What is the impact of the pensions lifetime allowance on other associated benefits?

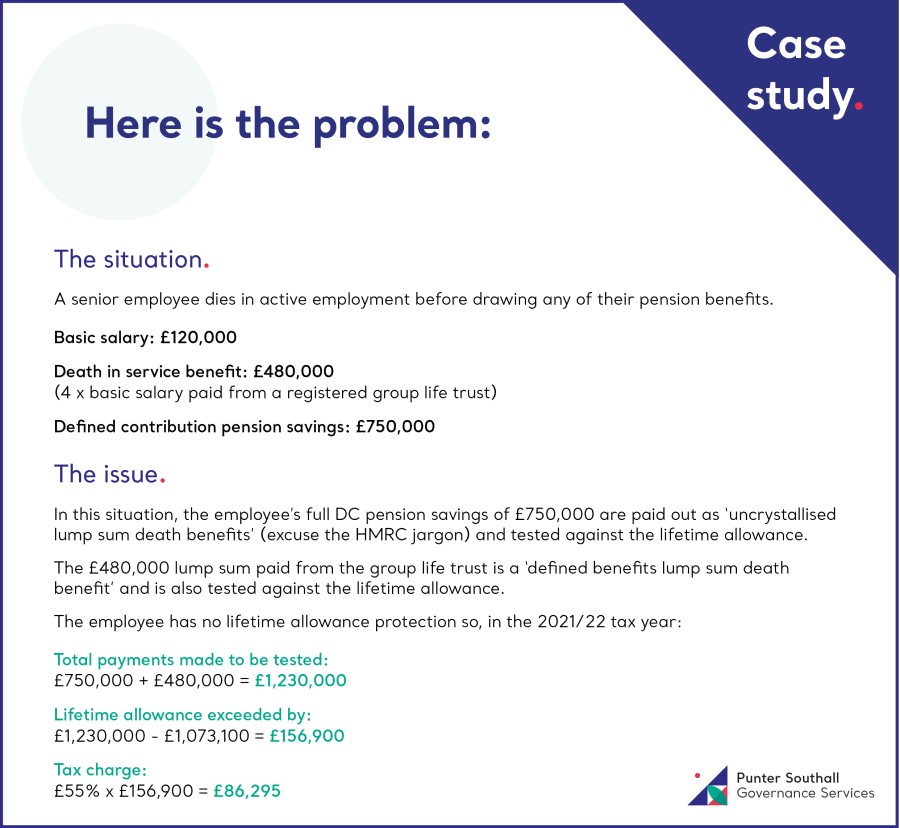

The LTA is £1,073,100 for tax year 2021/22. As this has been frozen by the Chancellor until at least the 2025/26 tax year, the problem will become more relevant and employers may want to review the way that benefits such as death in service lump sum cover is provided, particularly for higher earners.

Here’s an example of how the LTA can easily be exceeded by a higher earner.

One potential solution to these tax issues is an excepted group life scheme (EGLA). The advantage of this arrangement is that it falls outside the LTA regime, which applies only to registered pension schemes. This would mean that no LTA tax would arise in this example. It is relatively straightforward to set up an EGLA, although certain points need to be handled carefully to ensure there are no unintended tax consequences.

An excepted group life policy (EGLP) has a number of specific requirements, such as:

- The EGLP must not be set up with the main purpose of avoiding tax. This is an important issue – they should be established for commercial reasons, such as making it easier to recruit senior staff.

- Benefits must be calculated the same way for everyone included in the EGLP, such as four times salary.

- Only the benefits set out in the EGLP can be paid – there is no discretion to pay more or less.

- Benefits can be paid only to individuals, charities or trusts set up for individuals.

- Benefits cannot be paid to another person also covered by the EGLP. However, benefits can be paid if that other insured person is a dependant or relative of the person who died.

If you do review your group life assurance arrangements and you want to consider the EGLA, take into account these points:

- Above all, take advice – legal and potentially tax-based if that is appropriate – it could be via a specialist in-house tax adviser who handles the relationship with HMRC.

- It is best practice to set up a new trust before the 10-year anniversary for potential Inheritance Tax reasons, so you might, for example, name it ‘2021 Excepted Life Scheme’ just to remind you!

- If you use the life assurance provider’s ‘off the shelf’ documentation and Trust for cost reasons, bear in mind you will probably need to change this every time you change insurer. A master trust can help you avoid this challenge.

- In any life assurance arrangements, ensure that employees keep their expression of wish forms up to date in any event.

- Does the company want to take on the role of the Trustee and have the knowledge and experience required to exercise their discretion for complex death cases? A master trust with a professional trustee could help you avoid this challenge.

Other things you should consider…

Remember the pensions issues as well for the LTA – review how you treat employees who have to opt out of the pension scheme. Do you pay a cash supplement and is this adjusted to allow for the increased National Insurance paid by the employer on the cash allowance? Check the position too, if you have an insured dependants’ pension in a defined contribution arrangement to ensure cover is in place.

You should also bear in mind the Annual Allowance (AA) on pension contributions. This is hugely complex and difficult to calculate for high earners – do you allow employees to opt out for AA reasons and can they opt back in later? In due course you will have to re-enrol them in a qualifying pension scheme. You will need to manage communications carefully for both AA and LTA opt out employees and for anyone with a form of fixed protection.

The author is Ken Potter, client director from Punter Southall Governance Services.

This article is provided by Punter Southall Governance Services.

Supplied by REBA Associate Member, Vidett

Leading the way in professional trusteeship & governance