The challenge of growing pension funding gaps in an ageing society

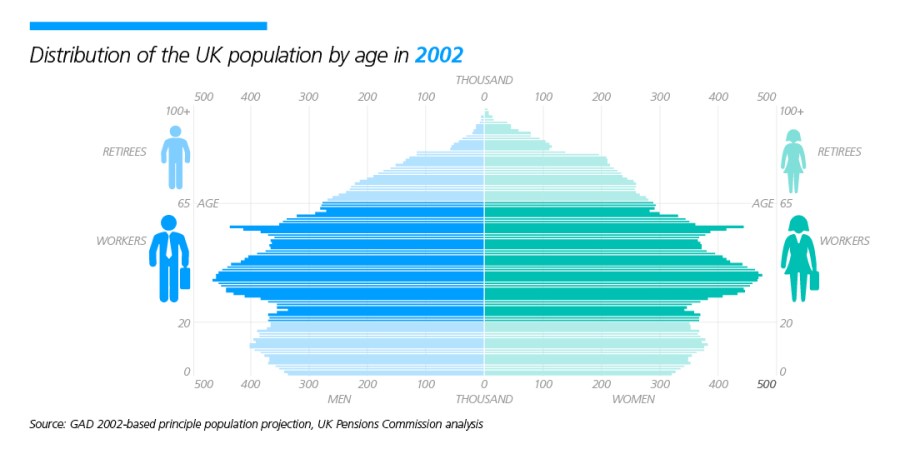

An ageing population means the ratio between those working and those in retirement is predicted to fall. Here’s a graph showing the population distribution in 2002 in the UK with ‘workers’ and ‘retirees’ highlighted.

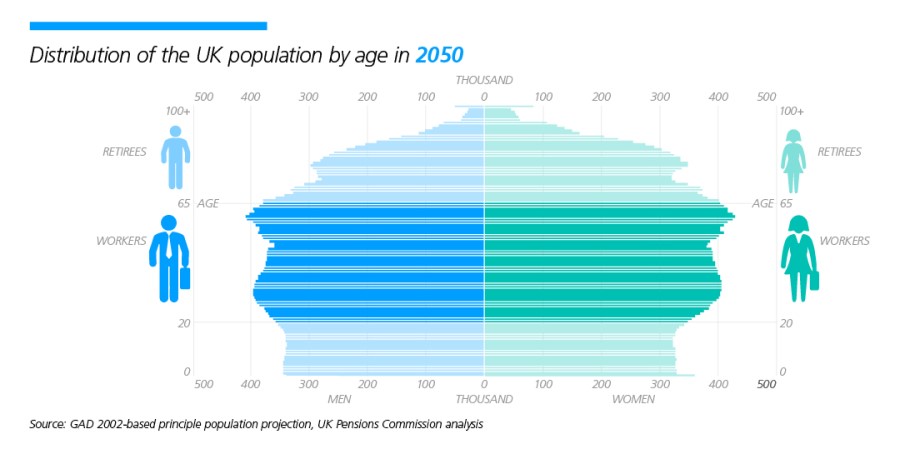

Now here’s a graph showing the predicted situation in 2050.

The rise of the developing world

As you can see, the ratio of ‘workers’ to ‘retirees’ is much lower, and this fall in the ‘support ratio’ is understandably putting fiscal and political pressure on public pension provision.

If future society cannot support the burden of increasing dependency, it follows that individuals will have to contribute towards funding their own retirement. But just how big is the shortfall they will have to make up?

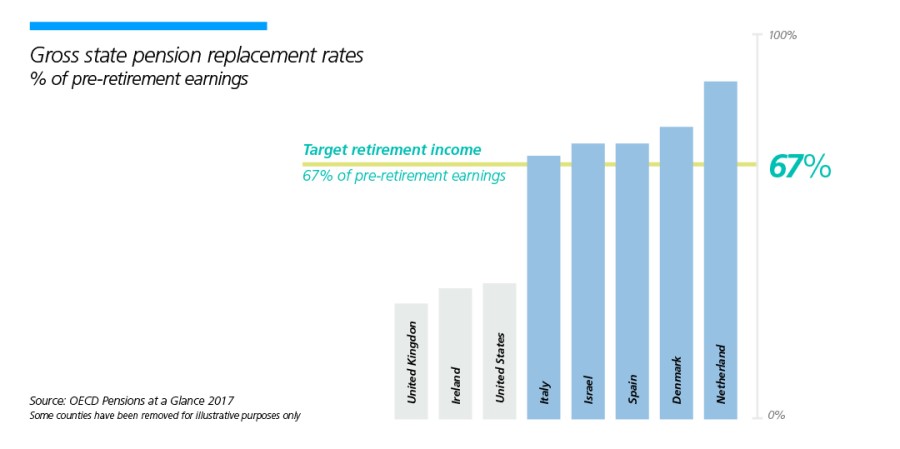

To a certain extent it depends on where in the world you live. The graph below shows the percentage of pre-retirement earnings currently provided by state pension schemes in selected countries worldwide.

Based on OECD recommendations that savers should aim for a retirement income of 67% of earnings when they stop working, the world’s largest economies have a retirement savings gap of USD 70 trillion, and this is expected to rise to over USD 400 trillion by 2050. Various factors are contributing to this gap, including improved life expectancy, lower investment yields and the demise of defined benefit arrangements.

It’s clear from these figures that an employer-sponsored retirement savings plan can be an extremely valuable, and therefore sought-after, benefit. The combination of employer contributions and access to investments at institutional prices arguably makes it the best way for anyone to close their personal funding gap – good news for employers looking for ways to recruit, motivate and retain a talented global workforce.

In the next article we will look at the different approaches to retirement benefits and how multinationals are currently providing retirement benefits for their internationally mobile employees.

This article is provided by Zurich.

Supplied by REBA Associate Member, Zurich

At Zurich, we’re proud to have been providing UK insurance for over 100 years. Whatever you’re looking to support or protect, we’ll do our best to help you.