Health and protection insights from REBA’s research reports

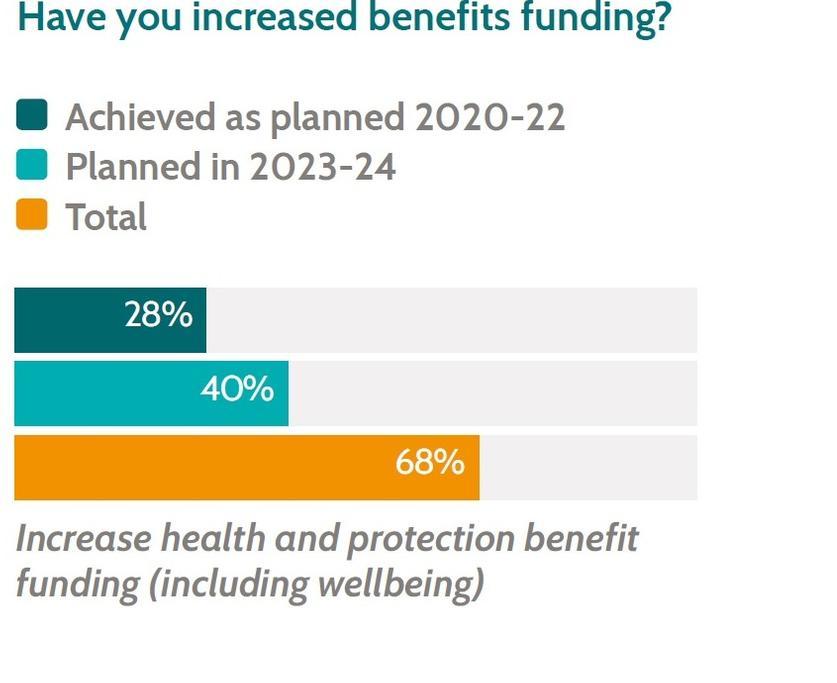

Spending on health and protection is increasing

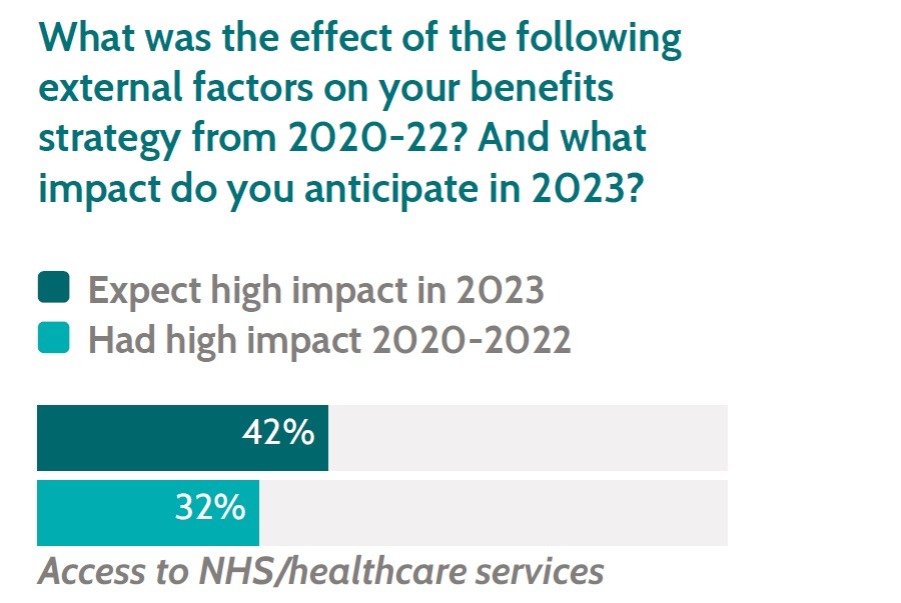

REBA’s Benefits Design Research 2023 found that spend on health and protection benefits is increasing, particularly across 2023-24. This may reflect employers aiming to offset the effect of treatment delays through the NHS, strategic decisions to provide health and protection benefits to more of the workforce, or higher costs for health and protection linked to medical inflation.

