Five ways to make sure that intergenerational fairness is at the heart of financial wellbeing

Money matters to all of us. PWC’s Employee Wellness Survey (2019) revealed that 91% of employees suffer from money worries. It’s also been shown that the number of employees stressed about their finances has increased across all generations.

Employees of all ages will have their own financial challenges, priorities and goals, it’s therefore crucial that your financial wellbeing programme doesn’t only deliver support relevant to one particular generation. Intergenerational fairness should be a key consideration when you’re devising your strategy. That way, you can ensure that your mix of products, services and overall support accommodates the variety of requirements within your workforce.

Here are five things you can do to embed intergenerational fairness into your financial wellbeing strategy to ensure that you deliver inclusive, relevant and valuable support.

1. Understand your workforce

In the same way that your business targets your customers, your financial wellbeing strategy should meet the needs of your employees.

To ensure your financial wellbeing strategy is inclusive, you need to understand the demographic make-up of your workforce. Know your people and your audience. Only then will you be able to provide a balance of products and services that are tailored to your employees.

You can then create a number of people profiles that accurately represent a large proportion of your workforce. This is a useful tool when you start to look for the products and services that will eventually form the basis of your financial wellbeing strategy.

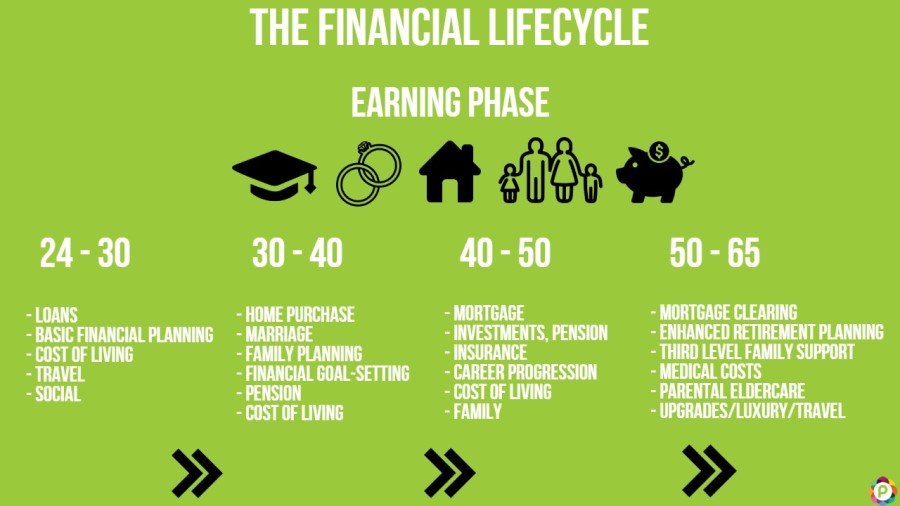

We are all part of a financial lifecycle. When we reach different points in life, we will have new financial priorities and goals.

A Financial Wellbeing Lifecycle Chart, like the one below, is a particularly useful tool once you have a full picture of your workforce’s demographic. When you consider the different age ranges of your employees, you can map out the various stages in the financial lifecycle that are relevant and of interest. The chart also suggests where areas of interest might overlap.

For example, employees aged 24-30 will likely be concerned about loans, financial planning, cost of living and travel. Whereas, employees aged 40-50 may place their focus on other areas such as investments, pensions and family planning.

Taking the time to understand your workforce will mean that you’re in a better position to accommodate intergenerational nuances. Whether it’s loans, pensions, investments or medical costs, you need to have a financial provision to offer your employees, no matter where they are in their lifecycle.

2. Do your research

Having built a solid picture of your workforce’s demographic, you can find out what types of products and services you need to provide a comprehensive financial wellbeing offering that has broad appeal.

Research is key and will ensure that intergenerational fairness remains the focal point of your strategy. With this in mind, you should canvass your employees to see what resources they believe would benefit their financial wellbeing. By sending out a financial wellbeing survey, you can quickly pinpoint key areas of interest and build a shopping list of things that your wellbeing programme needs.

This is also where the concept of the Financial Wellbeing Tree is useful. When we envisage financial wellbeing as a tree – a living entity that requires sustenance – we can decipher the specific elements it needs to thrive. As the below image shows, there are external factors and conditions that can influence the financial wellbeing of your employees that are out of your control, such as life events. However, there are other influences that nourish and support the root of financial wellbeing, which you can regulate and reinforce through your strategy.

