How to create a financial wellbeing strategy that supports your mental wellbeing agenda

There’s already a very well-established link between mental wellbeing and productivity levels in the workplace. The World Health Organization estimates that mental health issues cost the global economy about US$1 trillion a year in lost productivity. It’s this cost that is no doubt pushing health and wellbeing to the top of the HR agenda.

What is less established is the link between financial wellbeing and productivity. As we all know, there are certain events such as the death of a family member or work-related stress that can cause mental health issues, but financial worries have a massive impact too.

Our recent Coronavirus crisis and financial resilience research found that three out of four employees are worried that they don’t have savings, and two out of three employees state that money worries negatively affect their mental health. A further three out of five employees recognise that money worries in turn negatively impact on their performance at work. There’s a direct and an indirect link – a double whammy if you like!

Supporting financial wellbeing

So now that we have established the extent of the problem, what can employers do to turn this around?

The first step is finding out what financial issues your employees are facing. The issues will be different for different age groups. For instance, you would expect that those employees getting closer to retirement are going to start feeling anxious about having enough money in their pension scheme. But for younger employees, pensions are going to be the last thing that are keeping them awake at night.

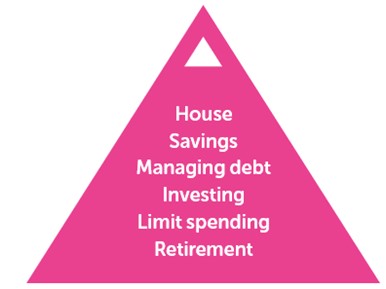

Our recent research found that millennials’ biggest concerns are getting on the housing ladder, accumulating accessible savings and managing debt. All issues that with the best will in the world are not going to be solved with a healthy pension pot that can’t be access until age 55.

Behavioural models such as Maslow’s hierarchy of needs tell us very clearly that people cannot be the best that they can be unless their most pressing needs, or what Maslow refers to as “deficiency needs”, are met first.

So, for millennials in particular, there needs to be a focus on financial education and workplace savings products other than just pensions. For instance, a savings product that should have more awareness than it does, is the Lifetime ISA. With a 25% government bonus it’s a great product to help younger people get on the housing ladder.

A growing trend is to allow employees to redirect some of their pension contributions (over and above auto enrolment minimums) into workplace ISAs such as the Lifetime ISA. In the context of financial wellbeing, it’s a great way to use existing spend to provide help where employees need it most. And a positive spin-off of this approach is that it also increases engagement levels with the pension scheme in that (using Maslow’s philosophy) it puts the pension scheme within the context of an individual’s other financial needs. With their more immediate needs being met, they’re starting to develop good savings habits and have the “head space” to think as far as retirement.

Financial priorities for millennials

A workplace ISA not only allows an individual employee to save for their most pressing needs, but it also means that they are building up accessible savings that can support them in a financial crisis.

Creating a coherent approach

The next step is working out how to bring this altogether into a coherent approach. The example that I have given above is for one specific demographic, but our research shows that financial priorities change with age. So how do you cater for everyone?

Simply: by giving everyone access to the same financial products but allowing them to determine what is best for them.

It’s what we do with flexible benefits. Employees have access to all benefits, but can choose some over others, more of one and less of another. It works and the reason it works is that employees are given the chance to take responsibility and make their own decisions based on their own personal circumstances. But most importantly, it recognises that one size doesn’t fit all.

It’s the same with workplace savings. Everyone understands the importance of pensions and saving for the longer term, but not everyone is yet ready to engage with the long term. Some are focused on more immediate needs.

A flexible approach

If flexible benefits can work why can’t flexible workplace savings? It’s called a holistic approach, one that requires a change in thought and that’s really the final step.

The change is the realisation that pensions on their own do not aid financial wellbeing. Pensions coupled with other savings products can provide the springboard for getting people to become more financially resilient, reduce their money worries, and ultimately improve the mental health of your workforce. We have flexible benefits and we are now moving towards flexible workplace savings – it’s a natural evolution.

This article is provided by Cushon.

Supplied by REBA Associate Member, NatWest Cushon

NatWest Cushon is a workplace pensions and savings provider with an award-winning proposition.