Is it time for workplace pensions to retire?

1) Evolution

Society has evolved, but pension plans appear stuck in a twentieth-century mindset, delivered the same way they’ve always been. The pension model doesn’t seem to meet the needs of employees or employers, so why would it be used for anything other than compulsory contributions?

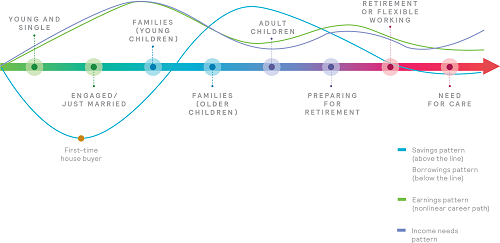

We’re living longer. How many of us will save enough during work to fund retirement that, for many people, will last into their 90s? Many will work for 40 years and retire for 30 — annuities worked well when the expected term was circa 10 years, but work less well when it’s more than 25.

Working patterns and demographics will force new employment models; multiple careers and phased withdrawal from the workforce will become the norm.

Average student debt for graduates in 2015 was £30,000. In 1985, a first-time buyer would borrow less than 2.5 times earnings to buy a house; by 2015, this had more than doubled, but, in London, had increased to more than 9 times.

We have up to five generations in the workforce, all with different needs and priorities — from accessing the housing ladder, paying off debt and saving for retirement to looking after elderly relatives.

2) A change of rules

The rules have changed, but it appears we’re still playing by the old ones. For example the removal of compulsory retirement age in 2011. It's no longer a hard stop, employees can choose when to exit; but what happens when people can’t afford to retire? Employers need to start planning and engaging with employees — this requires a new employee value proposition incorporating contractual, psychological and emotional elements.

Freedom and Choice legislation in 2015 now allows mass access to cash and drawdown-style solutions but innovative products haven’t yet come to the market to cater for this. Annuities are just one of the many options available.

3) It's difficult and time-consuming

Running a pension scheme can be difficult and time consuming. If their employees don’t value it, or if they can’t secure a return on the cost and risks involved, employers will develop a new solution. It’s possible to outsource the pensions scheme services to a bundled provider.

It’s also possible to outsource the trusteeship to a Master Trust or remove altogether.

Employers need to engage employees so they value the benefit being provided and view it as part of pay and rations. Modern HR strategy is increasingly moving to an integrated financial-wellness-based approach to improve the holistic well-being of employees, which leads to a more productive and engaged workforce. Pension strategy and delivery cannot exist in isolation.

Defined benefit provision, for the majority of employers, is an exercise in financial risk management and is run by the finance team; defined contribution provision needs to be integrated with other benefits and with provision of alternative savings that appeal to all sections of the workforce.

Many employees, particularly well-paid and/or long-service employees, are caught by the reductions in tax efficiency and are no longer interested in pension provision.

So should workplace pensions be retired?

Not entirely, but it’s time to go part time. Consider ditching the pension in isolation and embrace broader workplace savings in its place.

Workplace savings provision will evolve and be integrated into a wider financial wellness strategy. Saving for the future will include pension contributions for mandated minimum contributions, and voluntary contributions will go to a mix of ISA, LISA, pension and care insurance.

Mark Rowlands is head of DC & financial wellness services at Mercer.

This article was provided by Mercer.

Supplied by REBA Associate Member, Mercer Marsh Benefits

At Mercer, we believe in building brighter futures.