High earners and annual allowance – how to reduce costs and improve retirement outcomes

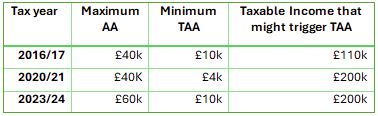

When the Tapered Annual Allowance (TAA) was introduced in 2016, it potentially impacted anyone with taxable income of £110k or more.

Exceeding the TAA, which was between £40k and £100k (depending on the combined value of income and pension contributions) resulted in a penal tax charge.

Many employers responded by offering employees earning above this the option to exchange employer pension contributions for a cash supplement.

Since then, we have seen changes to the TAA which mean individuals are only impacted if they have much higher levels of income (£200k+).

Most employers haven’t amended their policies in response to this change. In part, this is likely to be because of the difficulties associated with stopping cash payments that employees may have come to rely on.

With the increases in employer NICs that came about in April (which apply to cash supplements but not employer pension contributions) and ongoing concerns about individuals not saving adequately for retirement, a shift away from cash towards pension contributions could be a ‘win-win’.

Case study

Caroline has a basic salary of £150k and a bonus of £20k. She has no other taxable income. As a high earner, her employer gives her the option of:

- Participating in the pension scheme – if she chooses this option, she makes a minimum contribution of 5% of salary via salary sacrifice, and her employer contributes a further 10% of salary

- Opting out of the pension scheme and taking a cash supplement of 10% of salary

Although Caroline has an Annual Allowance of £60k (her taxable income is below the level that triggers the TAA) she is currently taking the cash supplement of £15k. This costs her employer £17,250 (including NICs), and after PAYE deductions, she receives £7,950.

If Caroline opted back into the pension scheme, the cost to her employer would reduce to £13,875 (a saving of £3,375 pa in NICs).

After allowing for tax and NIC savings on the 5% of salary she sacrifices for pension contributions, the reduction in Caroline’s take-home pay would be £11,925 (net value of cash supplement given up plus net cost of 5% salary sacrifice). In return, contributions of £22,500 would be paid into her pension.

At retirement, assuming 25% can be taken tax-free, she would receive £15,750 (ignoring investment returns and paying tax on the income she takes from her pension). This means the pension option delivers £3,825 more than the cash option.

What can you do to support staff and manage your costs?

An effective strategy some of our clients have used is to provide financial education on the choices available to employees. Typically, this takes the form of a webinar with one-to-one guidance as a follow-up if required.

In some cases, employers have seen over 60% of staff re-start or increase pension contributions, meaning more savings for staff’s income in retirement and improved retirement outcomes.

While in some cases, it also provides increased employer savings through reduced NIC costs. So, offering such support could be a ‘win-win’ for you and your employees.

As individual financial circumstances evolve, regular webinars or ongoing financial education can drive continued engagement and increased pension saving.

If you’d like to talk about how we can support you in putting an effective strategy in place for your workforce, please get in touch.

Supplied by REBA Associate Member, Hymans Robertson

We're one of the longest established independent consulting and actuarial firms in the UK