Understanding financial education, guidance, coaching and advice

Since 2020, our finances have faced one challenge after another, resulting in depleted resources and lowered financial resilience, leaving many still struggling to keep on top of everyday living costs.

Employees and their domestic budgets have had to adapt to changing working patterns such as hybrid working and having longer working lives.

Economic uncertainty has dented consumer confidence, pushing more would-be retirees to defer retirement, and leaving other workers worrying whether they will ever be able to afford to retire.

Over the last decade, with the introduction of pension freedoms, the growth in defined contribution pensions and more complexity with personal taxes, the responsibility for financial decisions has shifted more towards the individual.

As demand for financial wellbeing has increased, so too has the provider market.

Understanding and supporting benefits

Pension and benefits providers now add financial wellbeing into their service offering, new providers have entered the market and new services such as fintech platforms, salary advance, workplace loans and financial coaching have also emerged.

Supporting employee financial wellbeing is no longer only about offering pensions and other financial benefits; employees also need to understand their workplace benefits and need support to make informed decisions regarding those benefits and wider finances.

Employers trying to procure the best financial wellbeing support for their employees now need to consider raising employee financial awareness and additional support for those that need further guidance on key financial decisions.

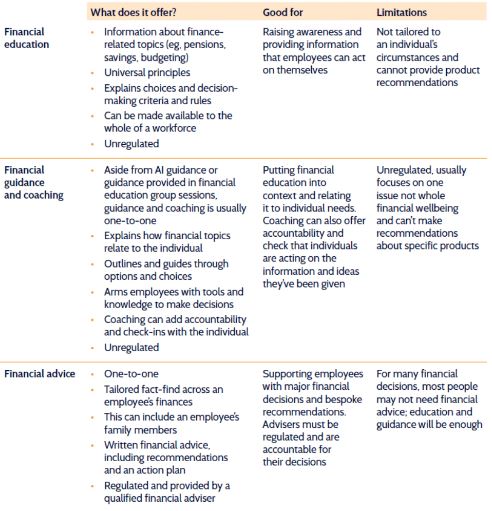

For organisations looking to review or enhance their financial wellbeing support, it is important to understand each service and what to expect from different providers.

Choosing the right wellbeing approach

What’s important when it comes to good financial education?

It needs to deliver education across the whole range of workplace benefits and all areas of personal finance and it needs to be multi-channel.

Financial education delivered in silos by individual providers leads to gaps and won’t equip employees to understand the whole picture or to make comparative decisions between different benefits or products.

Also, people access information in different ways; so if, for instance, resources are online only and there is no one-to-one support, you will not reach the whole workforce.

When considering guidance/coaching, your employees will benefit if there are a range of experienced, suitably qualified and diverse coaches, all of whom understand your workplace benefits.

Your organisation will benefit if the provider can deliver robust quality assurance processes to ensure consistent, quality coaching and to support the boundaries between guidance and advice, and to manage any issues.

Looking at financial advice needs, individuals may need help in many scenarios;

- Finding the right mortgage

- Reviewing protection ahead of a possible redundancy

- Considering consolidating a number of pensions

- Choosing a savings plan to fund care costs

- Tax planning

- Retirement decisions

If a provider cannot offer the full range of financial advice services, employees will be left to find a suitable adviser in the open market, and they are then likely to be vulnerable to considerable variation in quality, price and service.

In recent Close Brothers Spotlight on UK Financial Wellbeing research, employees of every age cited financial advice as a top priority workplace benefit, third only to a pension and private medical insurance.

Extra bit of help

A quality financial education programme should be enough to support the majority of employees with most financial decisions and through most life events.

Some employees may need that extra bit of help with additional one to one support via a financial guidance/financial coaching service.

And even fewer employees will need to seek financial advice.

Helping employees to better understand their financial options and feel confident in making money decisions is crucial to good financial wellbeing.

In an ideal world, workplace financial wellbeing programmes would offer employees financial education, guidance, coaching and advice, so each could choose the level of support needed at any given time. However, in absence of that, it is crucial that any organisation looking to include any of these services understands the limits of what each can deliver and what to expect from different providers so that they can be assured as to the expertise they are putting in front of their people.

Find out more about how our financial wellbeing services can help support your organisation.

Supplied by REBA Associate Member, TrinityBridge Limited, formerly Close Brothers Asset Management

TrinityBridge has been delivering workplace financial wellbeing programmes to some of the UK’s best-known employers for over 55 years.