Challenges in accessing NHS and healthcare services are affecting employers who responded to our Benefits Design Research 2023. Concerns include higher rates of absenteeism, and presenteeism from employees unable to access GP appointments.

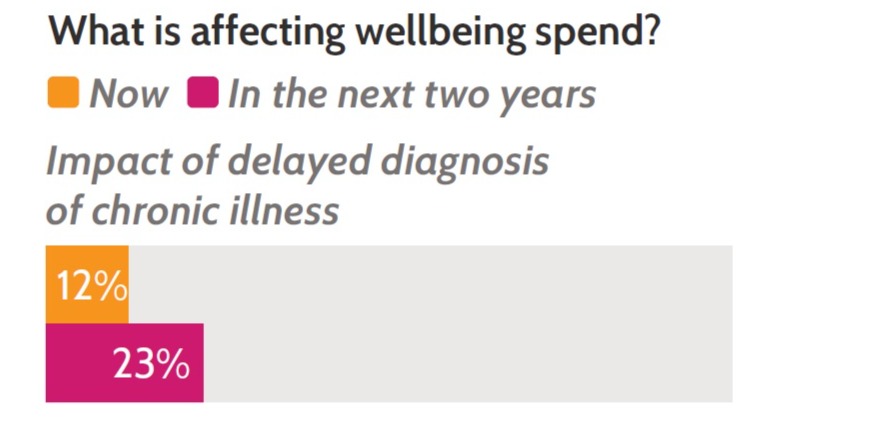

REBA’s Employee Wellbeing Research 2023 found that delayed diagnosis of chronic illness is also becoming a more significant factor in wellbeing spend.

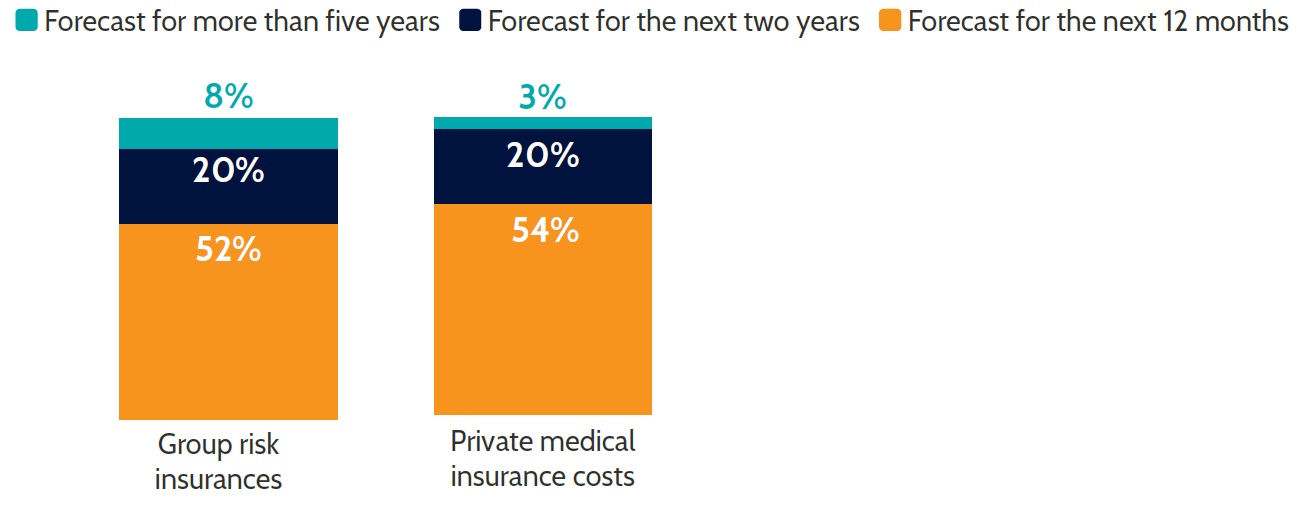

According to our Longer Working Lives: the future of people strategies report, the majority of employers forecast group risk and private medical insurance (PMI) costs for the next 12 months, but few work beyond this.

