Regulator turns light back on to pension contribution requirements

Earlier this year, The Pension Regulator’s (TPR) General Code of Practice came into effect with a renewed focus on good member outcomes.

This has resulted in many pension providers asking for extra information from employers. This is to ensure they can meet their duty to monitor the payment of pension contributions, and identify both under and over payments, as well as non-payments.

Process discrepancies

Due to this increased monitoring, we have already seen UK organisations checking for – and indeed often finding – discrepancies in their contribution processes. Many of the pension contribution errors identified have been significant; with a requirement for remediation projects to calculate and apply large corrective payments.

In this article, we explore our thoughts about the concerning increase in contribution errors, the causes of these errors and how UK organisations can better understand, and thereby manage, the type and frequency of errors within today’s pension contribution processes.

The context of change

In the current market, many UK organisations are moving faster than ever to compete, scale and grow within their sectors. In the past few years, there may have been restructures, acquisitions and potentially a post-Covid-19 recruitment churn leading to various new role holders and a transformed organisation.

Then, there are pension-specific changes to consider.

Firstly, auto-enrolment introduced new rules on top of existing processes, with limited discretion for an organisation on how exactly these may be applied. In tandem, most organisations have made real headway on improving family career benefits, sabbaticals, sick leave terms, salary sacrifice options etc. Each brings complexity and with them, new procedures, processes, and policies running through their benefits system.

It’s perhaps unsurprising that this weight of change has fed through in unintended ways to the calculated pension benefits.

Regardless of the change happening at an employer level, TPR has its own expectations. The recent increase in cases with contribution errors has, in part, been due to the new requirement for pension providers to review and update their processes for the monitoring of contribution compliance. Insufficient data standards have created a separate crop of issues.

Other issues are less obvious in this provider-organisation interaction, although we have also seen a drift in the contractual and policy rules of the organisation and its ground level calculations and payments.

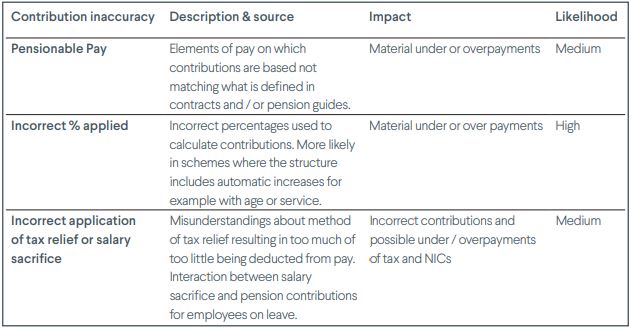

Inaccuracy themes

In our independent reviews, we have seen particular themes emerging, which we have summarised below:

Recommended actions

Inevitably every organisation is different. Whether comparing historical organisational structures and pension schemes, changes in personnel, or an appetite for developing a more flexible and varied benefit offering to staff, no two employers are the same. Understanding these differences is the starting point for an independent review. We recommend that such reviews should include:

- Testing accuracy of contribution amounts: definition of pensionable pay; % due, alignment between deductions made and amounts paid to provider.

- Application of tax relief and salary sacrifice: identifying method of delivering tax relief and checking it has been applied correctly, ensuring all salary sacrifice amounts are remitted as employer contributions

- Checking contributions for employees on leave: have contributions been calculated in line with company policies and legislative requirements?

Finally, it’s also worth noting that auto enrolment certification is itself sometimes a finding for organisations – with many not realising, or managing effectively, the requirement to re-certify schemes at least once every 18 months. This is a basic, yet important, additional check.

Supplied by REBA Associate Member, Hymans Robertson

We're one of the longest established independent consulting and actuarial firms in the UK