How financial worries are damaging employee mental health – survey

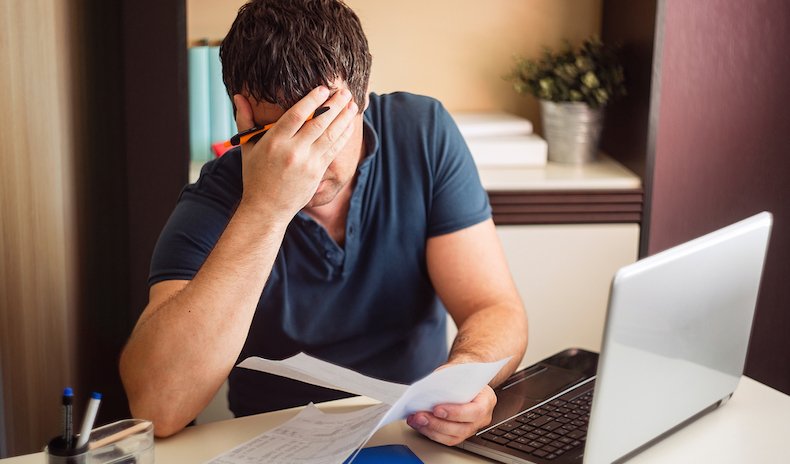

A quarter of people say they’ve lost sleep as a result of financial pressures. A similar number believe it’s affected their mental health.

Rising inflation, energy prices, economic uncertainty and rising interest rates are the main causes of this worry.

These findings are from Standard Life’s Retirement Voice 2023 report, which surveyed the views of more than 6,000 people in the UK.

There is some good news however. The UK’s financial mood appears to be no worse than it was before the mini-budget in September 2022. In some cases, people may be feeling a bit better than a year ago.

This is despite the effect of sustained high inflation and the highest interest rates since 2008.

That said, the nation is more receptive to taking on debt than in 2022, despite the cost of credit being more expensive. And many people are still suffering as a result of financial pressures.

In particular, Gen X and Britain’s mixed-race population both feel less positive than last year.

In fact, Gen X consistently feel the least positive about their financial situation. And they’re the only generation to have felt less positive every year since 2021.

Financial pressures

For around half of the UK population (54%), the cost-of-living crisis has significantly affected how they feel about their money.

Dealing with these financial issues is affecting many people’s wellbeing. Younger generations – 73% Gen Z and 65% of Millennials – are most likely to say that they’ve suffered from an emotional or health issue as a result of managing their finances.

This compares with half of Gen X (52%) and less than one-third of Baby Boomers+ (29%).

Women are also paying a higher price for the economic uncertainty. Almost half of women (47%) feel worried, anxious, stressed or overwhelmed, compared with one-third (33%) of men.

Women are also far more inclined to feel cautious with their money and to spend less.

Lacking support

While many people admit to suffering from mental and emotional problems as a result of financial issues or planning for their retirement, most people (62%) haven’t looked for support.

And, sadly, some groups who are among the most likely to find things difficult are also among the least likely to look for support.

Baby Boomers and Gen Xers are far less likely to look for help than Millennials or Generation Z. Women are also less likely to get support than men (26% vs 36%).

Planning for retirement

While Standard Life’s report identifies cause for concern, it also points to opportunities for employers to support their workforce when they need it most.

For example, the survey indicates that financial planning leads to better financial outcomes. People who plan feel less stressed about the economic climate and are more confident making financial decisions.

Here, employers are well placed to make a big difference, by providing access to financial education throughout people’s careers. By doing so, together we can reach and support those people who are struggling the most.

Download Standard Life’s Retirement Voice 2023 report for more insights.

Supplied by REBA Associate Member, Standard Life

Standard Life are part of Phoenix Group, the UK’s largest long-term savings and retirement business. We both share an aligned ambition to help every customer enjoy a life full of possibilities.