With age-related claims and NHS delays a growing issue in the workplace, forecasting further ahead may enable employers to manage plans more actively with providers and brokers.

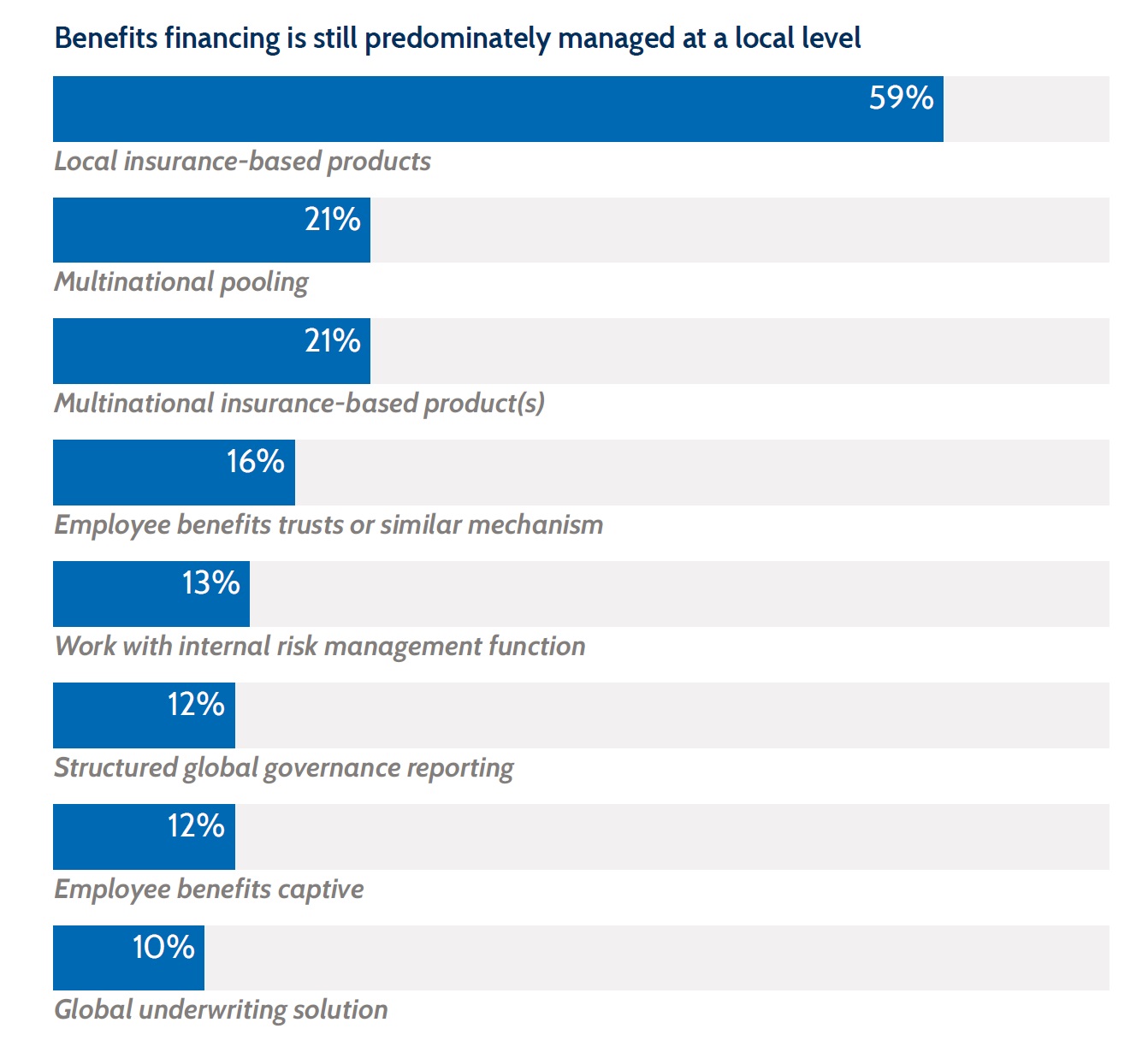

For employers with an international strategy, REBA’s Multinational Benefits Strategy Research 2023 found that local insurance-based products are still the mainstay of benefits financing across multiple regions.

