Make financial wellbeing land when it matters most

More employees than ever are stressed about money. Even among higher earners, 46% of FTSE 50 employees say they feel unclear about their financial goals. Yet usage of financial wellbeing benefits remains low.

The issue isn’t a lack of support, but timing. Most financial resources sit idle because they don’t reach people at the moment they actually need them. And that’s where many HR leaders are rethinking their approach: focusing less on how much support they offer, and more on when and how it lands.

Why generic financial wellbeing misses the mark

Many HR teams have built generous financial wellbeing packages: access to tools, content, webinars and discounts. But employees don’t go looking for help when everything’s fine. They act when something changes: a pay rise, a new baby, a house move, or a shock bill.

That’s the moment support needs to show up, because it’s when people are ready to listen. Miss that moment, and even the most generous benefits fade into the background, while employees keep worrying in silence.

What the best HR leaders are getting right

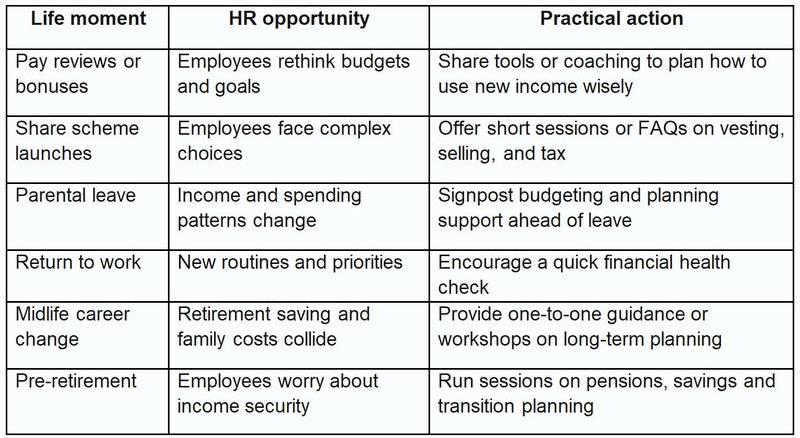

The most forward-thinking HR teams are starting to build their financial wellbeing strategy around timing, not topics. They’re mapping out “money moments” in the employee lifecycle and attaching clear actions to each one.

Here’s what that looks like in practice:

Why human guidance changes everything

Digital tools alone don’t shift behaviour: people need a trusted voice to help them act. For example, employees who have access to Octopus Money as a workplace benefit receive a combination of one-to-one support from qualified coaches and advisers and self-serve digital tools.

That mix gives people the confidence to take action and the accountability to stay on track.

This human layer is what changes behaviour. Employees are more likely to follow through when they’ve spoken to someone who understands their goals. And it reduces pressure on HR teams: managers don’t need to be financial experts, just confident enough to point people in the right direction.

How to make support land when it matters

- Map your moments: Review your HR calendar and employee lifecycle. Mark where financial events naturally occur (pay, bonuses, leave, onboarding, offboarding).

- Create ready-to-go content: Build short, plain-language templates managers can send instantly. The less time between event and support, the better.

- Use data wisely: Track uptake by event rather than channel. For example, did more people use coaching after bonus season or share-save launches? That’s your signal to double down next time.

- Train for conversations: Equip line managers to respond confidently if employees open up about money worries. They don’t need to have the answers: just know where to direct people.

- Keep it human: Pair self-serve tools with personal guidance. Accountability drives change far more effectively than information alone.

Turning wellbeing into business impact

Financial wellbeing only works when people use it. With living costs still high and financial confidence low, employees need help that reaches them when life (and money) changes.

For HR leaders, the opportunity now is to build financial wellbeing around timing: map the moments that matter, connect them to practical support and make it easy for people to act when they’re ready.

That’s what turns a wellbeing benefit into higher engagement, lower stress and stronger retention, and therefore a real business impact.

Supplied by REBA Associate Member, Octopus Money

People are your single biggest investment. We’ll help them get the most out of their pay and pension – by connecting the dots between their dreams in life and their reward at work.