The social impacts of ESG and why it matters

New considerations

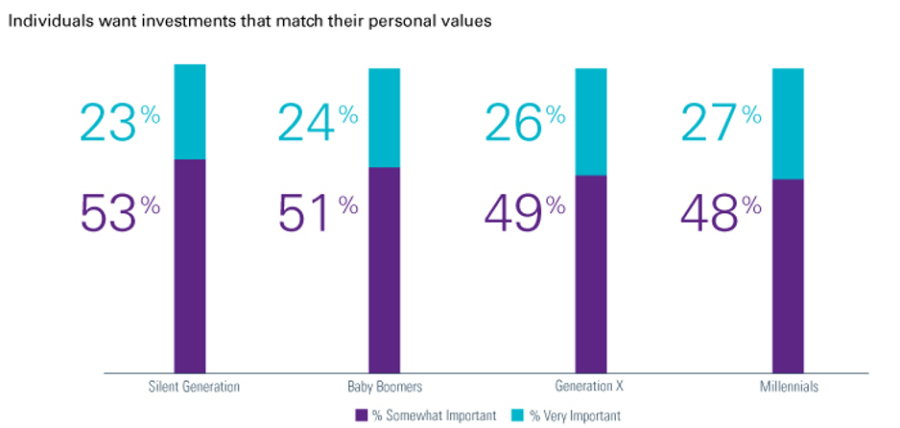

ESG covers a range of factors that are driving employers to think differently about how they respond to issues they may not have had to respond to at all before. Some issues that are well known and receive widespread publicity are factors such as the gender pay gap, diversity and inclusion. These issues, and more importantly how companies respond and handle these factors, are becoming more and more important for people when it comes to investing in, or working for, a company. People now want to know that they are working for and investing in organisations that share similar values to them.

These social elements can pose new challenges for employers when it comes to handling the social issues of their people. Companies now need to understand their employee and investor demographic and aim to meet the needs of them. This includes investing in funds that have social values that are similar to their organisations.

The awareness that investors who integrate ESG risks can improve their returns is now rapidly spreading across capital markets worldwide. Pension funds and insurers have now begun to exclusively award new investment mandates to asset managers with transparent, informative ESG capabilities.

How social issues are affecting investment decisions

In pension funds and investing, the social issues that are higher on the agenda are, of course, those that are perceived to have more financial relevance, in particular climate change.

Climate change is the biggest issue for many people, with parties as diverse as climate action groups and governments, driving individuals and companies to focus on climate challenges. As well as climate change now being a present issue that has huge significance, it also poses multi-billion pound economic consequences, meaning companies and investment funds are taking this extremely seriously. With the rise of technology, transparency in how businesses operate and access for all to information through media sources, individuals from asset managers to the man on the street have more knowledge about key issues affecting the world they live in, thus a key interest in what exactly their money is being invested in.

(Source: Natixis Global Asset Management)

(Source: Natixis Global Asset Management)

As well as pressure from legislation and the growing view that good ESG policies can offer improved returns, ESG is becoming a key consideration for organisations and pension providers as it is evident this is important to the people investing into the funds. A survey of more than 6,000 people conducted by the Department for International Development (DFID) found that, 68% of UK savers want their investments to be driven by ESG considerations. The study also found that 57% of the respondents were interested in further understanding the impact their pension savings have on people and the planet. In an environment where individual investors can be hard to engage, this level of interest should not be ignored.

Over the coming years, it is highly likely that these factors will become a larger responsibility on scheme sponsors to ensure that they are investing responsibly, as well as meeting the ESG issues their own stakeholders expect them to achieve.

This article is provided by Johnson Fleming.

Enjoyed this article?

Read more about ESG funds and the link to social wellbeing.

How are other employers responding to the ESG agenda? Ask your peers on rebaLINK, our networking and due diligence platform.

Contact the Associated Supplier to ESG funds.

Supplied by REBA Associate Member, Johnson Fleming

Through ongoing advice&support, we’ll help you achieve your business goals&legislative obligations.