This is unlikely to change significantly for health insurance benefits, where even multinational insurers may have to forge partnerships with local providers to meet regulatory requirements.

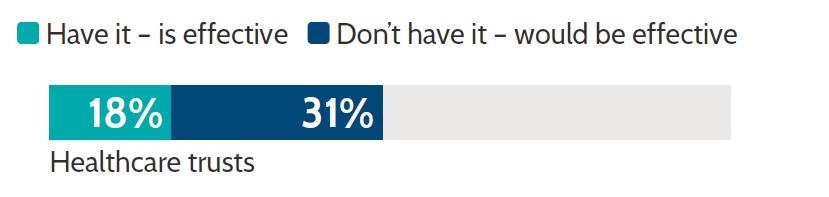

Our Longer Working Lives: the future of people strategies report found growing interest in healthcare trusts to provide cover for employees, with almost a third (31%) of respondents saying that they believe this could be effective for them in the future.

The ageing workforce is shaping health and protection strategies

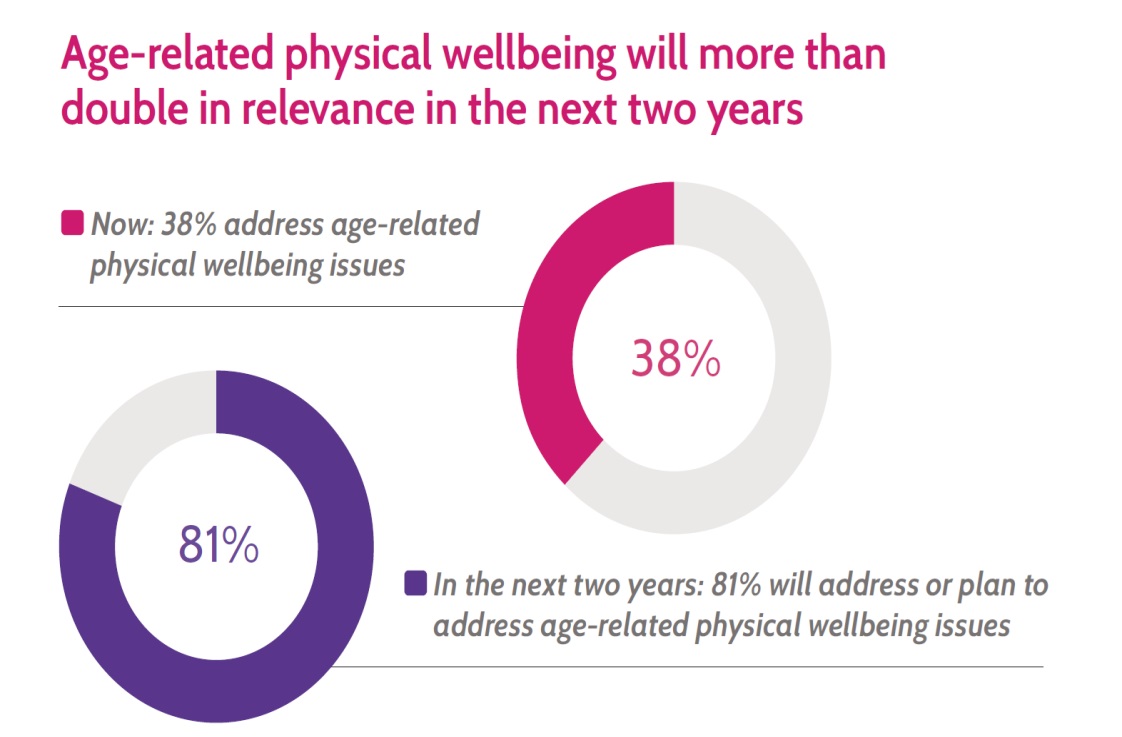

An ageing workforce in putting older employees’ wellbeing in the spotlight. Preventative wellbeing programmes and support for age-related long-term conditions are both a priority.

REBA’s Employee Wellbeing Research 2023 found that 81% of employers will address or plan to address age-related physical wellbeing issues in the next two years.

