Inequitable organisations and the role of CEO pay ratios

To achieve the UN’s sustainable goal on curbing inequalities, we need to realise that plummeting disparities and ensuring that people are not left behind are integral to corporate compensation policies.

Disparity within and among republics is a tenacious cause for alarm. There have been some positive strides achieved in reducing inequality such as increased minimum income in certain jurisdictions, however inequality persists in multiple countries.

What cannot also be ignored is the recent pandemic that the world finds itself engulfed in. Covid-19 has exacerbated existing inequalities, by hitting the most vulnerable and poorest communities. The pandemic has shed a bright light on economic inequalities and has led to a mass increase in global unemployment. Most employees also endured a hit on their incomes when their compensation fell.

At the same time, we find that average executive’s compensation has grown despite pledges from executives to cut pay. Utilising our compensation and governance intel, the data suggests that the average compensation of CEO pay in the S&P 500 and Russell 3000 has grown. Our database suggests that the average CEO pay has grown by 19% from $8.6 million in 2019 to $10.2 million in 2020. In the S&P 500, average CEO compensation has also increased by 24% from 2019 to 2020.

CEO pay to employee ratio in some European countries

In the UK and France there have been regulations introduced to mandate disclosure of CEO pay ratios. In the UK, under the new reporting requirement, issuers with more than 250 employees have been given three methodology options to choose from to report their CEO pay ratios.

Our data and analysis suggest that option A remains the most frequently used. Under option A, issuers are required to disclose their CEO pay ratio to their UK employees at the 25th, 50th and 75th percentiles. However, for options B and C, instead of calculating the total remuneration for all the company’s employees, it allows the possibility to use a gender pay data (option B) or any other metric (option C) to define three UK employees at the 25th, median and 75th percentiles.

In France, pay regulations have been strengthened to mandate issuers and their Remuneration Committees to disclose employees’ average and median compensation in comparison with the compensations of their senior executives such as the CEO.

In Finland, the SRD II has strengthened pay regulation and issuers are now disclosing five-years’ compensation of the CEO in comparison to their average employees’ pay.

The increasing unequal growth of CEO pay in large firms relative to typical workers’ pay has been well recognised. The very touchy topic of excessive CEO pay ratio and its inequality is important as it usually sends a signal that money is being kept in the hands of a small group of individuals. This affects pay structures throughout the corporation and the economy as a whole.

There are even broader issues associated with high CEO pay ratios as they have the potential to have a spill over effect on the larger labour market. As executives’ pay keeps on soaring, there is pressure on Remuneration Committees (Remcos) to be at the mercy of these executives if they want to hire and retain talent. In essence, it increases the bargaining power of these executives.

CEO Pay Ratio gap dwindling; are Remcos listening?

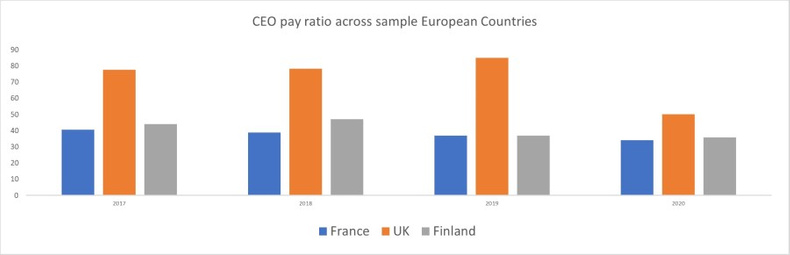

By utilising our compensation and governance intel, we can see the trends in CEO pay ratios in countries sampled such as France, the UK and Finland. The data suggests that the CEO pay ratio has dwindled in all three countries from 2019 to 2020. The UK, however, remains the country with the highest CEO pay ratio in 2020.

In the UK, the data suggests that the average employee median compensation to CEO pay is 50 times greater, which is a significant drop from 85 times in 2019. In France, the findings suggests that CEOs earn 34 times the average, while CEO pay compared to the average employee in Finland is 36 times higher.

Inequalities on the global front are gradually deepening for vulnerable populations in countries with weaker policies and by extension corporate governance. Corporations can help to reduce this menace by ensuring that their remuneration policies are structured with a long-term focus that also addresses pay gaps.

CEO pay ratio disclosure requirements are growing across many jurisdictions, however more countries need to follow in the footsteps of the UK and Finland by mandating disclosure requirement.

This article is provided by Diligent.

Supplied by REBA Associate Member, Diligent

Our modern governance platform empowers leaders & teams to digitally transform & create positive change.