Sally Camm of Experian on ways to build trust around financial wellbeing

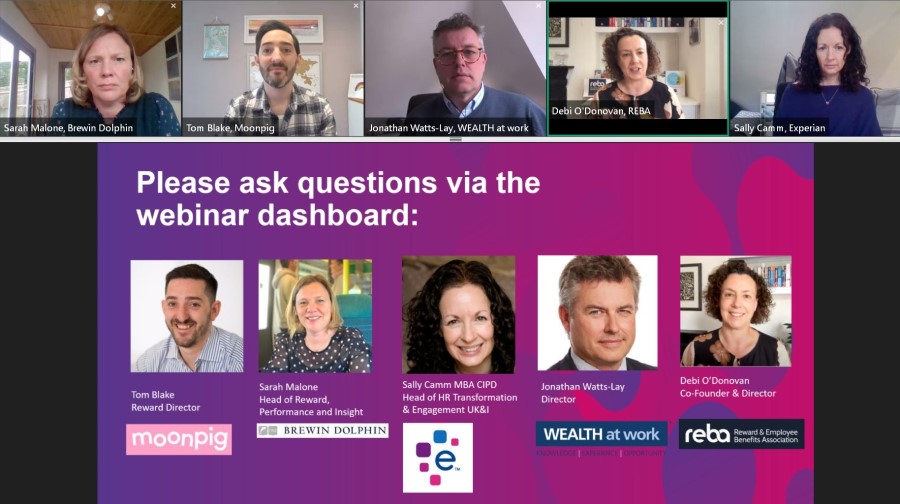

This issue was raised during REBA’s recent webinar on identifying financial wellbeing needs in a workforce. Sally Camm CIPD MBA, head of HR transformation and engagement UK&I at Experian, highlighted the importance of understanding employees’ requirements, and outlined how they had built trust as part of their financial wellbeing plans.

She explains that one of the main ways that they’ve engaged and thought about their workforce is by asking them what they want.

“The intriguing thing, and one of the biggest challenges we face when we talk about our financial offerings, is that people often aren’t honest,” she says. “You may ask the question [around financial wellbeing], but whether people will feel that they trust you or feel it’s appropriate to say ‘I’m struggling with debt’ is another matter, so you may not get as honest a view as you might do with other topics.”

Understanding what employees need from a financial wellbeing strategy is critical, as this will not only dictate your communications strategy, but it will also help you to decide what the aims of your financial wellbeing strategy should be.

All of the webinar panellists agreed that having a clear grasp of what your organisation wants to achieve from its financial wellbeing programme will ensure that it remains focused. Whether the aim is to increase pension contributions, improve financial literacy or boost awareness of workplace savings schemes, employers need to have a clear objective.

Building trust around financial wellbeing

“We focused on asking people anonymously about what [financial wellbeing support] they want; we’ve hosted webinars and Q&As so that when people ask questions we can get a view of what type of topics are on their mind.

“Once you know where the organisation is going and what the objective is, and you know what people want and what’s on their minds, then it leads you into the next step of being able to segment and develop your communication and engagement strategies,” says Camm.

There were three main ways that Experian tried to build trust in the organisation to support its financial wellbeing strategy:

1. Executive support

“Our chief financial officer is the sponsor in the company for financial wellbeing, so not only is he bought-in but he appears on our webinars, and he’s in our communications material to really front from an executive point of view the importance [of financial wellbeing],” explains Camm.

She adds that he has been a great partner and very active sponsor of the programme. He directly challenges the reward and HR team on what’s missing and the approach that they’re taking.

“It might not be your CFO, but to have that exec sponsor within a business is useful,” adds Camm.

2. Leverage people forums

Experian has an internal consultative body, which is centred around its people forums. “When we talk about financial benefits, or if we need insight, or if we’re lucky enough to launch a new benefit, we’ll present to them and get their feedback, which gives us a breadth of information.”

3. Running an ongoing campaign to build engagement

Experian run an ongoing annual campaign called Talk Money, which is piggy-backed from the external campaign run by the Money & Pensions Service (MaPS). On a monthly or six-weekly basis the business will run a webinar on a specific financial topic which might involve external speakers and employees as well.

Recently they ran a webinar on debt and financial difficulty, while other upcoming topics include savings, followed by money tips and hacks.

“It’s the consistency of talking about financial wellbeing as a topic that we find over time builds-up trust, and it is something that people feel comfortable to talk about,” says Camm.

For more on this topic, watch the full webinar on identifying financial wellbeing needs in a workforce.

The author is Dawn Lewis, content editor at REBA.