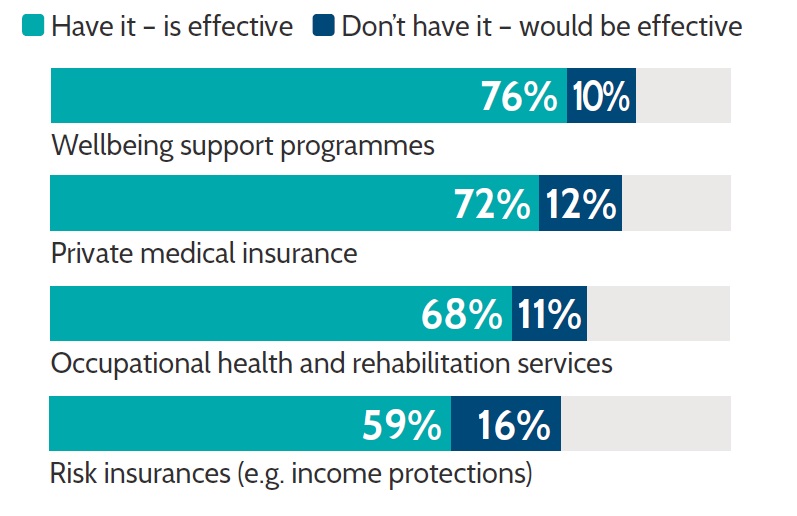

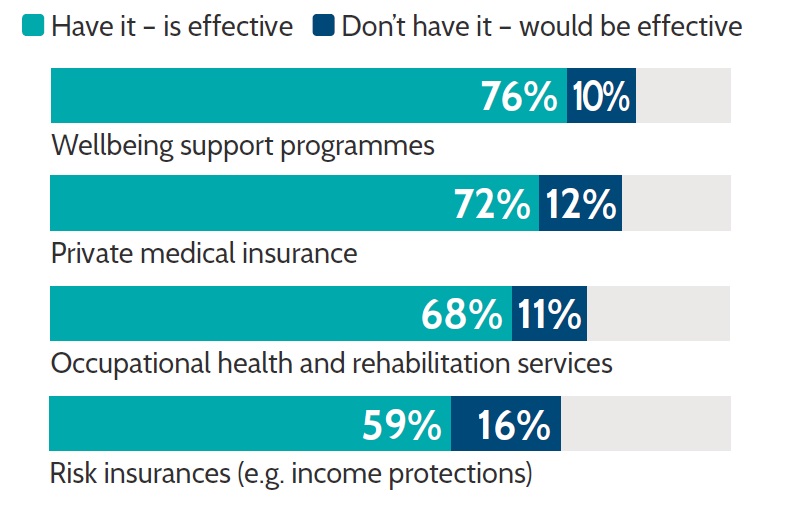

Around three quarters (72%) of employers offer PMI to help mitigate the risks of longer working lives, and find it effective, according to REBA’s Longer Working Lives: the future of people strategies report.

Employers are not yet focused on forecasting the health costs of an ageing workforce. Our Longer Working Lives: the future of people strategies report found that companies typically rely on data from products and providers to predict costs, but are missing more complex factors, such as the impact of working carers, or the cost of mental health conditions in the workplace.

Better technology is needed to support health, wellbeing and protection

High quality technology to support health, wellbeing and protection is a growing priority, with many employers finding their current offering is not fit for purpose.

In REBA’s Data and Technology 2023 research, 47% of respondents identified employee health and wellbeing platforms as a key area of change for the next two years.

This was also echoed in our Benefits Design 2023 research, which found that 54% will introduce new wellbeing technology within the next two years.

