How financial inclusion can support better outcomes for employees

Fair4All Finance is a not-for-profit organisation with the mission to tackle financial exclusion, so everyone has access to a suite of fair and affordable financial products and services.

Employers are a critical channel for getting people access to the financial products and services they need to lead healthy and productive lives. So REBA’s mission to support the HR community to pursue best practice and drive excellence in their reward, benefits and employee wellbeing strategies resonates with us.

At Fair4All Finance we believe that:

- financial products and services can and should serve everyone

- the right financial products can transform lives, benefit society and boost the economy

- the whole financial services sector must play a part to tackle financial exclusion.

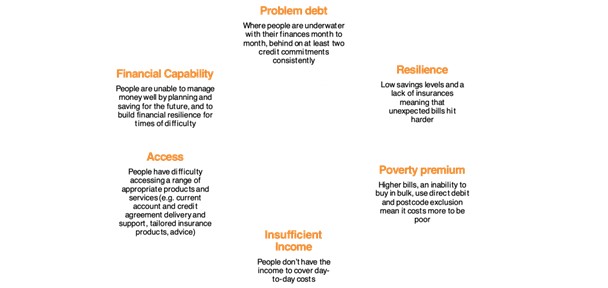

Our research suggests that at least 17.5 million people in the UK are in financially vulnerable circumstances and that these circumstances are the result of six main barriers to financial inclusion.

Our work, in partnership with others, aims to address these barriers and deliver better outcomes for some of the most vulnerable groups in our society.

The road to greater financial inclusion

In consultation with the financial services sector and other key stakeholders, Fair4All Finance has written a Financial Inclusion Plan, setting out a roadmap for how organisations from across the public, private and third sectors can help reduce financial exclusion through coordinated and concerted programmes that target these barriers and promote better outcomes for consumers.

Fair4All Finance’ segmentation model shows that 40% of people in financially vulnerable circumstances have a household income of more than £30k per annum and 72% are in full or part time employment.

Self-employed people (12% of people in financially vulnerable circumstances), those on zero-hours contracts (15%) or with multiple employments (12%) present unique challenges, but employers are in an excellent position to support all their workers and provide access to a choice of products and services that can improve their financial health and overall wellbeing.

However, perhaps the most alarming finding from our work is that only 3% of people in these circumstances would go to their employer or boss first if they had financial worries.

The role for employers

The Money and Pension Service (MaPS) has some clear insights on the important role employers can play in building the financial resilience of the nation, and how this affects their work, the businesses they work for and the wider economy.

Research shows that eight out of 10 employees take their money worries to work. Businesses are increasingly aware of how this can affect employee effectiveness and productivity, with around 4.2 million days a year lost to financial wellbeing related absences - equivalent to £626m in lost output.

I’ve been supporting REBA events for the past four years, first as a panellist during the virtual years of Covid-19 and since 2021 as facilitator of the financial wellbeing tracks at both the Employee Wellbeing Congress and Future Forum events. It’s been great to hear first-hand from so many different providers about solutions focused on building employee health and wellbeing, all played out against the landscape of the changing world of work.

The importance of good data is paramount to this. You cannot build an effective financial wellbeing reward and benefit package that will suit your employees and ultimately the needs of your business without a deep understanding of the needs of the entire workforce.

One of the most positive trends I have seen over the years is how reward strategies are becoming more balanced. Employers are increasingly recognising that all workers, not just senior management, deserve a good selection of benefits and that this leads to a demonstrable business benefit in productively increases and staff retention.

While it’s great to hear about new products and the innovations that providers are offering, I most look forward to the more strategic discussions and presentations that look at some of the macro trends.

This year, I am particularly looking forward to the session with Emma Douglas on the findings from Aviva’s 2024 Working Lives Report and how workplaces need to react and change to meet the needs of their workers.

And finally, headliner Kimberley Wilson will be talking about the challenges of having a multigenerational workforce and the importance of diet and nutrition.