Why financial wellbeing is not a ‘silver bullet’ benefit

You might expect to be told that financial wellbeing is the number one benefit you should be offering your employees.

But, the reality is, even though financial wellbeing has become a popular benefit in recent years, its value is best realised when an organisation is already offering several other basic benefits.

Some of the top benefits today include everything from physical and mental wellbeing, to childcare and financial wellbeing.

But it’s important to move beyond the idea that by simply adding popular benefits to your current offering, you’ll ensure employee satisfaction.

Benefits to satisfy workers

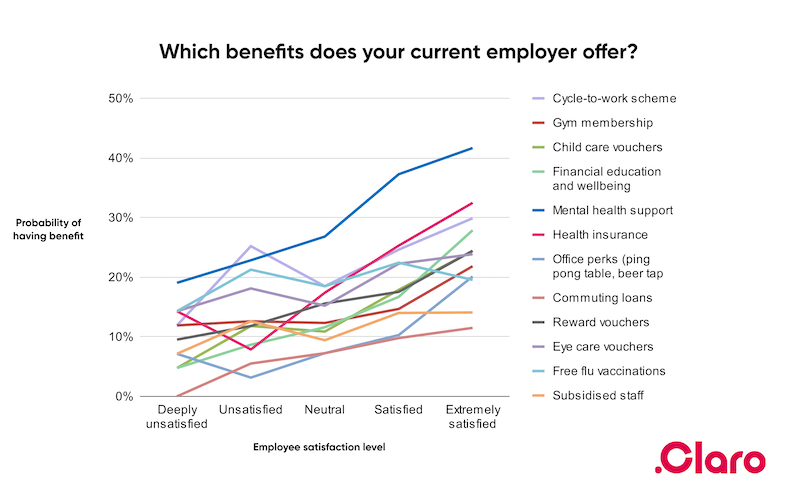

In Claro Wellbeing’s nationally representative survey of 1,300 UK workers, it asked people how satisfied they felt overall as an employee and benefits their employer offered them.

It found that extremely satisfied workers are, on average, around three times more likely to have any particular benefit than deeply unsatisfied workers.

Claro’s survey found a clear correlation between the number of benefits an employee has and how satisfied they feel. In short, the more benefits you offer as an HR team to your employees, the more likely you are to have satisfied employees.

There is (probably) no silver bullet benefit

While this correlation might seem unsurprising at first, it reveals why HR and benefits leaders should view employee satisfaction as a holistic outcome of a well-crafted benefits strategy that aligns with employees’ diverse needs and preferences.

As the research suggests, introducing single, new benefits to improve employee satisfaction and retention isn’t the answer. Rather, it’s about making the argument to internal stakeholders that a greater total investment in high-quality employee benefits overall will help satisfy employees better.

What it means for financial wellbeing

Bias comes in, then, when we look at how financial wellbeing improves employee satisfaction of those who are already pretty satisfied.

Intriguingly, of those who were extremely satisfied, 28% had access to financial education and wellbeing benefits. They were the most common benefits of extremely satisfied workers, after mental health support (42%), healthcare (32%) and cycle-to-work schemes (30%).

At the other end of the spectrum, financial wellbeing was one of the least likely benefits to be offered at organisations where employees felt deeply unsatisfied (just 5%).

So, while financial education and wellbeing alone probably doesn’t have the ability to make employees extremely satisfied, in the right circumstances it can be a valuable addition to a holistic employee benefits package.

A well-rounded benefits package is crucial. The data demonstrates that more benefits correlate with higher employee satisfaction. But it’s important to move beyond the idea that simply adding popular benefits will ensure happiness among employees.

Financial wellbeing, although perhaps not a panacea, plays a valuable role in boosting employee satisfaction.

It’s noteworthy that organisations with deeply satisfied employees often include financial education and wellbeing benefits among their offerings. It’s important to strike a balance between the quantity and quality of benefits, with financial wellbeing as a valuable component of a more comprehensive approach.

Supplied by REBA Associate Member, Claro Wellbeing

A financial wellbeing benefit to support your team where it matters most