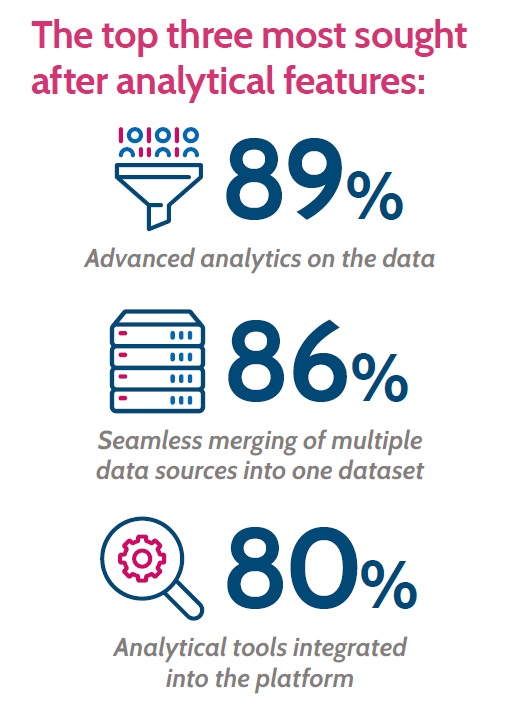

Reward and benefits professionals also want improved analytical tools to help them model future benefits costs according to our Data and Technology research 2023.

This could help to address the challenges that benefits professionals face in understanding the costs of an ageing workforce or the impact of chronic ill-health and disability at work.

