What is salary sacrifice?

‘Salary sacrifice’ is a familiar term used to describe a range of employee benefits where the employer can take advantage of potential national insurance and pension contribution savings and the employees can achieve income tax and national insurance savings.

Simply put, salary sacrifice is an arrangement where an employee gives up the contractual right to part of their future earnings in exchange for a non-cash benefit.

However when the term is applied to cars it is treated in a fundamentally different way.

The salary is still ‘sacrificed’ and therefore the employee doesn’t pay income tax on that proportion, and neither the employer nor employee pay national insurance on the salary being sacrificed. However, the employee now has a benefit-in-kind (BIK), that is a company car, and so it attracts BIK tax accordingly.

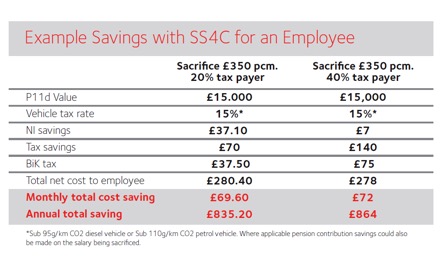

Company cars are taxed according to the vehicle’s list price, fuel type and CO2 emissions, and the employee’s income tax band. Because the rates of BIK tax can often be lower than income tax, the employee can make considerable savings if they choose cars with low CO2 emissions.

Low emission vehicles also have the added benefit of being more fuel efficient, as a delighted salary sacrifice car driver working in the public sector explained: “Straight away I saw a dramatic reduction in my fuel costs, my fuel bill went from over £400 a month to around £120 and this saving alone has all but covered the cost of the vehicle.”

The example below shows the savings that can be made if an employee chooses a diesel car with CO2 below 95g/km or a petrol model below 110g/km.

Salary sacrifice car schemes are extremely valuable and therefore an attractive addition to an employer’s flexible benefits package. It gives employers the opportunity to offer employees a worry-free way of running a brand new car, fully insured and maintained, with no surprise costs.

For many employees, a salary sacrifice scheme is a route to driving a brand new car for the very first time, as another happy driver explained: “I am able to drive a brand new car that I wouldn’t be able to afford myself with everything included. All I have to do is occasionally add fuel.”

Schemes are cost neutral to employers as they cost nothing to set up. The risks are mitigated through a range of insurances to protect against unexpected lifestyle events such as resignation, redundancy, or maternity or paternity leave.

Salary sacrifice car drivers love the all-inclusive nature of the schemes. All insurance, road fund licence, breakdown cover and even accident management costs are included in the monthly fee, as are servicing and maintenance and even replacement tyres.

There are no deposit or balloon payments, and at the end of the agreement, usually three years, they have the option of taking out a new agreement for another new vehicle and/or buying the car.

Salary sacrifice car schemes have been around for a number of years now, and some drivers whose employers were early adopters of the schemes are already on their second or even third salary sacrifice car. Uptake rates continue to rise, as more and more employees see their colleagues arriving at work in brand new cars, whilst making monthly savings.

Because of the value cars represent to employees, and the fact that there is no cost for the employer, salary sacrifice car schemes are fast becoming a must-have employee benefit in order to recruit and retain the best employees.

This article was provided by Tusker.

Supplied by REBA Associate Member, Tusker

Tusker is the UK’s leader in salary sacrifice cars. Part of Lloyds Banking Group, it has more than 15 years’ experience in offering an affordable way for employees to drive a new, fully insured, and maintained car. Its scheme, which is available to over 1.8 million UK employees, offers a range of options, from pure electric cars to hybrids and even traditional petrol and diesel vehicles. It provides a tailored scheme for organisations’ individual needs.