employer and the employee.

This could be financial but can be more about instilling confidence that they can weather storms and are prepared for the future. Flexible working, health insurance, savings and pensions plans are important, but so too is the guidance and advice to help people understand the value of these benefits and make the most of them.

If you’re happy and you know it

Ultimately, no organisation is responsible for ensuring employees are happy and any wellness programme must deliver a return on investment.

Much of the satisfaction employees gain through work comes from solving problems by applying physical and mental effort – that’s the job. But let’s not pretend it’s all done for love – the financial benefits are a key reason why employees stay or leave organisations.

Ensuring colleagues understand the financial value of the benefits available to them while at the same time helping them feel they have a plan in the face of life’s ‘what ifs’, will remove some of life’s distractions and leave them free to focus on their work and do their jobs better.

Supplied by REBA Associate Member, HUB Financial Solutions

We are totally focussed on finding the right financial solutions for people approaching, or in, retirement. We don’t do anything else. Our purpose is to help people achieve a better later life.