This tree model can be used as a helpful tool to identify certain areas where you could focus your attention to improve the financial wellbeing of your workforce.

It might also be helpful to create a map/criteria to ensure you find providers that offer services that match the different age categories within your workforce.

It’s then time to do your market research. What financial wellbeing providers are out there? What selection of services will cater to all generations?

3. Choose a range of providers

When selecting products and services for your financial wellbeing programme it’s absolutely essential to choose a range, rather than focus on a small group of providers that deal with very specific financial areas.

As mentioned previously, your employees’ financial concerns will be determined by where they are in their financial lifecycle. As a result, while mortgage advice might be helpful for one employee, it might not be relevant to another.

The same goes with the access point to your financial wellbeing services. Try and choose a selection of providers that can be accessed in different ways. For example, expert debt advisers can be accessed online and by telephone. This means that employees who may not feel entirely comfortable using a computer, can still get access to the same resources by phone.

In essence, you need to have a comprehensive financial wellbeing programme in place that your employees can fall back on whenever they need support. There should be a service applicable to any employee, regardless of where they are in the financial lifecycle. Whether an employee has just left university, is starting a family, wants to buy a property, is saving for their next big holiday or planning for retirement – your programme should deliver relevant support.

4. Educate, educate, educate

Did you know? 77% of UK adults did not received financial education at school, according to a Quilter report commissioned for Talk Money Week (2018). On top of that, two thirds of people in the UK feel too confused to make the right choices about their money and more than a third say they don’t have the right skills to properly manage their money, a learn direct study, cited in Credit Action - Debt, Facts and Figures (2011) found.

It’s clear that there’s a real issue when it comes to financial literacy and there’s a need to address the gaps in education.

Lack of education is a likely cause of poor financial wellbeing. When individuals aren’t well-informed about financial matters, it’s no surprise that they can become confused, worried and concerned because they ultimately don’t have the ability to manage their finances effectively. So, financial education is certainly an area to address in your strategy.

While many of your mature employees will have built up financial knowledge and experience over time, your younger employees fresh out of school, college or university might not be so well-versed in the matter of money.

Education is therefore a powerful tool. Teaching your employees about finance and equipping them with important information will give them the ability to take control of their finances and make informed decisions that will support their financial wellbeing. It can also help you spot further gaps in knowledge so you can develop and improve your financial wellbeing programme accordingly.

Financial education is also versatile and can, like your choice of providers, be tailored to your workforce so it’s fully inclusive and fair for all demographics within your workforce.

For example, you could run free financial education sessions on a weekly, bi-weekly or monthly basis. These could cover a range of topics such as mortgages, credit scores, loans, ISAs and pensions. As long as the education you provide is accessible, valuable and encompasses a wide range of topics, you can be confident that you’re providing an intergenerational financial wellbeing strategy.

Financial literacy is a key skill that will allow your employees to manage their money with confidence. As a result, they’re likely to feel more in control and relaxed about their finances and comforted in the knowledge they can utilise free educational resources when they need to.

5. Measure and develop

It’s important to understand that you might not deliver a perfect financial wellbeing programme straight away. Despite following all the above steps, there still could be room for improvement to ensure your strategy is fair to all demographics in your business. That’s why it’s essential to continually monitor and improve your programme.

A broad range of data will clearly tell you whether your financial wellbeing strategy is adequate or not. It’ll show whether there is a disparity in the usage of your services and resources.

For instance, if only half of your workforce is engaging with your programme, perhaps you’re not delivering a wide enough range of services. You could then investigate this further to see if there’s any gaps in your offering or if you’re delivering services that aren’t relevant to a specific age bracket within your workforce.

By following the process of measure, improve and control on an ongoing basis, you’ll be able to optimise your programme and its ability to deliver financial wellbeing services to employees of all ages.

Keeping intergenerational fairness at the forefront of your mind will ensure that your financial wellbeing strategy is inclusive, relevant and valuable to all of your employees, regardless of their demographic. While younger employees might need more guidance because they have less experience, remember that this doesn’t mean that the rest of your workforce won’t need financial wellbeing support. Money matters to all of us, and we all have our own priorities, goals and concerns that can be supported.

This article was provided by peoplevalue.

Supplied by REBA Associate Member, peoplevalue – The Employee Engagement Company

We are a leading provider of employee reward&recognition, benefits delivery&wellbeing solutions.