How international pension plans can be cost-effective for internationally mobile employees

However, many HR professionals ignore the IPP for small groups of mobile employees, seeing it as too expensive or risky. But is this actually the case? Let’s look at each of the objections in turn.

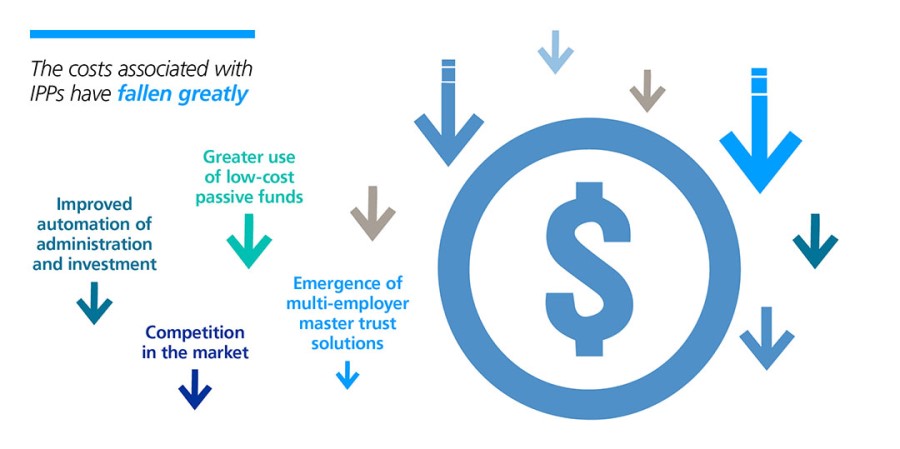

An IPP is too expensive

IPPs have historically been more expensive to set up and administer than domestic plans, largely due to the IPP market being much smaller and specialist and therefore lacking the economy of scale of domestic markets.

However, in recent years the costs associated with IPPs have fallen greatly and, while they are still more expensive than domestic plans, the difference has narrowed. This is due to a number of factors, including improved automation of administration and investment, greater use of low-cost passive funds, the emergence of multi-employer master trust solutions that cater for smaller numbers, and general competition in the market.

It is also important to be aware that employer-sponsored corporate savings plans will almost always be a better deal for the expatriate employee than plans available in the local retail savings market.

An IPP is too risky

While it’s not the only option available, the most common approach to setting up an IPP is under a trust – typically one established in a tax neutral location such as the Isle of Man or the Channel Islands. For some employers, there is a perception that trusts are expensive to set up and run, and that individuals must be appointed as trustees who then personally shoulder the burden of selecting an appropriate range of investments, with the risk that employees may in the future seek recourse for funds that fail to deliver on expectations.

The reality is that trusts serve a number of very important purposes that arguably justify the costs involved. In addition to separating the plan funds from the assets of the company, and so securing them for the benefit of the plan members, trusts add an important layer of governance and assist in plan administration, especially if things go wrong.

The trustees are responsible for ensuring that the funds made available are suitable for the members, but this responsibility need not fall on individuals, as the majority of IPPs are set up with professional firms of trustees, not individual employees or the sponsoring employer.

For smaller numbers of employees, the cost of setting up a trust may still seem disproportionate, but the growth in master trust solutions is starting to overcome this. While master trusts lack some of the flexibility of stand-alone trusts, they do offer a low-cost way for employers to provide an IPP for small numbers of mobile employees.

Is there a better approach to minimise the risk?

In the U.S. the trend is strongly in favour of target date funds. These funds seek to take the appropriate level of investment risk at the right time, reducing the level of risk as the target date approaches. A similar effect can be achieved with lifestyle or lifecycle funds, which also reduce the risk profile as retirement, or some other target date, approaches. These funds are normally the default fund, but where the member wants to be more involved in the process of selecting funds, trustees and employers can assist through the use of risk assessment tools and risk-rated fund options that maintain a particular risk profile on an ongoing basis.

A solution for everyone

The advent of master trusts, sophisticated blended and lifestyle funds and greater flexibility over when and how benefits are withdrawn, means that IPPs are now a solution available to all. As a result, HR professionals who have avoided setting up a plan due to costs and numbers of mobile employees may have options available that they have previously passed by.

In our next article we will look at the benefits of giving employees flexibility around the way they take the benefits from their IPP.

This article is provided by Zurich.

Supplied by REBA Associate Member, Zurich

At Zurich, we’re proud to have been providing UK insurance for over 100 years. Whatever you’re looking to support or protect, we’ll do our best to help you.