Cost-of-living crisis has hit women harder than men, says report

The ongoing economic uncertainty appears to be affecting women more than men. Significantly more women than men – 31% vs 19% – say they’re finding their financial situation difficult.

Women’s overall financial positivity has also declined significantly – from 44% in 2021 to 33% in 2022. Meanwhile, men’s financial positivity suffered much less – dipping from 54% to 50%.

These findings are from Standard Life’s Retirement Voice 2022 report. They suggest that the gap between men and women when it comes to pensions and general finances – already a huge concern – may now be even harder to address.

Compared with 2021, women are more worried about spending too much and running out of money. And women are even more worried that they’re not saving enough for their future.

Meanwhile, men’s worries about saving and spending have either remained the same between 2021 and 2022, or only changed slightly.

Generational differences

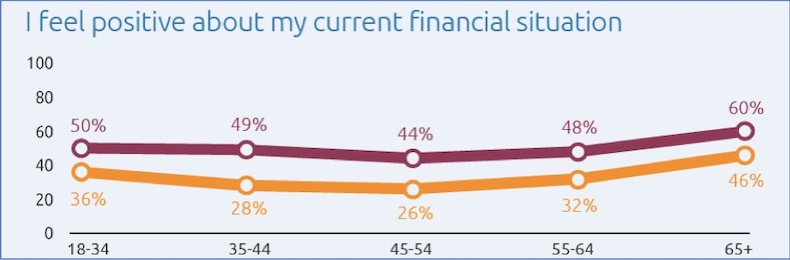

Across every generation, women feel less positive than men about their financial situation (see Figure 1). This includes among people aged 18-34, where there is already a 14% gender gap.

This gap is even greater among those aged 35-44 (21%). Women in this age group are significantly less financially positive than younger women, whereas for men there is no real difference.

For both men and women, though, financial positivity appears to be lowest among those aged 45-54 and greatest among those aged 65-plus.

Figure 1: Across every generation, men feel more positive than women about their financial situation

Saving too little

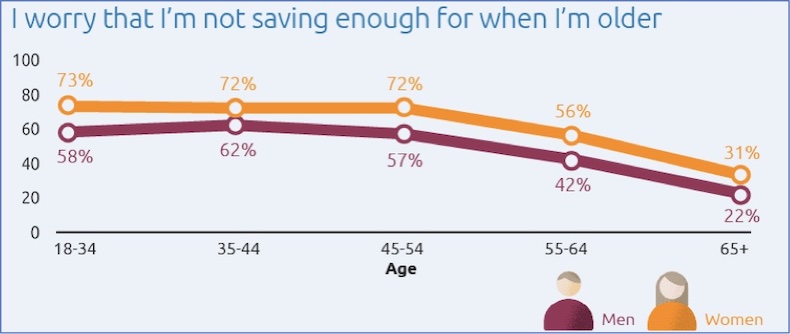

There is also a pronounced gender difference with respect to people’s worries about not saving enough for when they’re older.

Women worry more about this across every generation (see Figure 2). The gender difference is greatest at the start of people’s careers, and among those aged 45-54 (15% in both cases).

While these worries affect most women of working age, they affect men most in the 35-44 age group.

Figure 2: Most women of working age worry they’re not saving enough

Similarly, women worry more about spending too much money across every generation. Here, the gender difference is greatest at the start of people’s careers (13%) and among women and men aged 65-plus (16%).

Knocked confidence

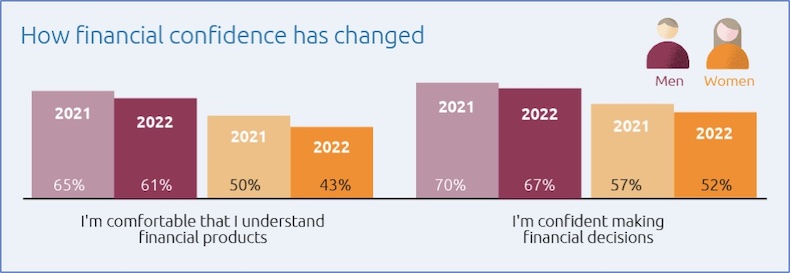

Fewer women than men also say they’re comfortable in their financial knowledge and their confidence to make good financial decisions. Here, the gender gap has also grown since 2021 (see Figure 3).

Figure 3: Financial confidence worsened more for women than men in 2022

This change is perhaps a symptom of the fact that women are now almost twice as likely as men to put no planning into their retirement (19% vs 35%).

Women are also less optimistic about how long they can support their retirement lifestyle: on average, they think they’ll be able to fund their retirement for three years less than men.

This problem is compounded by the fact that, on average, women can expect to live around five years longer than men after they stop working.

A widening gap

It’s concerning to see that the gap in financial confidence between women and men appears to have widened in 2022.

It’s clear that some people are unsure of where to start when it comes to managing their money. The world of finances can seem littered with jargon, leaving some people feeling overwhelmed, or even frightened, when making financial decisions. The financial pressures caused by the cost-of-living crisis may have made this situation even worse.

As a result, some people are more likely to focus on short-term financial goals. This can lead to low engagement when it comes to tacking long-term finances – ultimately affecting their financial wellness.

So, what can employers do to help their employees? Are there ways you can tailor the support you offer to help women and other underserved groups engage more with their financial planning?

First, it may be worth looking at the ways you currently help/or could help your employees to budget effectively, cut back or change their daily spending habits, and also to plan better for the long term.

Second, it may help to assess the support you can provide to employees with their physical and mental health. The cost-of-living crisis increases stress due to the day-to-day struggle of trying to make ends meet. Over time, this persistent stress can trigger or worsen mental illness such as anxiety, depression, suicidal thoughts, or addiction.

The sooner these risks are addressed, the better – especially because they can be compounded by other life-changing events, such as a relationship breakdown, bereavement, or a growing family.

Ultimately, wherever people turn for help on their short, medium or long-term finances, it needs to be personal, relatable and engaging. Only then can we hope to reach and support those people who are struggling most.

Supplied by REBA Associate Member, Standard Life

Standard Life are part of Phoenix Group, the UK’s largest long-term savings and retirement business. We both share an aligned ambition to help every customer enjoy a life full of possibilities.