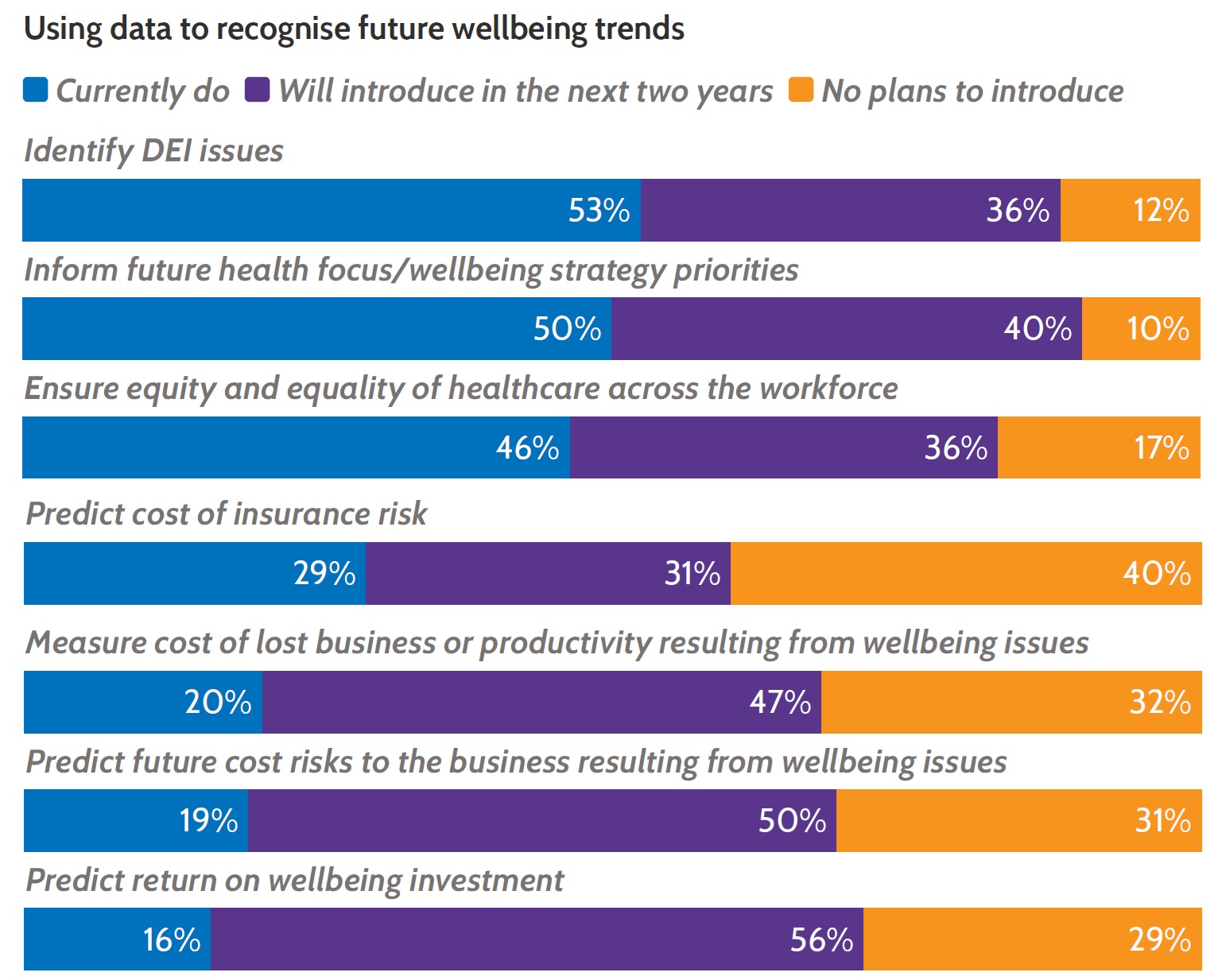

REBA’s Employee Wellbeing Research 2023 found that employers are already using, or planning to use, data to identify wellbeing trends in the workplace.

At present, these are focused on DEI and equity of offerings across the workforce. Using data to predict costs of insurance risk and future risk to the business is less well established.

Health benefits can support talent goals, attraction and retention

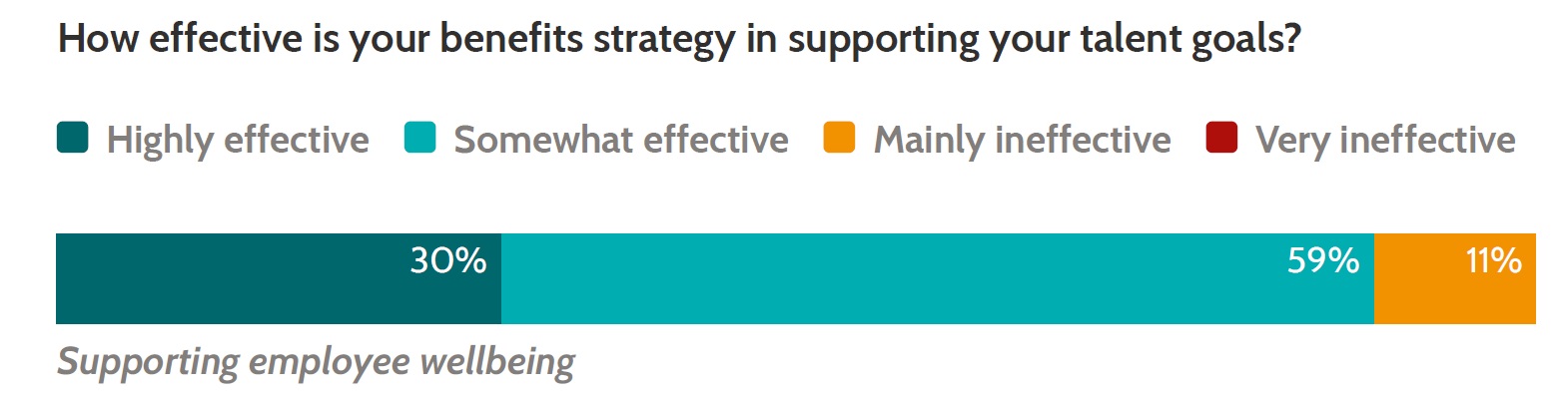

Supporting employee wellbeing is effective in achieving talent goals, according to our Benefits Design 2023 research.

REBA’s Disability in the Workplace 2023 research showed that respondents who identified as disabled, having a long-term illness, or an impairment or condition prioritised benefits that create certainty should they need extra support with their health.

Top five benefits for employees identifying as disabled, having a long-term illness, condition or impairment:

-

50% income protection

-

43% support with everyday health costs

-

43% paid-for counselling/mental health support

-

=38% payment if diagnosed with a critical illness

-

=38% private medical insurance for me

-

= 38% private medical insurance for my family

An effective benefits strategy for health and protection also helps shape employees’ perceptions of their employer.

Over a quarter (28%) of disabled employees or those with a long-term illness, impairment or condition, who are offered private medical care say they would recommend their employer to others with disabilities, compared to just 14% of those who don’t receive these benefits.