The importance of data analytics and what it can tell you about your global workforce

Single lines of data such as pension contribution levels, or the take up of a particular benefit are nice to know, but they don’t really add significant value or provide meaningful insights that we can learn from. The power really comes when you put multiple data points together.

An example of the power of data

- Internal data: Monthly salary – tax – benefits = take home pay

- External data: Take home pay – average debt repayments – average household expenditure = average disposable income

By looking at these items together, you can start to see how resilient your employees are from a financial health perspective. An example of this in action can be seen with one organisation we worked with who did exactly that. When looking at this data in conjunction with employee sickness levels, they were able to see a spike in sickness in the run up to payday for those who had lower levels of disposable income. Interestingly, it was not necessarily the employees who were on the lowest salary levels that were most impacted. This gave the organisation the opportunity to look at their policies to see how they could help support those who were struggling to make their money last throughout the month, and therefore improve the sickness levels during those times.

Insight-led actions

Data-led insight will help you identify groups of employees who could benefit from more support in particular areas. This could include, those re-entering the workforce after time out to raise children, those approaching later life needing to make decisions about the future, or those who have recently had a life event and may benefit from understanding the importance of protection.

Employees’ benefit needs change throughout their lives as their financial needs evolve. It’s critical for employers to provide options to support that growth and development by enabling them to utilise products and services based on their needs, when and how they require.

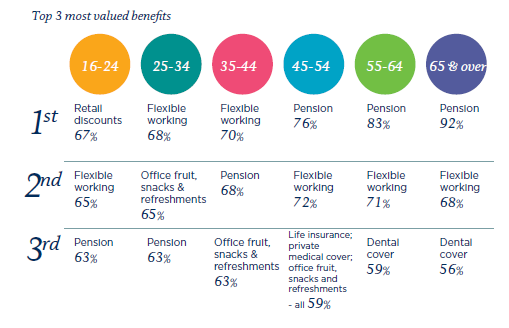

We recently surveyed more than 10,000 UK employees to get a real snapshot of the nation's financial health. This enabled us to get a clear picture of the benefit priorities across different age groups. The research highlights that there are definite trends. For instance, retail discounts are a number one priority for the 16-24 group, with pension provision and flexible working being the key priorities for employees over 45.

Insights taken from LCP Employee Wellbeing -The state of the nation’s financial health research launched May 2020.

When working with a global workforce, the same principles apply. Use the data you have available, combine this with additional sources that can support your objectives, and analyse these to provide the answers to your questions. This will then enable you to produce a well-rounded strategy that supports the diverse needs of your employees, no matter where they are based. The end result; adding the most value and boosting engagement and morale.

The author is Heidi J Allan, senior financial wellbeing consultant at LCP.

This article is provided LCP.